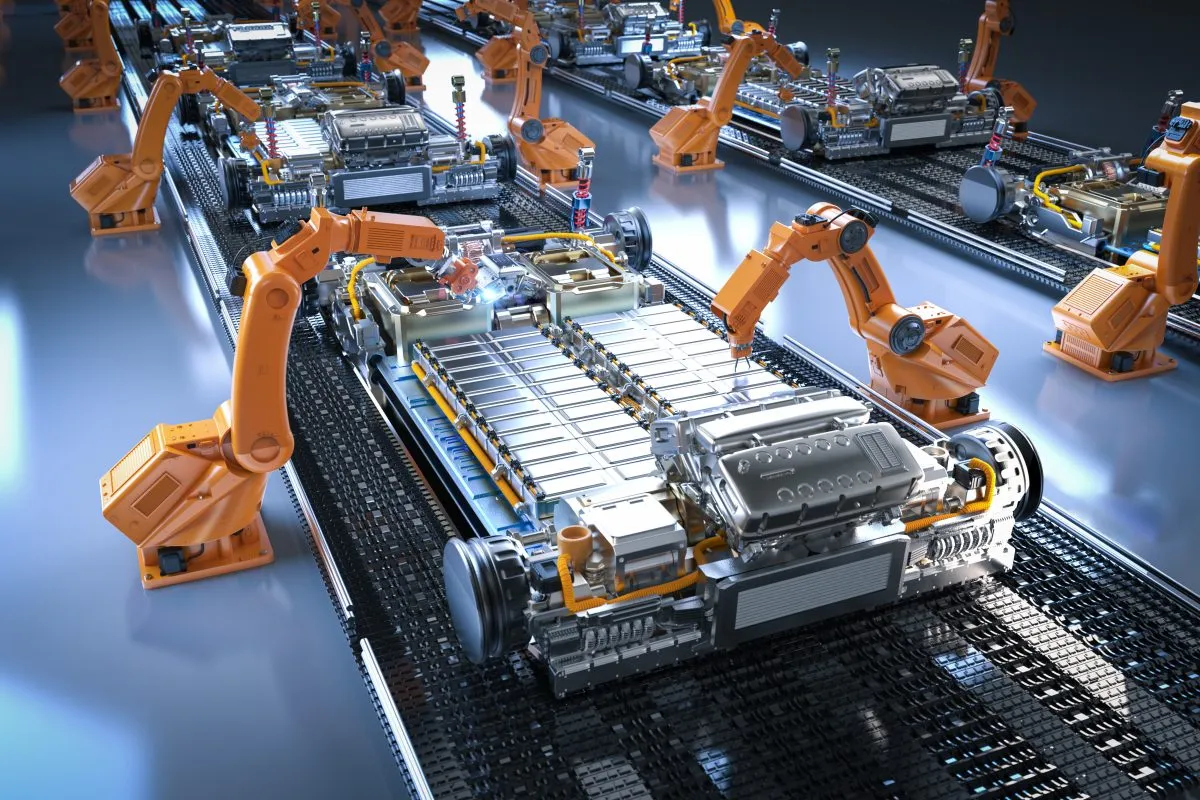

Humanity once again stands at the dawn of a new industrial epoch. Similar to the ways in which coal and gas powered the first and second industrial revolution, the transition to cleaner energy and the use of battery power for cars, homes and even industry is expected to mark the arrival of a new industrial age.

In recent years, concern about the fate of the planet has increased in tandem with the warming of the earth, driven in part by fossil fuels and emissions from the vehicles, industries and homes that rely on it.

Now, the emergence of battery technology promises to reverse this trend and, many in Africa hope, catalyse the industrialisation of the continent, where several of the metals that undergird this new technology can be found.

Of course, Africa providing essential resources for the rest of the world while deriving only a fraction of the benefits is a tale that many in and outside the continent would find wearily familiar. Africa’s gold, diamonds, oil and cocoa, among others, have had a greater impact elsewhere than they have on the resource-rich yet poor continent.

This time, however, leaders are resolved that it will be a different story. Countries where these metals are available are committing to value addition, rather than allowing the metals in their raw state to go for processing outside Africa, as has been the case in the past.

