The World Bank and the IMF began their Spring Meetings in Washington DC on Tuesday amid fears about runaway inflation, instability in the banking sector and simmering geopolitical tensions.

But as richer countries prepare for more belt-tightening, economists are calling for a massive increase in funding for developing countries to deal with the green transition, the fallout from Covid and the risks of a serious debt crisis.

Many African delegations arriving in the US capital will be seeking a breakthroughs in talks between China and the IMF over how to restructure billions of dollars in debt held by poor nations to unlock desperately needed aid.

With 25% of emerging markets and 60% of low-income countries, including in Africa, in or near debt distress, up to $520bn needs to be written off by richer countries, a recent report by Boston University found.

“Debt distress needs urgent resolution to avoid defaults, as the IMF and World Bank meet,” says Zem Negatu, the chairman of Fairfax Africa Fund.

A central tension looming over debt talks is the question of whether China, the IMF and World the Bank can coordinate in writing off some of this debt, says Kenneth Rogoff, IMF chief economist and a professor at Harvard University.

“That’s really been a struggle,” he told the BBC.

Over the last 15 years, China has emerged as the biggest bilateral lender to many emerging economies, including Africa. This has created a “new system of international rescue lending” in which China acts as a “lender of last resort”, a recent report said.

The Covid-19 pandemic coupled with Russia’s invasion of Ukraine have heightened debt distress risks in Africa, with 22 African countries now in debt distress or at high risk.

“The problem the IMF has is that it was really set up for short-term loans, the World Bank is the one that’s set up for development assistance, [but] has somewhat run out of resources – there just needs to be a lot more aid funds into the developing world. They don’t just need short-term loans, they need aid,” Rogoff told the BBC.

After a prolonged hiatus due to Covid-19, a Chinese delegation will attend the talks for the first time in three years.

Meanwhile the IMF fears that China might withdraw its membership, a move that would threaten the entire system of globalisation, Rogoff says.

Debt talks

Countries including Zambia and Ghana arrive for the meetings at a time when they are in the middle of debt restructuring talks that involve lending from Chinese creditors, like China Export-Import Bank.

On the sidelines of the meetings, Zambia’s finance minister, Situmbeko Musokotwane appealed to the IMF for a solution to restructure its external debt, which stood at $14.87bn at the end of June 2022.

Last week IMF chief Kristalina Georgieva said Zambia will need official creditors, led by China and France, to agree to a debt-relief deal before the IMF signs off on the latest $188m tranche of a $1.3bn Extended Credit Facility (ECF) agreed last September.

On Tuesday, Musokotwane implored the Fund to release the funds, even if Zambia’s creditors aren’t able to reach an agreement on how to deal with the nation’s debt.

“Zambia has performed according to the program, so it must not be punished. It must be rewarded,” he said in an interview with Bloomberg TV.

Banga’s big week

At this year’s Spring Meetings the spotlight will also fall on Ajay Banga, whose nomination as the next head of the World Bank has raised hopes of reform of the 78-year-old institution’s lending model, especially to developing countries.

Banga, who is expected to be confirmed as president of the bank in the coming weeks, is under pressure from African countries to undertake reforms to address the continent’s energy poverty and climate change challenges. This includes reshaping the role of the World Bank to support low- and middle-income countries in responding to these challenges, providing financing for clean energy infrastructure, and promoting energy access.

Day 1 – Tuesday

Day 1 of the meetings marked the release of the World Economic Outlook which saw the prospects for global growth dimmed in the face of rocketing inflation, surging interest rates and uncertainties surrounding the collapse of two American banks.

