This article was produced with the support of 4G Capital

4G Capital, the leading neobank lender to micro-enterprises, is on a mission to grow small businesses across the world. From its base in East Africa, the fintech is scaling its solution to the global challenge of delivering working capital to these businesses.

Starting from sub-Saharan Africa, the fast-growing firm is pioneering tech-driven financial inclusion to bridge the urgent financing gap estimated at $500bn by the International Finance Corporation.

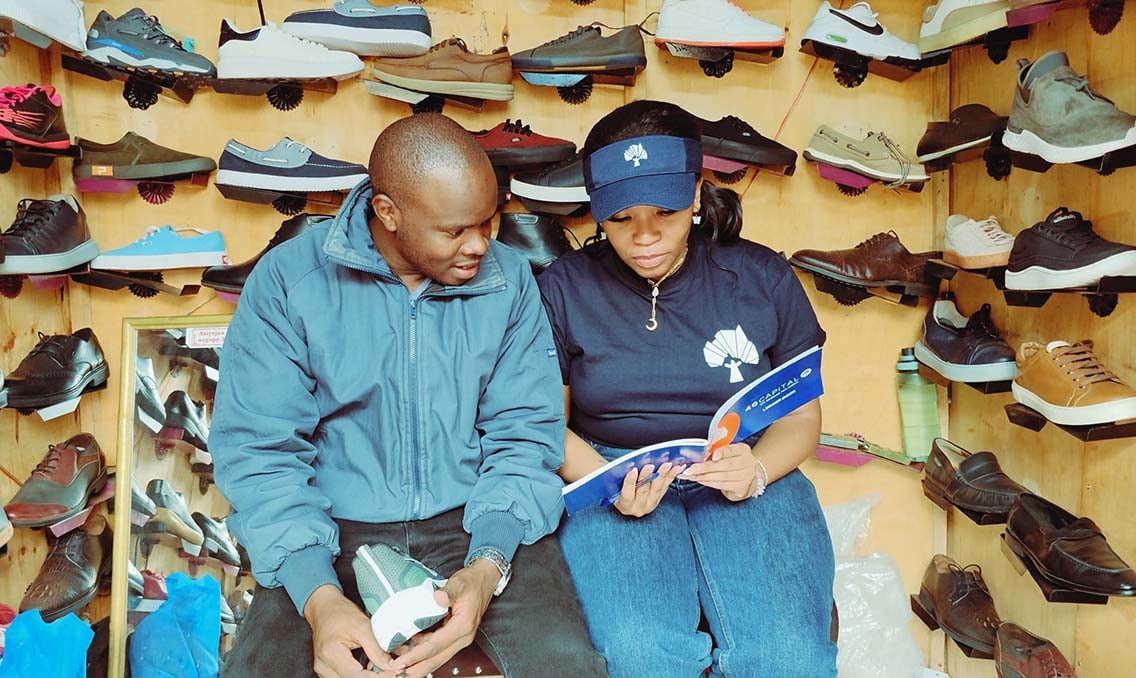

It delivers unsecured short-term loans, for up to 30 days, to small businesses in Kenya and Uganda through mobile money. This is peppered with customised business skills training to enhance the chances of success for these excluded, yet high potential micro-enterprises, the majority of which are run by women and youths in rural communities.

By enabling these businesses to grow, 4G Capital is also unlocking the massive opportunity presented by the rapidly expanding informal sector in creating jobs and improving the quality of life in communities. In Kenya, for instance, the informal sector is a critical cog in the economy, supporting 83.6% of jobs according to the government’s Economic Survey 2025.

At the core of 4G Capital’s solutions is human customer service delivered by an agent network of 1,600 people from its 211 branches across Kenya and Uganda.

The field staff are backed by the firm’s pioneering, proprietary AI-backed technology platform that has an advanced assessment model to robustly select, size and approve the right loan suited to each prospective customer’s business cycle. This has minimised defaults, with repayment rates averaging 94.6%.

Touch-tech model

“We are evolving and scaling our unique touch-tech model to deliver an African solution to the global challenge of unlocking the potential of the informal sector. Starting with data from the ground through our field officers, we are scaling with data and fintech to provide working capital to businesses,” says Wayne Hennessy-Barrett, the Founder and Executive Chairman of 4G Capital.

In just over a decade, the fintech’s growth has been phenomenal, recording market-leading impact. Since 2013, it has delivered 5.5m loans, valued at $620m to more than 600,000 customers; with their ability to borrow almost doubling over 36 months. This has helped the customers’ businesses to thrive – 72% of whom are female traders and 81% are based in rural markets – in addition to creating 1.3m indirect jobs.

This has earned 4G Capital huge acclaim and it was recently named Best Fintech at the prestigious African Banker Awards 2025, which celebrate excellence and innovation in Africa’s financial services industry. This is in addition to multiple industry awards and recognitions, including being the highest scoring fintech amongst B-Corporation firms, a new class of businesses committed to balancing purpose and profit.

“We are committed to responsible lending because we succeed when our customers do. Since we cater for some of the most underserved entrepreneurs, our delivery model and backend is built to ensure that we do not inadvertently introduce more risk and vulnerability.

“Our intention is to create a global business neobank to help small businesses escape the poverty trap through success in their enterprises,” Mr Hennessy-Barrett adds.

Building on the huge progress made in East Africa and lessons learned, 4G Capital now has its sights on the global stage that has a $10trn financing gap for small businesses. It intends to scale the solution into other African markets, before moving on to Latin America, Asia, the Middle East and North Africa. This will see it scale its products, lending more than $3.6bn over the next five years to enable underserved small businesses that are overlooked by formal lenders to thrive and transition into formal enterprises, to support the livelihoods of a growing global population.

Delivering on this ambition will need access to significant capital for onward lending. This will follow up on successful capital raises so far – from seed financing in 2013, 4G Capital secured Series A funding in 2016/17, Series B funding in 2020 and Series C funding in 2022.

“Investing in small businesses to grow is an opportunity to do good and service the economy while delivering market-beating returns to investors,” Hennessy-Barrett says.

Sign in with Google

Sign in with Google