Zimbabwe, one such country, has gone as far as banning all exports of lithium, one of the components needed for battery production, from the country.

Oluranti Doherty, Director of Export Development at African Export-Import Bank, says that African leaders are alive to the task. In April this year, the Bank, UNECA and the governments of DRC and Zambia signed a framework agreement to support the two countries establish special economic zones where battery precursors as well as batteries and electric vehicle value chain would be produced.

Doherty says the leaders of the two countries have acted with impressive dispatch. Following discussions that began in November 2021 at the DRC-Zambia Business Forum in Kinshasa, the two countries signed a collaboration agreement, a significant step considering their combined output.

“Between DRC and Zambia, they account for 11% of all global copper shipped for beneficiation in Asia, while DRC in particular accounts for 88% of global cobalt exports,” she explained in a recent conversation with African Business.

Now, with this new agreement, the two countries are moving even closer to the reality of producing batteries and making a claim to some of the prodigious returns that battery makers are expected to accrue.

“We know that the battery precursor market will be about $271bn by 2025. So there are enormous opportunities even in the precursor space,” she says.

And then you can look at the assembly and sale of electric vehicles, which will reach a market capitalisation of about $7trn by 2025, quoting from a report that the bank commissioned from Bloomberg to assess the potential of the battery production in the region.

The report encourages players who are banking on the potential of developing a regional value chain based on battery production. Among other positive indicators, it projects that demand for the metals necessary for battery production will continue to grow exponentially, reaching a staggering 13.5m metric tons by 2030.

Cobalt, in particular, is set to experience substantial growth, with demand expected to increase by 1.5 times from the levels observed in 2021.

Demand for another vital component, nickel, predominantly used in the cathode, will reach approximately 1m metric tons by 2030, a five-fold increase on 2021 figures. Similarly, copper, crucial for various battery components, is projected to see an annual demand of 3.9m metric tons by 2030. This figure represents a six-fold increase compared to the levels witnessed in 2021.

In much the same vein, aluminium will see its demand soar to 3.1m metric tons by 2030, again marking a substantial six-fold growth over the same period. In essence, the lithium-ion battery industry is poised for explosive growth and players who get a foot in stand to reap tremendous benefits.

Pre-feasibility study underway

That is the hope that Afreximbank and partner DFIs including Africa Finance Corporation (AFC), the African Development Bank (AfDB), Arab Bank for Economic Development in Africa (BADEA), the Africa Legal Sustainability Fund (ALSF) and ECA have and why each of them has offered its support to the initiative.

Currently, there is a pre-feasibility study underway, after which efforts will turn to bringing in the extra investment that will be needed to implement the project.

Arise Integrate Industrial Platforms (Arise IIP) who have a strong track record in developing industrial parks and other infrastructure projects have been engaged to prepare the pre-feasibility study for the projects.

There will be two parks built, one in each country, to focus on different areas of production. “The two SEZs will be complementary and focus on different parts of the production process. The idea is for them to support each other and integrate into the value chains in the continent in terms of sustainable materials or in terms of sourcing intermediate products,” Doherty explains.

But while these SEZs will be the sites for production, Doherty says the initiative has broader ambitions to build value-chain linkages with other parts of Africa where these metals can be found.

“So one of the things we are doing right now within the pre-feasibility study is looking at other African countries where we can source materials that would be required to produce within the SEZs in DRC and Zambia,” she says.

“We’ve been engaging counterparts in Gabon, in South Africa, and even in Madagascar because there are quite a number of minerals that are spread across the continent.

“So we are not just creating these two SEZs but we are integrating them into the various linkages within Africa where they can source materials and equipment and even explore intermediate processing,” Doherty says.

It is extremely significant that this is happening around the same time that the implementation of the African Continental Free Trade Area has been ramped up, thus offering opportunities for cross-border production and the development of regional production chains.

Lower production costs a major advantage

While the benefits for the countries – and for Africa – will be immense, there are several other reasons why this project may have an impact beyond the borders of the two countries.

