In the late rainy season of Gambia’s capital, Banjul, 24-year-old Kumba Njie is a few weeks into her six-month diploma in cloud computing at the Indian Institute of Hardware Technology. Cloud computing, which enables businesses to manage and process data online rather than relying on physical servers, is transforming industries globally and contributing to a market valued at over $600bn.

“We’re learning about cloud concepts, security issues, networking in the cloud, and other topics, within eight modules,” says Njie. “I love all things tech, and I’m hoping this will lead to a job with Amazon or Microsoft once I’m done.”

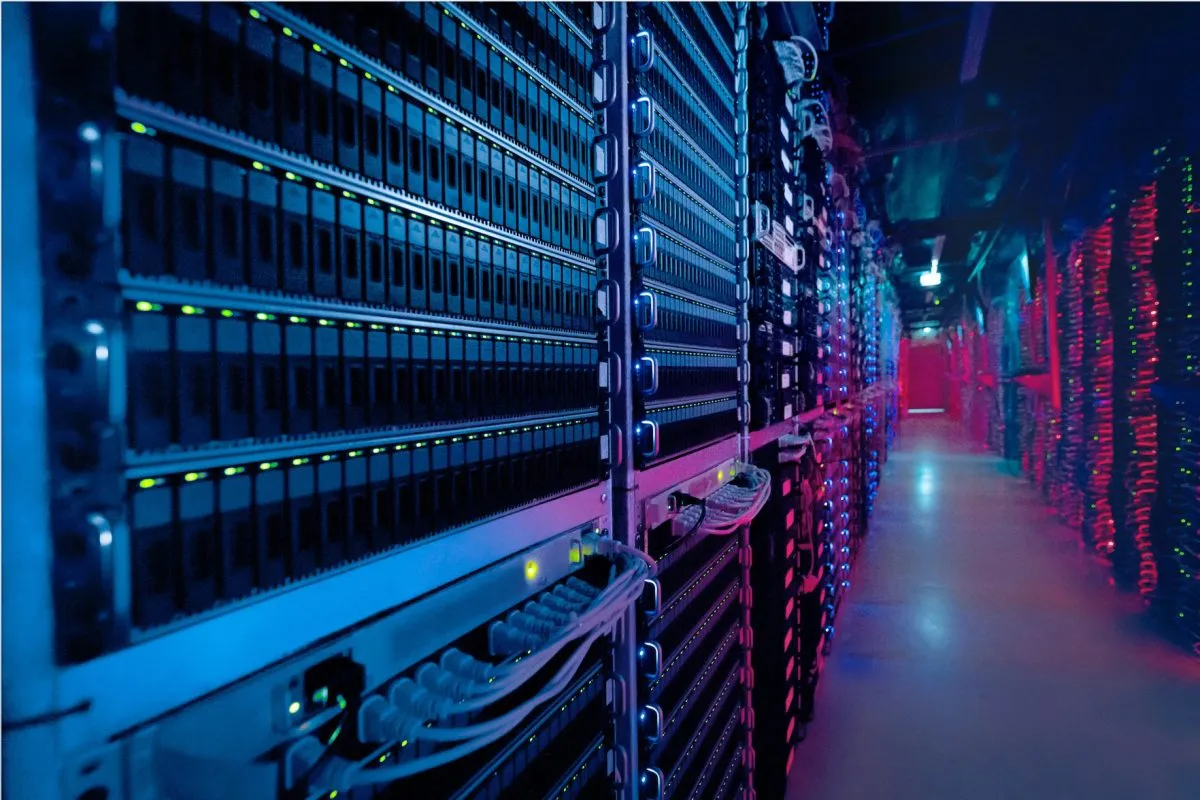

Cloud technology is revolutionising how companies store and process data. It offers increased flexibility, scalability, and cost savings. Businesses adjust resources in real-time, scaling their data and storage needs up or down as needed, without the heavy investments required to maintain physical servers on-site.

