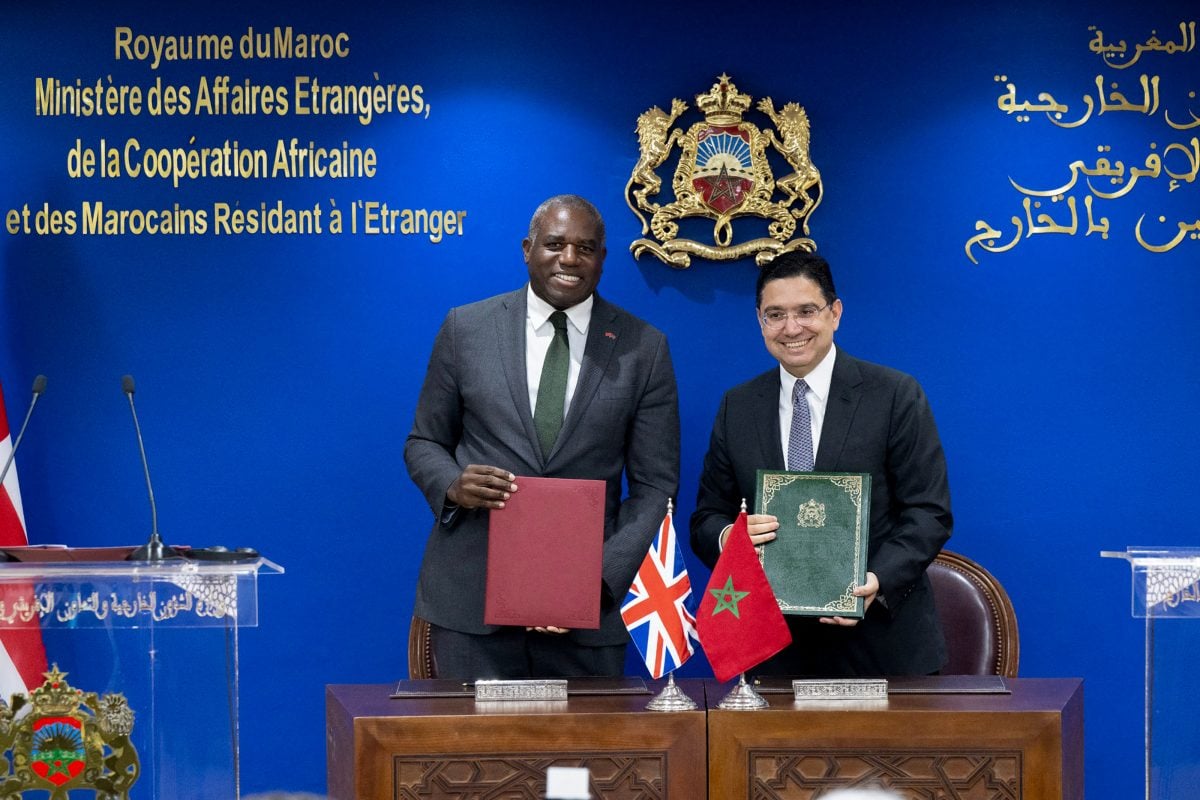

Speaking in Rabat earlier this month, the UK’s foreign secretary David Lammy announced that his government would now be backing Morocco’s claims to sovereignty over the Western Sahara. Lammy said “the UK has chosen to endorse autonomy within the Moroccan state as the most credible, viable, and pragmatic basis for a mutually agreed and lasting solution to the Western Sahara dispute, one that can deliver on our commitments to conflict resolution in the region and self-determination for the people of Western Sahara.”

It is hoped that the move will unlock billions of pounds’ worth of investment deals and infrastructure projects for British companies in Morocco.

The Western Sahara was a Spanish colony until 1975. After Spain’s withdrawal, both Morocco and the independent Polisario Front movement claimed sovereignty over the territory.

The territory remains on the United Nations’ list of non-self-governing territories, but efforts to resolve the conflict through UN-mediated talks have largely stalled over the past decade.

While Britain has maintained a neutral stance on this dispute since then, it has now joined a growing number of powers – such as France, Germany, and Israel – in formally recognising Morocco’s claims to the land.

The US became the first major Western nation to recognise Moroccan sovereignty over the territory in December 2020, during the first Trump administration – a decision that was then reaffirmed by President Biden.

Time for business

The move is seen by both sides as a major move towards strengthening trade and business ties. Hakim Hajoui, Morocco’s ambassador to the UK, tells African Business that this “represents a strategic step that opens new avenues for deeper UK-Morocco economic cooperation and shared prosperity”.

