Mining executives, government ministers, start-up founders, and others with a connection to mining convened at the Cape Town Convention Centre in February this year for the annual Mining Indaba.

This year’s theme – ‘future-proofing African mining today’ – was accompanied by key pillars including mining’s role in industrialising Africa and community growth, the delivery of effective net zero strategies, the introduction of game-changing technologies, and the prioritisation of health and safety.

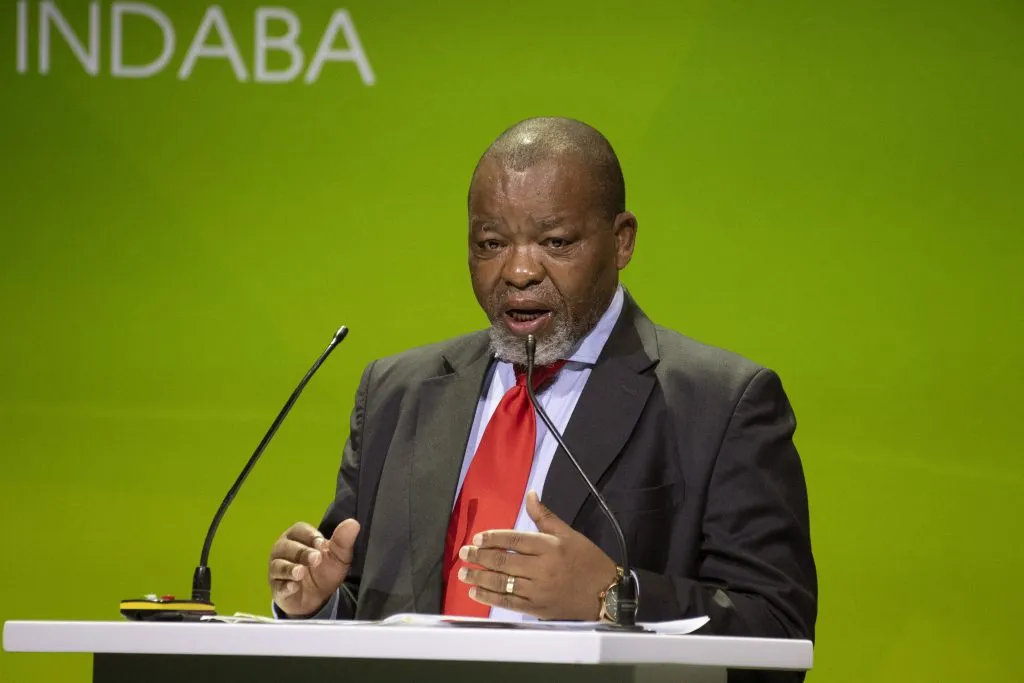

Opening the conference, South African minister of mineral and petroleum resources Gwede Mantashe said that it was long overdue for Africa to use its mineral wealth for its development, especially as the critical minerals which it has in abundance come to play a central role in the global economy.

“The truth of the matter is that Africa is the world’s richest mining jurisdiction, possessing at least 90% of the world’s chromium and platinum, 40% of the world’s gold, and the largest reserves of the world’s cobalt, vanadium, manganese, and uranium. Despite having these abundant mineral resources, Africa remains poor, and this must change,” Mantashe said. “We have something that the world wants. We are not beggars. We must use that endowment for our own benefit as a continent.”

For decades, African countries have exported minerals with limited local beneficiation, with only a fraction of its true value captured on the continent. Mantashe estimated that while South Africa has approximately 37% of the world’s manganese ore reserves, only 2% of its manganese ore is currently processed in the country.

“We, therefore, urge African leaders and investors across the continent to also promote the beneficiation of these minerals close to the point of production so that we can stop the export of jobs and profits,” Mantashe said.

From words to action

Those remarks sparked a robust debate at the conference about how beneficiation can be achieved.

