This article was produced with the support of African Gazettes Forum

In 1949, France decided to peg the Djiboutian franc to the US dollar in order to restore monetary confidence. This decision, unprecedented in Africa, has provided the country with stability that has lasted for seventy-five years.

Invited to speak at the first African Gazettes Forum, Franco-Djiboutian lecturer, researcher and specialist in the monetary systems of the Horn of Africa Moustapha Aman looks back on this unique story – and did so at a time when the debate on the CFA franc is resurfacing in West Africa, particularly in the Sahel, he noted.

In 1949 the French Somali Coast, the future Republic of Djibouti, became the first African territory to leave the franc zone. After a series of devaluations and a traumatic reform in 1943 — which forced residents to exchange their banknotes at a discount of 50% to 90% — confidence in the French franc was shattered.

Paris then authorised an unprecedented move: pegging the local currency to the US dollar in order to restore stability and preserve the port’s competitiveness vis-à-vis Aden, the neighbouring British-administered gateway.

“This pegging to the dollar was not a monetary whim, it was a geopolitical calculation,” says Aman.

By deviating from its principle of monetary unity, France was seeking above all to preserve its influence in the region. “The project was kept confidential until the last moment so as not to give other colonies any ideas”, says the lecturer and researcher.

Seventy-five years of stability

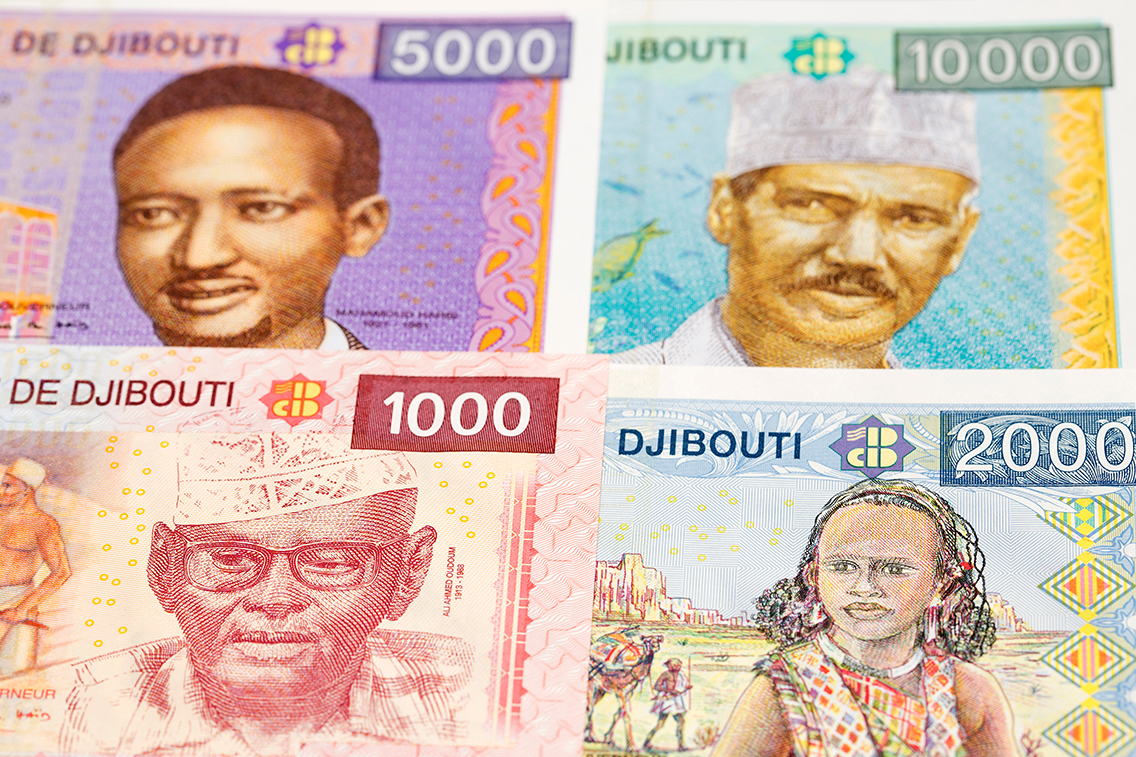

Seventy-five years later, this currency has never been devalued. This consistency has enabled Djibouti to develop a solid financial sector and become a recognised regional banking centre in the Horn of Africa.

But today, as the BRICS countries pursue their de-dollarisation strategy and several West African countries question their monetary future, the Djiboutian example is resurfacing. “Back in 1949, the question was the same: how to leave a monetary zone without losing the stability it guarantees?” recalls Aman. He calls for a rethink, when the time comes, of the Djiboutian franc’s pegging so that it continues to serve national interests in a changing world.

Sign in with Google

Sign in with Google