“Regional stability creates fertile ground for trade and investment, especially in this region that serves as a key gateway to Africa, with the Atlantic port of Dakhla playing a central role,” he adds.

Dakhla, a city in the Western Sahara, is being viewed by the Moroccan government as a potential future hub for energy and logistics, with new port and road infrastructure aiming to improve connectivity within markets across Sub-Saharan Africa.

Amal El Fallah Seghrouchni, Morocco’s minister for digital transformation and administrative reform, also tells African Business that the government is eyeing a new data centre in Dakhla as part of their plans for boosting Morocco’s AI capabilities.

Such projects are attracting interest from investors in the Gulf and, increasingly, Europe – with the French Development Agency (AFD) recently announcing a €150m ($167m) investment in environmental and water supply projects in Western Sahara.

Security at centre stage

A Moroccan foreign affairs specialist, who wishes to remain anonymous, tells African Business that the UK government was persuaded to change its long-standing position on this issue as these commercial interests are entwined with security.

Given the rise of political violence and instability in the Maghreb and Western Africa, European governments and others increasingly believe there is a need for strong institutions in order to safeguard their own diplomatic and commercial interests.

“Morocco’s main argument was that you need strong governance and a strong state presence in the area – not only in the Moroccan Sahara, but also in the whole region,” he says.

“We have all seen the spread of coups d’état in West Africa. It’s really important for the international community to acknowledge that strong states and strong institutions in these regions are paramount in order to ensure peace and prosperity.

“We believe this could have positive reverberations across the region in creating an arc of security and prosperity.”

A “UK-Morocco association agreement” has been effective since 2021; prior to Britain’s exit from the European Union, UK-Morocco trade took place under a framework agreed with Brussels. Trade volumes remain, however, relatively small.

Indeed, total trade in goods and services between the UK and Morocco stood at £4.2bn ($5.7bn) in 2024, with the North African country accounting for just 0.2% of the UK’s total trade. This is significantly lower than Morocco’s trade with comparable European economies such as France or Spain. France’s exports to the country, for example, reached €7.4bn ($8.56bn) and are continuing to grow.

In light of this, a government official in Rabat says that “both parties believe the economic partnership is under-performing and that it could be much bigger – we hope to see a steady rise in bilateral exchange and trade.”

UK targets infrastructure contracts

The UK government appears to recognise the potential, with Lammy noting during his trip that Morocco and Africa more widely “has one of the greatest growth potentials of any continent. This young, dynamic population makes the continent an engine room for growth.” Prior to entering the government in July last year, Lammy also suggested that engaging more deeply with developing markets in Africa could be a route to much-needed higher growth in the UK.

There have been steps made towards closer economic engagement with Morocco. This month, the UK Department of Business and Trade signed a partnership agreement with Morocco’s minister delegate of budget that will see the countries collaborate on critical infrastructure projects ahead of the 2030 FIFA World Cup, which Morocco is jointly hosting with Spain and Portugal (see “Ambitious Agadir aims for World Cup boost”). As Morocco seeks to modernise its infrastructure and public services, some £33bn ($44.75bn) of public procurement contracts are expected to be on offer over the next three years – and the UK government hopes closer diplomatic ties with Rabat will put British firms in a stronger position to secure some of these lucrative contracts. To this end, the UK Department of Business and Trade and Morocco’s Ministry of Equipment and Water also signed a memorandum of understanding (MoU) to strengthen cooperation on water and ports infrastructure. Furthermore, UK Export Finance, the government’s export credit agency, signed a deal with TAQA Morocco, a major Moroccan energy company, to support the company’s transition to low-carbon power generation.

World Cup boost

Several other MoUs were also concluded to set the basis for increased cooperation across procurement, higher education, scientific research, healthcare, energy, and more. British firms are also expected to participate in the $1.5bn project to expand and modernise the Mohammed V International Airport in Casablanca, which will see its annual capacity almost triple from 30m to 80m passengers per year.

The Moroccan official notes that the World Cup – which will see up to $6bn in investment in the country alone – is a “catalyst” for stronger economic relationships between Morocco, the UK, and other European partners.

“For me, the most powerful thing is that Morocco – an Arab and Muslim country – is jointly organising the World Cup with two Western countries, Spain and Portugal,” he says.

“This signals a high level of alignment and a high level of cooperation with other Western countries – and of course, a strong and steady rise in interdependent economic relationships is likely to follow.”

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google