One of the issues that seems to be concentrating minds across the continent is that of sovereign debt. This, coupled with an equally worrying trend in escalating national debt, can no longer be relegated to the bottom drawer where all unpleasant matters are stored and hopefully forgotten about until some evil day when they have to be removed, looked at and dealt with.

Debt, especially sovereign debt – i.e., debt owed by the nation to various lenders including global institutions, commercial banks and finance houses and other sovereign nations – has hung over the continent’s neck like a rotting carcass for most of its independent life.

Africa, in common with anybody who has had to undergo the misery of carrying the burden of debt, has experienced all the anguish of incessant demands, rising and multiplying interest rates and being lectured, threatened and abused by the creditors.

Many countries find themselves falling into the nightmare of the debt vicious cycle.

They have to allocate a very sizeable chunk of their annual revenue to service their debt, which means they do not have enough to meet their budgetary expenses, which in turn means they have to turn to international lenders to borrow, which means their debt levels rise, leading to more revenue needed to service the debts… and so on until some countries finally throw up their hands in defeat and are effectively bankrupt and live on the charity of others.

The only way out of this vicious cycle, we are told, is for them to increase revenue streams by generating and selling more of their products abroad and raising more taxes domestically.

The catch is that to be able to do either, you need greater capital goods – in the case of nations this often translates into productive infrastructure such as railways, roads, ports, energy generation, better quality education and so on. But to install this vital infrastructure, you need… you’ve guessed it – to borrow! Back to square one.

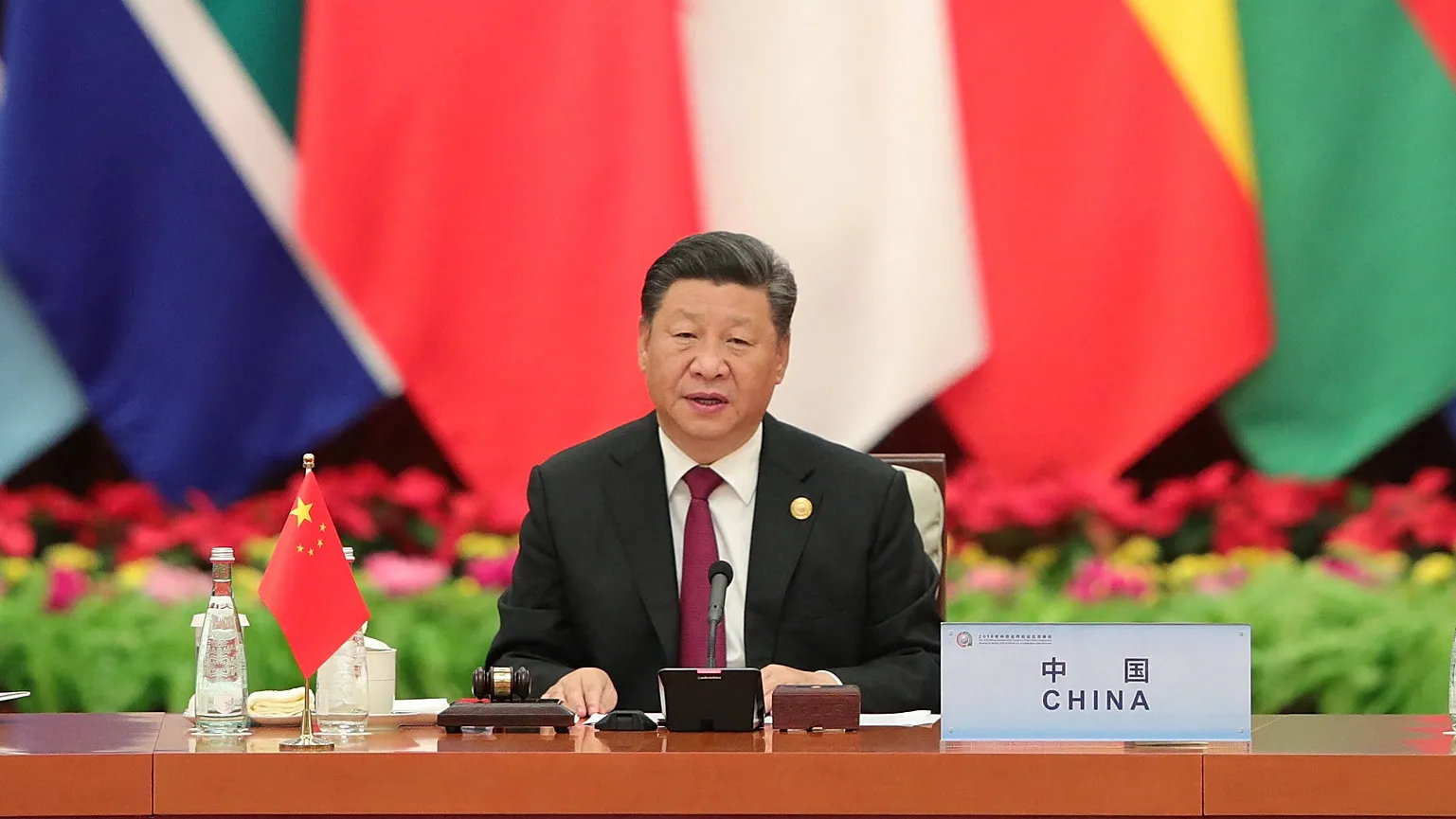

Chinese loans foster growth

Enter China. The Chinese proposition was simple: “We’ll build your infrastructure for you in return for your natural resources if you have any; and if you open your markets for our goods.”

Most of Africa, in fact most of the developing world to whom this proposition was made, said “Yes please, when can you start?”

The Chinese response was usually “tomorrow”. True to their word, they rolled out trillions of dollars’ worth of infrastructure across the length and breadth of Africa, in Latin America, in the Middle East and across most of Asia.

The net result was that scores of African and other developing world nations registered record growth levels. But for the canker of corruption which many cannot seem to shed and which wasted a lot of this progress, more developing nation countries would have attained similar levels of prosperity to some of Asia’s Tiger economies.

In the process, China’s own GDP rose to rival that of the US and the EU and its soft power influence outstripped and challenged the West’s hegemony.

Western banks, not China, hold most of Africa’s debt

Alarm bells began ringing furiously and warnings that Africa and other developing nations were falling into the “Dragon’s mouth” and would be swallowed whole by a rampant China, come to collect its debt, were issued almost on a daily basis.

Today, as the world faces an unsettled period of rising living costs, biting shortages of essentials and a polarisation between the West against Russia and China, Africa is being asked to choose sides. The issue of debt can no longer be ignored.

But is China really about to close the debt trap and ensnare Africa for the foreseeable future as we are being warned?

Not so, says Debt Justice, formerly the Jubilee Debt Campaign. African governments owe three times more debt to Western banks, asset managers and oil traders than they do to China, and are charged double the interest. China has been blamed by Western leaders for the failure to make progress on debt restructuring, but the data shows this is not the case it says.

The organisation says that 12% of African governments’ external debt is owed to Chinese lenders compared with 35% owed to Western private lenders.

Tim Jones, head of policy at Debt Justice, says: “Western leaders blame China for debt crises in Africa, but this is a distraction. The truth is their own banks, asset managers and oil traders are far more responsible, but the G7 are letting them off the hook.”

He wants Western governments to compel private lenders to ease their stranglehold on African countries at this critical phase. We say Amen to that.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google