This article was produced with the support of Central Bank of Nigeria

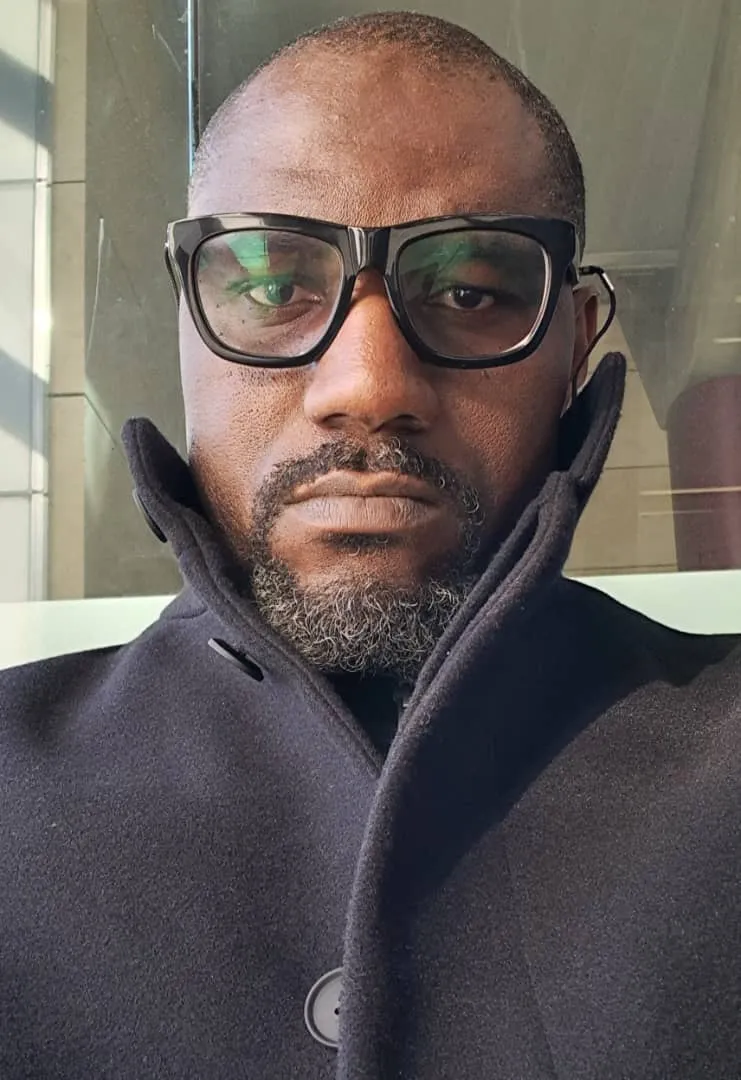

When you meet Yemi Cardoso, governor of Nigeria’s central bank, the first thing that strikes you is his height. Then when he speaks you are also struck by his deliberateness and calm. He speaks in quiet tones but beneath that calm is a stubborn insistence and quiet determination to do the right thing – which in this case means insisting, entrenching and following through on a strictly orthodox approach in the management of Nigeria’s financial sector, macro-economic environment and foreign exchange market.

Yemi Cardoso has spent two years in the saddle as governor of Nigeria’s apex bank and in those 24 months, the former Citibanker, commissioner, consultant and African Banker’s Central Bank Governor of the year 2025 has earned himself the sobriquet “Mr. Reforms”.

Two years may be short, but it can be long when the focus is on perception and reputation. In a private conversation on the sidelines of the IMF/World Bank Spring Meetings, he had admitted in his usual calm manner that “we inherited a mess, but it was not something you could say in public because it would alarm people.”

Cleaning up that mess without alarming people was not easy and it often cast Cardoso in a quixotic mould; a knight wielding the Monetary Policy Rate (MPR) like a lance.

The MPR has been a key weapon in Cardoso’s arsenal. A few months after assuming office, the Central Bank of Nigeria (CBN) governor announced an increase in the MPR from 18.75% to 22.75% in February 2024. The increases have continued over time peaking at 27.50%.

Speaking at an event organised by the Harvard Club in October 2024, one year after his assumption of office, Cardoso had explained that “our decision to raise the Monetary Policy Rate (MPR) to 27.25% was a bold move. Higher interest rates, while painful for borrowers, are necessary to curb excess money in circulation and control inflation.”

Has this bold move worked? Headline inflation has moderated significantly from a high of 34.8% in December 2024 to 20.12% in September 2025.