David Sturmes-Verbeek, founder of The Impact Facility, says beneficiation policies could involve offering tax incentives – such as reducing or exempting royalties on minerals – if miners agree to undergo further processing of raw materials within the region. Alternatively, higher punitive royalties could be imposed on minerals exported in concentrate form.

In his speech, Mantashe said that South Africa “will this year intensify our engagements with the manganese producers and investors to invest in local beneficiation and thereby add value to these minerals.” The minister floated more specific ideas, including “sustaining commodity linked tariffs, as well as consolidating and applying incentives and other existing financial instruments to support and encourage beneficiation.”

Yet in South Africa and beyond, the provision of power remains a major block to value addition. Turning raw mining produce into advanced technologies – such as parts for electric vehicles or clean energy battery components – requires huge supplies of reliable power. In South Africa, which has in recent years undergone intense periods of power cuts known locally as load shedding, that is particularly challenging.

David Luke, professor in practice and strategic director at the Firoz Lalji Institute for Africa at the London School of Economics, told African Business that Africa’s energy deficit means it is unlikely to be able to begin major value addition immediately.

“The energy situation in most African countries that have minerals – including South Africa – is difficult, which constrains their chances of being competitive in processing minerals. This is not going to change in the short term. There is relatively little investment going into the power sector and without power you can’t transform the minerals. These minerals require transformation and it’s a big consumer of energy. China is the world’s leading processor of minerals, because energy is cheaper there,” says Luke.

Mantashe attempted to reassure investors that South Africa is making progress towards offering a reliable energy supply to enable value addition.

“We are mindful that for local beneficiation to succeed, we need to guarantee consistent, reliable, and affordable electricity supply. Despite the recent setback, I can assure you that, now that we have reached over nine months with no electricity interruptions, government is working on measures to reduce administered prices, and in so doing reduce the cost of doing business in South Africa,” he told the Indaba.

Power for beneficiation is also on the agenda in Guinea, which sent its largest ever delegation to this year’s Indaba as it looks to ramp up production at its long-delayed Simandou bauxite project. Speaking at the Indaba, Bouna Sylla, Guinea’s minister of mines and geology, outlined the measures the government is taking to develop alumina processing plants and refineries and added that the country is interested in working with regional gas producers to provide energy for alumina processing.

However, power is not the only impediment to beneficiation. LSE’s Luke says that too many countries still lack the technology and know-how to add value to their minerals. Throughout the Indaba, community leaders echoed this concern, calling for more investment in skills development so that African mining employees can take higher paying jobs often reserved for expatriate workers.

Cross-border cooperation

Whether on energy supply or skills, there was an increasing acknowledgement at the Indaba that it will be difficult for individual African countries to go it alone in a competitive global environment where natural resource extraction often resembles a race to the bottom. Instead, countries were urged to work with neighbours or regional blocs to build value chains that cross multiple countries, enabling them to pool skills, energy supply and industrial and scientific know-how while crowding investment.

“In Africa, we take different positions and we become vulnerable as a continent,” Mantashe told the Indaba. “If we don’t have capacity (to add value to a mineral), neighbouring countries must talk to us.”

That new openness to cooperation is evident across the continent, notably in the ambitious Lobito Corridor scheme. The Corridor, which is being billed as the biggest US-supported infrastructure scheme on the continent, will connect the Port of Lobito on Angola’s Atlantic coast with Zambia through a series of transport schemes. It may later be extended to East Africa. As part of the scheme – which has received international commitments of around $6bn – the African Finance Corporation (AFC) said it would commit up to $500m in financing for the Lobito-Zambia greenfield rail, one of the Corridor’s flagship projects.

The AFC signed a deal with US critical minerals firm KoBold Metals – a US firm backed by Bill Gates and Jeff Bezos – as an anchor client on the rail line, guaranteeing a minimum of 300,000 tons of copper and related freight per year. The AFC also committed $100m to Kobaloni Energy to support Zambia’s first battery-grade copper sulphate facility. At last year’s Indaba, Ivanhoe Mines signed an agreement for transporting mineral products from the Kamoa-Kakula Copper Complex along the Lobito Atlantic Railway Corridor.