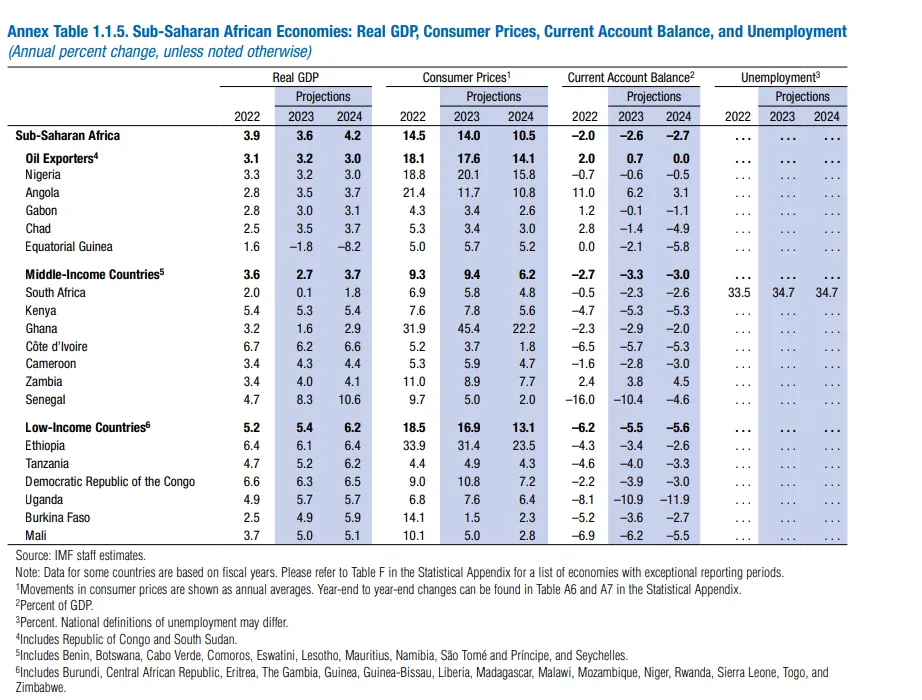

Economic growth in sub-Saharan Africa is expected to slow to 3.6% in 2023 and then accelerate to 4.2% in 2024, the IMF predicts in the report.

Nigerian growth is expected to drop from 3.3% in 2022 to 3.2% this year, while South Africa’s 2% growth in 2022 is forecast to plummet to 0.1% in 2023.

Consumer prices are expected to remain high, with an average inflation rate of 14.5% in 2022, falling to 14.0% in 2023 and further down to 10.5% in 2024.

The region’s current account balance is projected to remain negative, with an average deficit of 2.0%, 2.6%, and 2.7% in 2022, 2023, and 2024, respectively.

Unemployment rates are expected to remain high in some countries, particularly in South Africa, where it is projected to remain above 30% throughout the forecast period. Low-income countries are projected to experience relatively higher growth rates than middle-income and oil-exporting countries.

Day 2 – Wednesday

A crucial high-level sovereign debt roundtable was held on Wednesday on the sidelines of the summit, amid ongoing delays in finalising debt treatment agreements for Zambia, Ghana and Ethiopia.

During the Global Sovereign Debt Roundtable Meeting at the World Bank and International Monetary Fund’s Spring Meetings in Washington on Wednesday, China’s governor of the People’s Bank, Yi Gang, indicated the country would be more flexible about how to restructure billions of dollars of debt held by poorer nations. The move signals a long-sought breakthrough in talks that have been stalled for some time.

One proposal under discussion is for the World Bank to provide concessional loans and grants to countries that have defaulted, in exchange for China dropping a key demand for multilateral development banks to take losses alongside other creditors in debt restructurings.

Following the meeting global creditors, debtor nations, and international financial institutions agreed to streamline and expedite long-delayed debt restructuring efforts. The World Bank, International Monetary Fund (IMF), and India, the current president of the Group of 20 (G20), issued a joint statement after the first meeting of the new Global Sovereign Debt Roundtable during the spring meetings of the IMF and World Bank in Washington. The participants focused on ways to accelerate debt restructuring processes, including under the G20 Common Framework, by improving data sharing and developing clearer timetables.

While the statement did not include any commitments by China, the world’s largest bilateral creditor, to speed up the restructuring process, the IMF’s strategy chief, Ceyla Pazarbasioglu, noted that China and other participants acknowledged that there are different ways of contributing to a restructuring. The participants agreed to urgently improve data sharing on macroeconomic projections and debt sustainability assessments, and meet again in the coming weeks to work on principles for cut-off dates, suspending debt payments, and how to treat arrears, among other issues.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google