A new research paper by Chatham House says that the West and China must work together on solutions to African debt distress, which is likely to worsen in 2023.

The report says that although China’s lending to Africa did not cause the current African debt distress in most cases – Chinese lenders account for 12% of Africa’s private and public external debt – it must cooperate with the West, as well as leading African nations, to benefit all parties and support Africa’s investment needs, after a tumultuous year of recession for most economies on the continent.

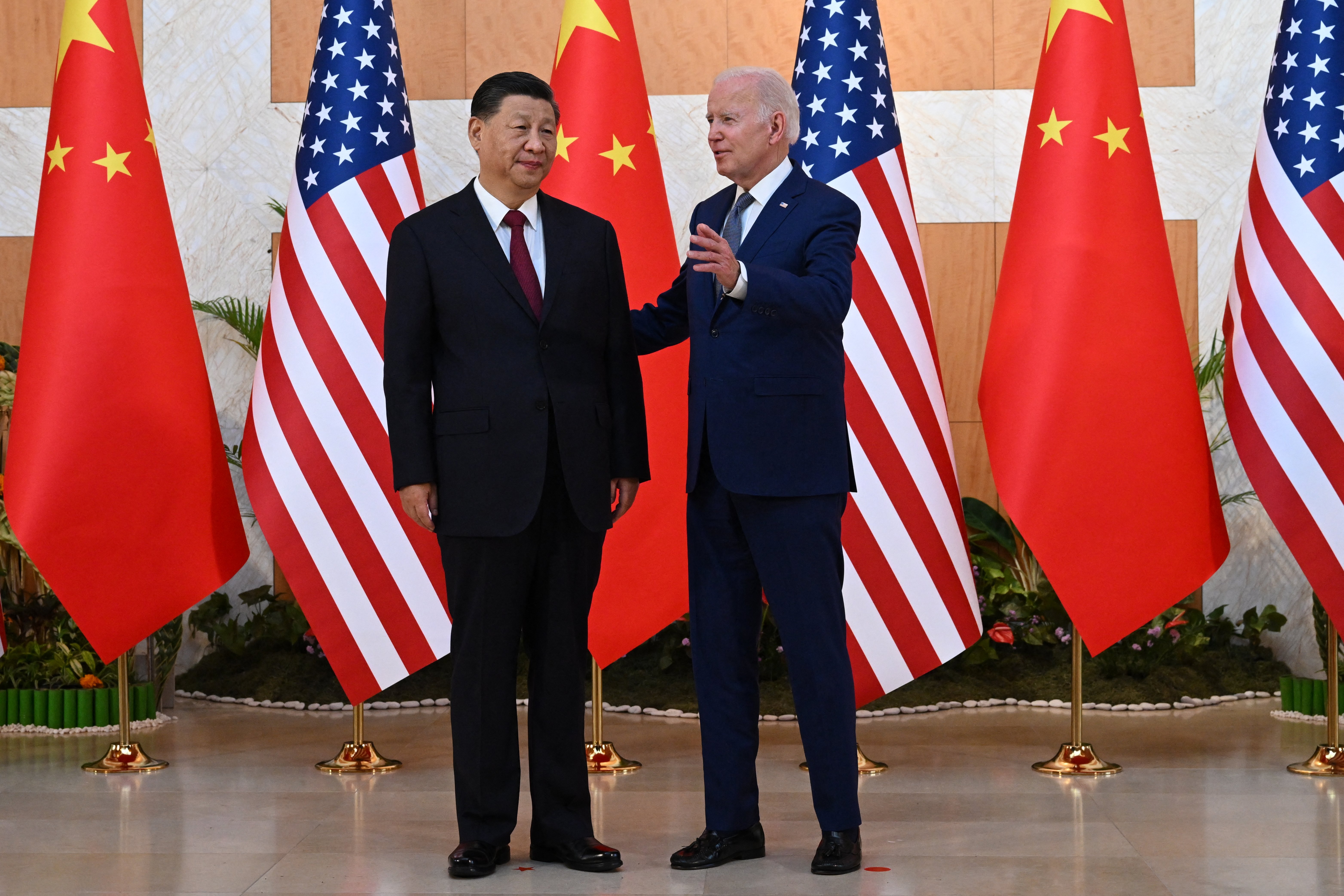

“Attempts to tackle debt distress in Africa urgently need to be separated from the broader geostrategic competition,” says the report.