According to data firm Xalam Analytics, the demand for cloud computing services in Africa is soaring, with annual growth rates of 25% to 30%. This pace far exceeds projected growth in Europe and North America, where cloud service uptake is expected to grow at 11% and 10%, respectively, between 2023 and 2028.

Levelling the playing field

This shift is helping level the playing field for African businesses, allowing them to compete globally without the financial strain of maintaining expensive individual data centres. The impact of cloud technology has been especially profound for Africa’s fintech and telecommunications sectors.

“We harness the power of the cloud to drive efficiency, cut costs, and scale effortlessly across high-transaction markets like Nigeria,” says Gurbhej Dhillon, chief technology officer at Flutterwave, a fintech firm. By leveraging Microsoft’s Azure cloud infrastructure, Flutterwave handles payment processes for its global merchants.

Cloud computing services that are available to African businesses span a wide spectrum, from basic data storage and virtual computing power to advanced tools for application development and customer management.

Infrastructure as a Service (IaaS) offers flexible server and storage capacity through leading global providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, while Platform as a Service (PaaS) helps companies streamline application development and management.

Meanwhile, Software as a Service (SaaS) provides accessible solutions including customer relationship management (CRM) platforms and payroll systems.

For larger African enterprises, the cost of cloud services varies greatly depending on their specific operational needs. High-transaction companies may spend in excess of tens of thousands of dollars annually, with expenses driven by factors such as storage requirements, computational power, and data usage.

Several African companies are already benefiting from cloud technology. TymeBank in South Africa uses AWS to manage 85% of its digital operations. The bank can scale its resources automatically during high-demand periods, such as month-end surges, without disruptions.

Nigerian fintech Aella Credit uses AWS to streamline its loan services, reducing verification errors and improving access to credit for underserved communities.

Flutterwave’s cloud infrastructure enables the company to quickly respond to market shifts, such as high-traffic events like “Black Friday”, by minimising downtime and ensuring swift recovery from disruptions.

“We’re always fine-tuning, resizing, or deactivating resources when needed,” says Dhillon.

By leveraging server-less computing through the AWS Lambda service, the company reports annual infrastructure savings of $120,000. AWS Lambda powers many of Flutterwave’s key processes, such as payment integrations with Visa, while Amazon API Gateway and Amazon Simple Queue Service (SQS) handle settlement reports and transaction data.

Flutterwave says its switch to AWS has drastically improved its customer onboarding process, reducing the setup time by more than 60%. What previously required up to five days now takes less than two, enabling faster scaling.

Data residency laws pose challenge

As African businesses continue to harness the power of cloud technology, they must tread carefully through a patchwork of regulatory requirements that threaten to impede their progress. Walking a tightrope between innovation and compliance, firms need to adapt their cloud strategies to meet – at-times – stringent data residency laws and navigate complex national regulations across the continent.

The Central Bank of Nigeria (CBN) enforces strict data localisation requirements. Under the Nigeria Data Protection Regulation (NDPR) and CBN’s directives, financial institutions must ensure that customer data is stored locally.

For firms like Flutterwave, this has meant adopting a hybrid cloud strategy. While they leverage global cloud providers like AWS for scalability, they simultaneously store sensitive financial data on local servers to comply with national regulations.

“This experience has shaped our broader African cloud strategy,” says Dhillon. “Anticipating similar regulations in other markets, we developed a flexible framework for region-specific deployments, ensuring regulatory compliance and adherence, building customer trust, and enabling scaling across Africa’s diverse regulatory landscape.”

Regulations often require firms to invest in local data centres or partner with in-country providers, and can increase costs and slow deployment.

This challenge is particularly pressing for companies expanding across multiple African markets, where regulations vary by region, says Jean-Claude Gellé at consultancy McKinsey’s Johannesburg office. McKinsey research shows that over 50% of leading African firms cite “legal and regulatory constraints as the primary barrier to cloud adoption”.