What have the reforms meant for the overall economy? As economists will tell you; stability is the foundation of economic growth, and a regime of volatility is often unhelpful which is why many miss the point when they reference the exchange rate of the naira to the dollar.

What they fail to consider is that the old exchange rate regime did not reflect market realities. Following the removal of subsidies and devaluation of the Nigerian currency which was exchanging at about 500 naira to the dollar at the end of 2022, the naira has found its true value and the distortions brought about by rampant arbitrage in the market have been contained.

Speaking on Arise TV, renowned economist Bismarck Rewane explained in detail how effective that approach has been in terms of moderating inflation, increasing foreign reserves and moderating inflation.

Thanks to what he described as a “managed floating exchange rate being efficiently managed by the central bank,” he said, “the gap between the official and parallel market has closed.”

Raising investor confidence

He noted that the CBN’s reforms and policy direction have also raised investor confidence. “Foreign portfolio investment has gone up by $13bn. They are taking advantage of our high and stable interest rate. When the exchange rate is stable it helps moderate inflation pressure which makes the country attractive to investors.”

Macroeconomic and exchange rate stability have been largely achieved as the World Bank reported in the May 2025 edition of its Nigeria Development Update (NDU): “economic growth in the last quarter of 2024 increased to 4.6% (year-on-year), pushing growth for the full year 2024 to 3.4%, the highest since 2014 (excluding the 2021-2022 Covid-19 rebound).

“Recent reforms have also helped to strengthen the foreign exchange (FX) market and Nigeria’s external position. The consolidated fiscal position improved in 2024, driven by surging revenues. The fiscal deficit shrank from 5.4% of GDP in 2023 to 3.0% of GDP in 2024, a major improvement which was driven by a sharp increase in revenues of the entire Federation, which rose from 16.8 trillion naira in 2023 (7.2% of GDP) to an estimated 31.9 trillion naira in 2024 (11.5% of GDP).”

The report went further to note that “the challenge is to consolidate macroeconomic stability and ignite inclusive growth through deeper, wider structural reforms.”

While there is no doubt that change and growth are taking place, driven largely by improved revenue from oil, increase in non-oil export receipts, transparent FX regime and enhanced remittance inflows, the critical imperative is for the average Nigerian to see the stability and moderation in the rate of inflation reflected in the price of goods and services and their purchasing power.

The issue of macroeconomic stability trended in August after World Trade Organization director general Ngozi Okonjo-Iweala hailed President Bola Ahmed Tinubu’s administration for maintaining economic stability. Many saw her comment as “political” but, in a widely referenced post on X, Yemi Kale, former head of the National Bureau of Statistics and now group chief economist and managing director of research and trade intelligence at Afreximbank, provided context. The economy has achieved some stability, he wrote, but “stability is like stopping a boat from rocking wildly, but hardships persist if the boat is still far from shore.”

As Cardoso marks his second year in office this must weigh on his mind; things are working thanks to the application of sound macroeconomic principles, but the ship of Nigeria’s financial fortunes is still far from shore. Monetary policy, while important, is no silver bullet. Fiscal policy must complement it and this is what needs to be pursued with vigour.

What lies ahead?

So what lies ahead for Cardoso over the next year and beyond? The banking recapitalisation exercise will conclude in March 2026. With seven months to go, 14 banks have crossed the hurdle which means that the CBN governor must anticipate some mergers and/or acquisitions as the finish line draws close or will there be an extension and if that happens what does it communicate about the resilience and health of Nigerian banks?

Inflation is another issue. A drop from 34.8% to 20.12% is cause for cheer but that drop must have an impact on food prices, especially, for Nigerians. The foreign reserves reached $42bn in September compared to $36.46bn in August 2024 highlighting, as Rewane noted in the same interview, that the country is now “less leveraged and less vulnerable to exogenous shocks” with its “external position no longer as fragile as it used to be when we look at it from a monetary policy perspective.” That trajectory of growth must be maintained which means that Cardoso must resist Ways and Means pressure even as an election year approaches.

And finally, while the target of 1bn naira monthly diaspora remittances has not been achieved, Cardoso’s recent comments at the 18th annual Banking and Finance Conference where he described diasporan inflows “as a “strategic lever” necessary for achieving foreign exchange stability and broader economic transformation shows that his eyes are still on that ball.

If these boxes are all ticked, Yemi Cardoso can lift his head high at the end of his first term and wear with profound pride his toga of “Mr. Reforms”.

Sign in with Google

Sign in with Google