Reacting to news that China’s economy has fallen into deflation, American President Joe Biden last week declared the country to be “a ticking time bomb” under the global economic and security apparatus. Pointing to Beijing’s weak growth figures, high levels of unemployment, and ageing workforce, Biden said that “China is in trouble.”

Figures released by the National Bureau of Statistics of China (NBS) showed that the consumer price index, the country’s main gauge of inflation, fell by 0.3% in July. Factory gate prices continued to decline, having fallen by 5.4% in June, the fastest rate of depreciation in over seven years. These concerning numbers come amid a sluggish post-Covid recovery that has raised fears China is entering an era of declining prices, stagnating wages, and low demand for consumer and industrial goods.

But what does deflation and economic instability in Africa’s biggest export market mean for the continent? Could Africa also be “in trouble?”

Carl Mbao, managing partner at Frontier Capital Partners in Lusaka, is concerned about the impact Chinese deflation could have on the country’s demand for African commodities, particularly copper. In 2021, Zambia sold $1.64bn worth of copper to China – with the commodity making up 70% of the country’s total exports. In Mbao’s words, Zambia is therefore “hugely exposed” to Chinese demand for its commodities.

Some African neighbours are even more exposed. The Democratic Republic of the Congo (DRC) sends almost half of its exports to mainland China. Over 90% of the DRC’s exports consist of just five commodities: refined copper and unwrought alloys, cobalt, unrefined copper, copper ores or concentrates, and crude oil. Weaker demand from China, and depressed prices on global markets, would likely lead to a significant drop in exporting activity and revenue.

Commodity prices have already posted declines on global markets in response to China’s deflation news, even though the trend will take at least a few months to feed into real demand. At time of writing, the NASDAQ copper index had declined over 7% in August alone as China’s economic woes stifle prices. Brent crude also fell by 1.3% in the immediate aftermath of the news.

Mbao notes that the potential implications, both for Zambia and other African commodity exporters, go further than a simple (if worrying) drop in revenue for exporters. “Copper is our single largest source of foreign exchange – so from a budget perspective, it’s critical for Zambia,” Mbao tells African Business.

“With less forex coming in, could that impact our ability to service dollar-denominated debt?” Mbao also asks. “China is Zambia’s largest bilateral creditor. Their view on their own macroeconomic environment probably affects how they’re thinking about debt restructuring conversations.”

“An environment of rising interest rates in the States has its own effects on capital markets, but when you combine that with softer growth and productivity in China, all this could encourage less “concessionary” stances around things like debt,” Mbao adds.

Not all bad news

However, it is not all necessarily bad news for Africa. Max Walter, senior industrial policy advisor at the Tony Blair Institute for Global Change in Nairobi, says that “we shouldn’t jump to too many conclusions based on one month’s consumer index figures.”

“Some analysis suggests that the decline in prices in China is temporary,” Walter notes. “Last year was a somewhat skewed year because the global economy and the Chinese economy are coming out of Covid. We’ll have to wait and see if there are longer-term shifts happening.”

While recognising the implications of China’s deflation on African commodity exporters, he also argues that this must be balanced against the potential upsides. Walter points out that a weaker Chinese yuan (CNY) – which plunged to a fourteen year low after the consumer price index figures were released – has a number of benefits. While the vast majority of African debt is denominated in dollars, that which is priced in CNY is likely to become easier to service.

“Of course, if commodity prices go down and if Chinese demand for African commodities reduces, that could make it more difficult to repay existing loans, but on the other hand, if the Chinese currency becomes weaker, yuan-denominated debt becomes cheaper to repay,” Walter tells African Business.

“Loans that carry a variable interest rate – commercial, private Chinese loans to Africa – will also be impacted by the Central Bank lowering its base rate again and make it slightly easier for loans to be repaid. I think that might temper any negative effects a bit,” he says. The People’s Bank of China has taken strong steps to slash interest rates in a bid to encourage spending and stimulate economic activity.

Edward Knight, geopolitical researcher at the Tony Blair Institute in London, also points out that Africa’s exposure to China is varied. While the focus has been on commodity prices – and therefore commodity exporters such as Zambia and the DRC – it is important to note that Africa as a whole runs a trade deficit with China which, in 2022, stood at $47bn.

“Most African countries don’t have a trade surplus with China – it’s actually a relatively small number of resource-rich nations that will be negatively affected,” Knight says. “Deflation in China and a weaker yuan will mean cheaper imports, which is especially positive for those countries suffering from inflation.”