However, forward-thinking companies are tackling these challenges by engaging early with regulators and collaborating to accelerate cloud adoption, says Gellé. They’re also implementing intelligent architectures that blend on-premises servers and cloud solutions, staying agile as regulations evolve.

Foreign investors are keenly eyeing Africa’s cloud computing market, where penetration rates are set to grow rapidly. In a 2024 McKinsey survey of technology leaders at more than 50 major African businesses, participants reported that, on average, 45% of their workloads are already hosted in cloud environments.

Africa’s increasing access to high-speed internet, facilitated by a growing network of undersea cables, is a major driving force behind this expansion. But many African firms still rely on foreign cloud providers, using data centres situated abroad. This reliance is notable among Nigerian government agencies, with 70% hosting their data overseas, a trend influenced by cost, reliability, and storage requirements regardless of regularity demands.

Despite making up 18% of the global population and contributing approximately 3% of global GDP, Africa accounts for less than 1% of global public cloud service revenue.

Investment in infrastructure needed

Local infrastructure is vital for Africa’s digital transformation. Africa Data Centres (ADC), a provider with facilities in Johannesburg, Nairobi, Lagos and Cape Town, helps businesses meet local data laws while maintaining low “latency” – essentially allowing computer services to respond swiftly – and high security. This is particularly crucial for sectors like banking and telecoms, where secure data handling is essential.

McKinsey’s Gellé says companies are increasingly turning to local infrastructure providers such as ADC to balance compliance with performance, allowing them to navigate regulatory constraints more effectively.

“We are expanding pretty much in every single market where we are already operating,” says Xavier Matagne, chief development officer at ADC. The company’s projects include a new data centre in Accra, Ghana, as well as upcoming expansions in North Africa, catering to the region’s growing cloud needs.

Matagne says, however, that the divide in cloud infrastructure between South Africa and other regions on the continent remains stubbornly high.

“There’s a big gap between South Africa and West Africa, where cloud adoption is still catching up,” he says.

ADC’s Johannesburg facility now consumes 40 MW of power, and the Lagos site started with just one.

A key advantage ADC offers is its cloud-neutral stance, giving businesses access to multiple cloud providers like AWS, Google Cloud, and Microsoft Azure from one location.

“Most of our largest customers are cloud providers,” Matagne says. This multi-cloud connectivity allows companies to benefit from reduced latency, increased flexibility, and more reliable services – all without needing to invest in their own data centres.

This expanding cloud ecosystem is further strengthened by local providers like Kenya’s Angani and South Africa’s Cloud ZA, which offer critical services tailored to regional needs. Angani, one of Kenya’s leading cloud providers, enables businesses to leverage the flexibility of the cloud for data workloads such as enterprise and web applications.

With data centres across Kenya and beyond, Angani helps firms cut costs by outsourcing their IT infrastructure. Similarly, Cloud ZA assists startups by simplifying cloud adoption through AWS, allowing companies in Cape Town and Johannesburg to modernise their digital platforms efficiently. Yet the cost of adoption remains one of the most significant challenges.

Navigating the complexities

“Price is critical,” says Phares Kariuki, who founded Angani but now runs Pure Infrastructure, a cloud consultancy. “Many local companies don’t have the technical teams to manage cloud environments and often rely on resellers to navigate the complexities.”

Devaluations in the Kenyan shilling or Nigerian naira can drive up cloud costs, forcing businesses to reassess their usage models. For many small and medium enterprises (SMEs) the shift to the cloud is not just a technological decision but also an economic one.

This pricing sensitivity and the demand for tailored solutions could open the door for African cloud providers to play a critical role in shaping the region’s digital landscape.

One area in which Kariuki believes there is not a shortfall is in talent. With a significant number of skilled IT graduates entering the workforce each year, the issue is not a lack of knowledge, but a lack of opportunities and infrastructure to harness that potential.

“Africa doesn’t have a talent problem; it has an opportunity problem,” he says. “The future growth of cloud will rely heavily on nurturing both local talent and local infrastructure to meet the continent’s diverse needs.”

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google