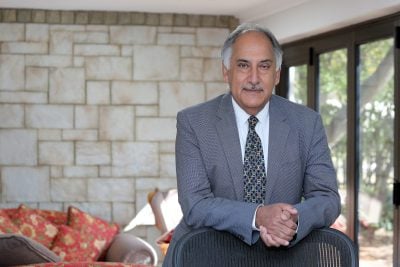

On 15 May the President of Kenya, William Ruto, nominated Kamau Thugge to be the new governor of the Central Bank of Kenya. If the appointment is ratified by both houses of the Kenyan parliament, Thugge will begin his first term as governor in the middle of June and replace the incumbent Patrick Njoroge, who has led the central bank since 2015.

The nomination of Thugge comes at a pivotal time for the Kenyan economy. With inflation still running at almost 8% and the Kenyan shilling hitting all-time lows against the US dollar, the monetary policies of the central bank are likely to come under increased attention in the months ahead. But how much do we know about the man who will soon be playing a crucial role in managing the Kenyan economy?

Thugge is widely seen as a conservative choice for governor. Educated in the United States, he has spent his career in national and international economic organisations. He started with a near-twenty-year stint as an economist at the IMF between 1985 and 2004, before returning for a two-year spell between 2008 and 2010 as a deputy division chief.

His career has also involved time working for the Kenyan government, with his most recent post being in Ruto’s council of economic advisors.

In 2019, Thugge was arrested as part of a corruption probe involving suspicious payments in a dam construction project. However, the charges against him were ultimately dropped and there seems to be optimism in Kenya that he could prove to be a wise choice. Edwin Dande, CEO of Cytonn Investments, an investment management firm based in Nairobi, tells African Business that “the gentleman is uniquely qualified, with Treasury and IMF experience, not to mention his Ivy League credentials… I hope he will uphold strong ethical standards – that’s the main challenge in this market.”

The financial markets also appeared to react positively to the news of Thugge’s appointment, with the Nairobi Securities Exchange Index jumping over 7% in the aftermath of the announcement. This perhaps reflects a hope that his experience in international finance could help the country clear a path for itself out of economic malaise. Thugge’s history at the IMF could be particularly valuable, with Kenya reported to be in talks for fresh funding with the organisation. Kenya is seeking assistance to support its dwindling foreign exchange reserves, which have fallen to $6.6bn, the lowest level since 2015.

This means the reserves are equivalent to just 3.66 months of imports, despite the central bank being required by law to maintain four months’ worth of cover. Fitch Ratings has warned that “increased balance of payment pressures and/or a sustained reduction in international reserves could lead to further negative rating action.” Thugge will need to leverage his experiences at the IMF in order to secure the funding that Kenya desperately requires.

Dorcas Muthoni Mutonyi, a financier in Nairobi who was on the shortlist of candidates for the governor position, tells African Business that Thugge’s economic principles appear to be similar to those of the President. “Dr Thugge has worked closely with President Ruto as senior advisor and head of fiscal affairs and budget policy,” she says. “This is a strong indicator that not only is he very well aligned with the president’s priorities, but that he has likely played a significant role in defining the president’s economic and fiscal priorities.”

Will Thugge back the Hustler Fund?

This alignment with the President may indicate that the central bank would seek to support the government’s high-spend policies, such as the “Hustler Fund,” an offer of reasonable credit to poorer Kenyans. One way to achieve this would be through quantitative easing (QE) – which is designed to inject more cash into the money supply and lower long-term borrowing costs to support spending.

Such a strategy would, though, risk increasing the rate of inflation at a time when it is already high. Mutonyi suggests that, rather than embracing QE, Thugge is likely to look to the bond markets to find the money needed for the government’s policies.

She tells African Business that “Thugge’s understanding of the international bond market will be useful in the role because it will give him the skills and knowledge necessary to raise funds from international investors… this will be important as Kenya seeks to finance its development agenda.”

Navigating bond markets will be a challenge, given that Kenya’s credit rating is six levels below investment grade, deep in “junk” territory.

Thugge could help strengthen Kenya’s credibility on international markets, but firm action to improve Kenya’s credit rating will be needed before the country can start to borrow at attractive rates again.

Focus on the shilling

Stabilising the Kenyan shilling will be another major task for Thugge as he attempts to reduce inflation in Kenya. Food and fuel prices have risen in the region, both prompted by market instability following Russia’s invasion of Ukraine. The weakening shilling has further contributed to prices rising in local terms.

Kenya is currently running a substantial trade deficit of just under $800m a month and relies on imports for many essential goods, most of which are priced in US dollars, the international currency of trade. (See “Can BRICS break the grip of the greenback?” for news of potential emerging challenges to the dominance of the dollar.)

Thugge could attempt to strengthen the currency by hiking interest rates in an attempt to incentivise more foreign investors to hold the shilling. However, it is also true that the Kenyan Central Bank will partly be at the mercy of global economic factors, not least the actions of the Federal Reserve in Washington DC.

Indeed, the shilling’s recent weakness can be attributed not just to domestic instability, but also to a US dollar that has strengthened on the back of the Fed’s move to hike interest rates and a global flight to “safe” assets amid economic volatility.

This exposes the limits of the governor’s powers. Mutonyi says that Thugge’s international experience equips him with strong knowledge of the global context and that “if he is able to navigate the challenges of the role successfully, he has the potential to make a positive contribution to the Kenyan economy.”

No shortage of challenges

As Thugge prepares to take office next month, it seems likely that many of his priorities will be about fixing problems. He needs to strengthen the central bank’s reserves and secure a new financial package from the IMF. He needs to improve Kenya’s rock-bottom credit rating. He needs to get prices under control, defend the Kenyan shilling from further declines, and give the currency space to make gains. But, as Mutonyi argues, he needs to do all this while also introducing more proactive measures to stimulate long-term economic growth in Kenya.

“Will we see regulations for open banking? Is he likely to oversee a regulatory sandbox for financial innovation? What actions can the central bank take to promote financial inclusion among those who do not earn in traditional ways? How will he respond to the uptake of cryptocurrency as a store of value and medium of exchange? Will he use artificial intelligence and machine learning to gain insights from data, analyse complex macro-financial linkages, and obtain real-time forecasts?” Mutonyi asks.

The initial signs are positive for most, but Thugge has a lot to do if he is to succeed in dragging Kenya out of its current economic predicament.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google