The Corridor was just one example raised at the Indaba of how countries can work together via value chains to enable critical minerals investment and beneficiation.

Talking on the Indaba’s podcast before the conference, John Sloan, economic affairs officer at the United Nations Economic Commission for Africa, said that progress is apparent, and added that he is encouraged by discussions on an African green minerals strategy.

“We see very tangible progress in the minerals sector and related areas for example regionally with the African Continental Free Trade Area… [there are] a number of cross-border agreements and initiatives to build value chains, to move together into higher value activities.”

Net zero

Regional and continent-wide cooperation is also essential if the mining sector is to aid global efforts towards net zero. At present, the global mining sector contributes 4-7% of global greenhouse gas emissions, according to McKinsey & Company, including emissions from mining operations and power generation.

Strategies for net zero were proposed during the course of the indaba, with most speakers pointing to new technology as the solution.

While firms like Anglo American flaunt new plans to achieve net zero – the UK and Johannesburg-listed mining giant told the Indaba it aims to be carbon-neutral by 2040 – smaller miners often struggle to align their corporate and sustainability goals.

Many mining companies operating in remote parts of the continent still rely on purpose-built heavy fuel oil (HFO) plants to provide power for their operations, although miners are increasingly establishing their own solar facilities on or near their mines in order to provide reliable and climate-friendly power supply. HFO plants are among the most polluting ways to generate electricity and are considered obsolete in much of the world. Mining companies account for the majority of the 13 GW of HFO consumed in the continent (outside of South Africa) currently.

But, so far, less than 1 GW of HFO demand in Africa has been displaced by renewables, suggesting that there is a long way to go before the sector can achieve a genuine net zero contribution.

New technologies floated at the Indaba– including Anglo American’s bid to use less polluting liquefied natural gas that emits less carbon in its fleet of ships, and an app presented by Krux Analytics to help companies drive efficiencies in their drilling operations – will doubtless help to shift the dial. But without wholesale energy reform the mining sector’s contribution to energy usage is likely to continue to be disproportionately high.

A new approach to artisanal mining?

Whether on energy, beneficiation or other topics of interest to the mining sector, this year’s Indaba was recognised for inviting community leaders and activists impacted by the industry to participate in these conversations.

“It’s not that communities are against mining but they have certain expectations and they need to be heard and integrated through not only consultation but by joint decision making,” said Sturmes-Verbeek.

“Personally, I think it was a huge step up for Mining Indaba, and I think it was a welcome development across the board. I don’t think it’s the end of it. Now that they have had positive feedback from attendees of the Indaba, it will happen again.”

For Sturmes-Verbeek, whose organisation was founded on the basis that mining communities, despite being the most affected by mining, are not benefiting enough from the practice, there were welcome discussions in particular around the contribution of artisanal mining.

His Impact Facility focuses on initiatives to formalise and partially mechanise artisanal gold miners across Kenya and Tanzania by leasing out equipment to miners who are otherwise unable to access funding. Sturmes-Verbeek says that while the formal sector is often very much to the fore at industry gatherings such as the Indaba, there is also huge potential for advancements in multiple areas by working with artisanal miners, who he says produce about 18% of Africa’s gold. Bridging the gap between the informal and formal sectors should be a priority and will benefit the economy, climate and safety, he argues.

“Artisanal is defined as informal, unmechanised, manual… As you move towards a more mechanised way of mining, it may come with sacrificing jobs, however, you can increase productivity, increase health and safety, reduce the environmental impact, and you can see regional and even national development,” he says.

Yet relations between governments and artisanal miners are often complex if not outright hostile. The divide was summed up in further Indaba remarks by Gwede Mantashe, who excoriated the practice of illegal mining following the deaths of at least 78 illegal gold miners in a police action near Johannesburg in January.

“Once you get into illegal mining, your minister is the minister of police, it’s not me, I’m not your minister, you are stealing gold, your minister is the mister of police… that’s it.”

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google