“The overall sovereign debt situation in Africa is serious and looks set to get worse. But technical disagreements and limited political will to overcome them, between China, Western governments, and the private sector, mean that the key mechanism for providing debt relief multilaterally – the Common Framework – is progressing very slowly.”

The authors recommend that the G7, led by the incoming Japanese presidency for 2023, develop and build support for a new three-part plan to be eventually embedded at the G20 level on debt relief and future investment in Africa.

The plan would include a broad-based dialogue led by, but not limited to, the G7, China and leading African nations on Africa’s medium- to long-term external financing needs; a high-level political understanding between the West and China on the mutual benefit of strengthened cooperation to address African debt distress; and a detailed action agenda, led by the G7 and G20 Finance Tracks, to address obstacles to faster implementation of the G20’s existing Common Framework for Debt Treatments.

“In short, this would make an offer to China to engage on a broader multilateral approach over the long-term, and respond to the expressed wishes of African nations on how they want the issue of debt distress and long-term finance to be dealt with at a global level. If successful, it would help deal with the rising threat of debt distress facing some key African economies in 2023 and beyond and would also put in place a longer-term framework, which would have substantial benefits not just for individual African nations, but also for the wider world in the fight against climate change and global public health threats,” the authors write.

The slow pace of the G20 Common Framework

The IMF identified 22 low-income African countries as being in debt distress, or at high risk of debt distress, at the end of last month.

The overall picture is set to deteriorate due to the economic legacy of the pandemic, food and energy price shocks underpinned by Russia’s invasion of Ukraine, and the rise of interest rate levels in developed countries to fight inflation.

In November 2020, during the Covid-19 pandemic, China and Western lenders tried to cooperate regarding Africa’s debt conundrum with the creation of the G20 Common Framework, which applies the Paris Club methodology but with the inclusion of China and other non-Western lenders.

However, two years later, only Chad has completed has completed a treatment of its debt. Zambia and Ethiopia – the two other countries that applied – are still waiting for their debt restructuring agreements which are delayed due to Chinese positions in the framework, says the report.

“There has so far been very limited appetite on the part of countries to apply for relief under the Common Framework, in part because progress towards completed debt treatments for those that have applied has been painfully slow…it is clear that the Common Framework has not yet met its initial promise and there is scope for significant improvement.” the authors say.

More specifically, four factors are identified as responsible for the slow pace of the Common Framework:

“First, some lenders and parts of the authorities in China are still uncomfortable with the central role played by the IMF – together with the World Bank – as an independent arbiter of how much a country can afford to pay through the debt sustainability analysis. Second, there is the concern of both public and private sector Western lenders over the lack of transparency in the total amount of external debt African countries have incurred. Third, there are differences of view between the Chinese authorities and Western governments on exactly how burden-sharing should be implemented between different types of the lending institution Fourth, is the differences between Chinese lenders and Western lenders (particularly in the private sector) in the way in which any relief should be delivered.”

Chatham House warns that the above factors mean that the Common Framework will be unable to deal with Africa’s biggest debtors in 2023.

However, “it is widely accepted that there is no realistic alternative – either politically or economically – to the Common Framework as the basis for tackling debt distress in low-income countries,” says the report.

The only way out of this gridlock is therefore strong reforms targeting the Common Framework itself and finding long-term solutions that can meet African economies’ financial needs and avoid a similar situation in the future.

G7 core in leading a multilateral discourse

As China moves away from its previous high-volume, high-risk model of investment in Africa to one where deals are struck at a smaller and more manageable scale, its approach to the management of Africa’s debt distress problems is likely to become increasingly multilateral, argues the report.

Traditionally, China has taken unilateral actions to deal with its African debtors, such as last August when it forgave 23 interest-free loans for 17 African nations while pledging to deepen its collaboration with the continent.

Considering China’s difficult economic position, such actions are unlikely to take shape next year, making the incoming Japanese presidency of the G7 a chance to open a broad-based dialogue with China and leading African nations on the topic. “An important determinant of the route China chooses to take, on both debt relief and future investment in Africa, will be the extent to which it sees benefit in continuing and even deepening the current multilateral approach,” say the authors.

“From the West’s perspective, China is critical to finding a lasting solution to African debt distress. Neither the current debt crisis, nor Africa’s future financing needs, can be tackled without China’s participation.”

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google