Take the cost of production. According to the Bloomberg-authored study, establishing a precursor facility with a capacity of 10,000 metric tons in the DRC would come with a relatively modest price tag of $39m. This compares favourably with the expenses associated with a similar facility in the US, China, and Poland.

Specifically, constructing an equivalent facility in the US would necessitate three times the investment, amounting to a hefty $117m. In China, the financial commitment for a comparable project shoots to $112m, while in Poland, it still amounts to a substantial $65m.

The primary factor contributing to the DRC’s cost competitiveness is the significantly lower expenditure associated with acquiring land and executing the construction phase of the project. This cost advantage positions the DRC as an attractive location for businesses and investors seeking cost-efficient opportunities in the realm of precursor production.

Doherty notes another point in favour of local production. “As you know, one of the things China is grappling with is increasing labour costs. While in Africa, we still have a major competitive advantage in terms of labour costs. So in the long run, it is much cheaper to localise production on the continent.

“Apart from labour costs, it is also cheaper to produce where the minerals are than to ship them all the way to Europe or Asia which, when you do, also adds to the carbon emissions we are trying to reduce,” she says. “Thus the projects would contribute to the continent’s drive to promote clean energy and sustainable industrialisation.”

What this means for producers is that they can lower their costs, make cheaper cars and help push the electric vehicles to more buyers who may have been prohibited by costs, especially in the poorer regions of the world, including Africa.

Support from local leaders will be crucial and Doherty reports that there have already been fruitful engagements with the two governments.

“One of the key commitments they have made is to ensure they put in place enabling regulations and the kinds of policies that will make them more investor-friendly. The manufacturing facilities will be located in the SEZs where there will be special incentives for investors.”

With the return of restrictive industrial policies in the West, notably the Inflation Reduction Act passed in the US last year, and China’s move to control the export of minerals from the continent, combined with the uncertain geo-political situation, African governments would be well advised to give local industries every assistance they can.

Especially, as Doherty describes it, in ‘audacious projects’ such as this one, with so much riding on it. “Having the support of the governments means that we are able to move swiftly in terms of project development, and attracting local, regional and international investments.”

Private sector will be defining factor

Ultimately, however, this is a private sector venture and the role of the DFIs currently supporting the project, as well as the other investors expected to come on board after the completion of the pre-feasibility report, may be the defining factors.

Doherty speaks of the trio of stakeholder groups that she says should be a source of confidence. “We have strong commitments from the government. We have strong commitment from our financial partners – AFC, AfDB, BADEA and others. And we also have strong technical content partners in the ECA and ALSF. All in all, we have the right ingredients to make this succeed.”

And while this is and will remain African in its focus , Doherty says investors from all over the world are welcome to tap into the opportunities the venture provides.

“We need not only African, but international investors to come on board. Our focus is for beneficiation to take place here on the continent and we can achieve that through partnerships. It could even be with international firms that choose to set up in Africa so they can be close to the raw materials in the continent.”

Of course, what is already assured is the support from African DFIs, for which this project means a bit more than a lucrative investment opportunity.

The goals of increasing Africa’s share of global trade, adding value to its minerals and supporting industrialisation are shared by these DFIs and this is an opportunity to achieve all these in one fell swoop.

For Afreximbank, the objectives driving the project are particularly resonant. “This initiative ties in well with two key pillars of our sixth strategic plan, namely to promote intra-African trade and implementation of the AfCFTA; and to facilitate industrialisation and export development.

“We really want to ensure that we support the diversification of African trade, so we can reduce our dependence on commodity exports and increase our share of global trade,” Doherty stresses.

The bank is funding the feasibility study and, along with its partner DFIs, including AfDB, AFC and BADEA, will almost certainly be among the first investors once that is completed and the project moves to the next stages of financial closing and actual implementation.

A lot will be riding on this initiative, from the economic fortunes of the DRC and Zambia, the viability of minerals-based industrialisation to the very fate of the clean energy revolution.

Analysts and observers will be keen to see how well prepared these two countries and their early stage financial partners are for this enormous undertaking. Its success would also encourage other African countries to pursue a similar path with their own mineral resources, which would have profound repercussions for the future of global trade, a future in which Africa is not just the source of raw materials, but a key player in the global value chain.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google