South Africans will go to the polls on 29 May in what is set to be the closest election since the end of apartheid, and which is expected to be dominated by the issue of electricity.

The ruling African National Congress has dominated the country’s politics for the last 30 years, easily winning parliamentary majorities at every election since 1994.

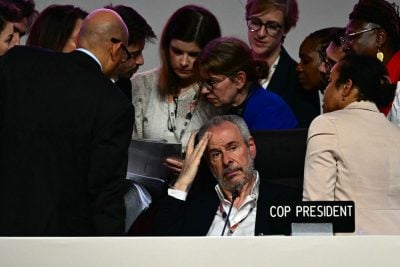

Now, however, after presiding over the implosion of South Africa’s electricity system, opinion polling suggests that President Cyril Ramaphosa’s party is in danger of failing to secure the backing of 50% of voters.

A poll from last May found that 24% of voters who had previously backed the ANC planned to take their votes elsewhere if the issue of load-shedding (power cuts) is not resolved.

This could see the ANC having to rely on smaller parties – possibly the far-left Economic Freedom Fighters – to form a government. In a less likely scenario, the Democratic Alliance, the main opposition party, may be able to cobble together a coalition that would see Ramaphosa ejected from office.

The risk with a coalition government is that the various players will prove unable to agree on the difficult decisions needed to rescue the energy system.

Indeed, after the election, whoever leads the government will have few tools with which to immediately tackle the shortfall in power supply.

“There are no quick wins to reduce load-shedding, unfortunately,” says Shawn Duthie, associate director at advisory firm Control Risks.

Load-shedding to dominate campaign

It wasn’t meant to be like this. Six years ago, the president took office in a wave of “Ramaphoria”, as South Africans celebrated the resignation of his disgraced predecessor, Jacob Zuma.

While Ramaphosa has made some progress in tackling corruption and restoring investor confidence from its nadir under Zuma, he has proven unable to keep basic services running. Load-shedding, once an occasional nuisance, has become an infuriating feature of everyday life. Over the past year South Africans have sometimes had to go without mains electricity for more than 12 hours a day.

The problem stems from the long-term neglect of the country’s electricity generation and transmission networks. South Africa’s fleet of ageing coal-fired power stations has been left to decay, while little investment went into alternative sources of generation until recently.

Corruption and mismanagement at Eskom, the troubled state-owned utility, have compounded the problem. And the failure of municipalities to pay their electricity bills has in turn exacerbated Eskom’s financial malaise, further limiting its ability to maintain existing facilities and invest in new infrastructure.

In fact, under Ramaphosa, the government has already taken numerous measures to attempt to alleviate the crisis, while also fundamentally reforming the energy system to reduce dependence on Eskom. Several bidding rounds have attracted independent power producers (IPPs) into wind and solar generation, while reforms implemented in 2022 allowed businesses and households to make greater use of off-grid solar generation.

“A lot of the quick wins around energy acceleration have been unlocked by a task team that sits in the President’s office,” notes Vuyo Ntoi, joint managing director at African Infrastructure Investment Managers (AIIM). “This has seen cumbersome regulations that fulfil no practical purpose removed, such as the limit on power projects that could operate without licensing.”

Rooftop solar capacity has almost doubled in the past year. This appears to be a factor in load-shedding easing slightly over recent months. Whether the tentative improvements will be enough to save Ramaphosa will become clear on 29 May.

Coalition complications

Ramaphosa has spent much of his presidency under attack from all sides, with factions allied to Zuma never forgiving Ramaphosa for his role in forcing his predecessor to resign.

Zuma was suspended from the party in January after announcing he would campaign for a splinter group. The consequences for the ANC’s vote share in KwaZulu-Natal, Zuma’s political heartland, could be significant.

If the ANC’s support does fall below 50% – as it did in municipal elections in 2021 – then the political horse-trading will begin as the parties scramble to form a working government.

The Democratic Alliance, the second largest party in the National Assembly, has formed a loose alliance, known as the ”Multi-Party Charter” (MPC), with nine other smaller parties. Members of the MPC have pledged not to support either the ANC or the EFF in a post-election coalition.

However, whether a coalition – of whatever composition – can be more effective than the ANC government in turning the lights back on is highly questionable. Duthie warns that a coalition could bring “policy stagnation”.

“If coalition politics at a local level is any marker, then major reforms – or even proper governance – will be slowed considerably,” he warns. “Many South African political parties seem to view governance as a zero-sum game and working closely with other political parties to pass legislation or reforms – a necessity in coalition governments – is seen as a negative.”

Whoever leads a coalition government could be removed at any moment should they lose the support of any one of their coalition partners. Under the country’s constitution, the president is elected by the National Assembly and can be removed through a vote of no confidence by lawmakers.

From the perspective of energy investors, the worst-case scenario would appear to be the EFF entering government in a coalition with the ANC. The EFF’s firebrand leader, Julius Malema, has pledged to halt the split of Eskom into generation, transmission and distribution entities, a reform that is generally supported by investors. The EFF has also made a manifesto commitment to scrapping the IPP programme and replacing it with a process that would see contracts awarded to majority black owned businesses.

Duthie, however, believes that a doomsday scenario is unlikely. “The EFF’s bark is much worse than their bite,” he says, noting that some of the party’s more radical policies – such as nationalising land – could not be achieved without a constitutional amendment that would require the support of two-thirds of the National Assembly.

Amid all the speculation around what a coalition could look like, it is worth noting that the ANC itself has been anything but united in recent years. Several ministers, including energy minister Gwede Mantashe, have engaged in almost open rebellion against the Just Energy Transition Partnership deal signed by Ramaphosa, which brings international funding for new renewables generation. Mantashe and other ANC chiefs with strong links to mining unions favour a continued dominant role for the coal industry.

Doug Fourie, lead economist at Oxford Economics Africa, believes the success of the next government will hinge on who becomes energy minister. He notes that, judging by the current pace of the IPP programme, load-shedding is likely to persist until at least 2028, if not 2030. However, he adds, “an appropriate energy minister with the requisite qualifications, knowledge, and skills could likely speed reforms up to end load-shedding by end-2026 if that minister does not face severe internal political opposition.”

Breaking the gridlock

Whether Ramaphosa clings to office or not, the government will have limited room for manoeuvre on energy policy. As well as having to contend with load-shedding, South Africa’s economy has been virtually stagnant for several years, meaning the scope for public sector investment is severely constrained. AIIM’s Vuyo Ntoi believes further private sector investment is inevitable.

“The current generation shortfalls coupled with the need to strengthen the national transmission network entails that significantly more investment will be required,” he says. “Given the government’s limited fiscal headroom, it will be incumbent upon the private sector to invest further capital into electricity infrastructure.”

Solving the country’s grid constraints will be perhaps the single most important priority for the next president and energy minister. Without better transmission, generation projects cannot deliver power to homes and businesses.

Indeed, the inability to connect new wind and solar projects to the grid resulted in the country’s previous IPP round ending in fiasco, with far fewer projects awarded contracts than was originally planned. A new round is currently in progress, but critics said that bidders for wind and solar contracts were encouraged to select sites close to current transmission lines – rather than in the best areas for wind and solar generation.

Ntoi notes that securing grid access remains “cumbersome”, partly because of a lack of expertise within Eskom. He argues that the government should allow generation companies to build their own grid connections, and then “amortise that benefit through a share of the national transmission company’s revenues”.

Ultimately, all solutions will take time. There are no easy routes to ending load-shedding. The country faces a daunting range of problems in the energy sector that have accumulated over many years and will not go away overnight. One thing that is certain is that the next government will have its work cut out.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google