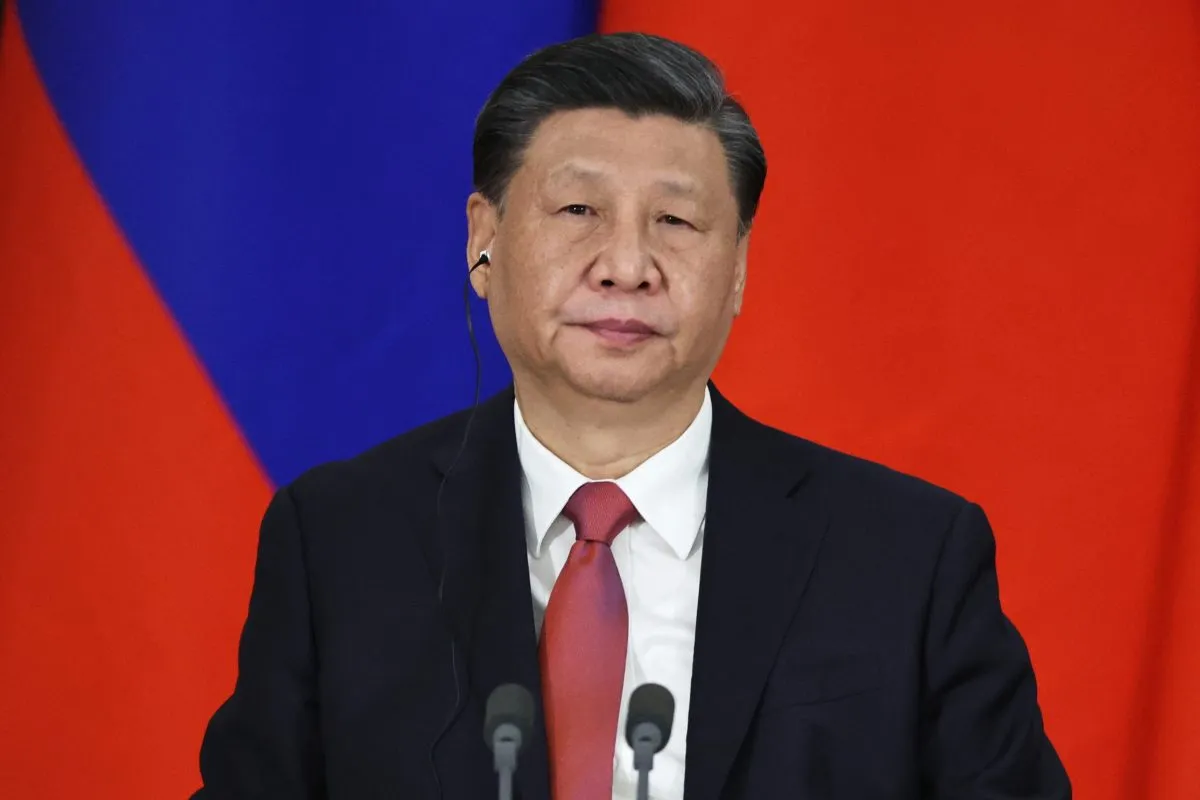

This period of economic instability comes at a time when major world powers are increasingly competing for greater levels of economic and diplomatic influence in Africa. China has been trying to further its interests in Africa for at least a decade, with President Xi Jinping’s flagship Belt and Road Initiative (BRI) seeing Beijing make investments in 52 out of 54 African countries.

Last December, President Biden hosted the US-Africa Leaders Summit in Washington DC as the US attempts to counter this influence. Russia, too, is seeking to build on its relationships in Africa. In July this year, President Putin hosted a “Russia-Africa Summit” in St Petersburg while, in August, he announced his intention to establish a free trade zone with four North African countries.

Could economic weakness in China jeopardise Beijing’s attempts to gain greater leverage amongst African countries? Knight believes that “we’re seeing a shift in terms of China-Africa relations, where it’s becoming more political and less purely economic – I think these economic conditions could potentially accelerate that shift.”

Chinese investment in Africa peaked in 2016, with changing domestic priorities and a string of failed loans encouraging Beijing to reconsider its “purely economic” relationship with the continent. China lent African governments a total of $28.4bn in 2016, but this number fell to just $1.9bn in 2020. Low growth in China is likely to incentivise Beijing to dedicate even fewer resources to Africa as policymakers focus on stimulating economic activity within its own borders.

From Africa’s perspective, too, the perception of economic weakness in Beijing could raise further questions about how exposed the continent is to China. Dr Edward Howell, a lecturer in Chinese politics at the University of Oxford, believes the current economic situation could mean many African countries will reconsider the viability of China as both a political and economic partner – but that doubts about Beijing’s activities in Africa have been growing for some time.

“China has signed memoranda of understanding with several African countries, 52 of which have entered into agreements under the BRI, but many of these countries, of which Angola is a prime example, have suffered from “debt trap diplomacy” and a failure to pay back loans to China,” Howell says.

“A slowing Chinese economy will certainly affect these countries’ decision to rely financially on China, but the failures of the BRI, and questions about China as an economic partner, have been seen long before China’s domestic economic troubles commenced.”

Deflation in China and weaker Chinese demand for African commodities will undoubtedly cause problems for the continent’s exporters, even if a weaker yuan could bring benefits for most African countries. While commodity prices are unlikely to remain low indefinitely – copper in particular is seen as essential to the world’s green transition – both Mbao and Walter suggest this period of volatility could encourage some countries to think about how to diversify their economies and hedge against such risks in the future.

“This is another reminder that commodity prices are volatile and having an economy that’s dependent on raw commodity exports is not a good long-term strategy,” Walter says. “There is more and more willingness and interest among African leaders to be more aggressive on industrial strategy; to try and move their economies away from dependence on raw commodities and towards more value-added production.”

“Ultimately that is the only way that these economies can become more resilient in the long-term.”

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google