These are challenging times for everyone as we enter the second year of a pernicious Covid-19 pandemic. There is a general consensus that the year ahead remains full of uncertainties. Any economic recovery in 2021 is subject to a cornucopia of caveats – the speed and reach of vaccinations, the rapid mitigation of virus variants and the return to a ‘new normal’ bereft of lockdowns, layoffs and insolvencies.

Investors too have faced unprecedented challenges as the first global pandemic in a century ravaged the world economy. The fact that the pandemic continues to define the 2021/22 outlook suggests that fiscal and monetary support remains essential on the road to recovery.

Central banks around the world have effectively taken interest rates to zero. With less opportunity for yield across fixed income assets, investors will likely continue to shift exposure to risks through their asset allocation portfolios.

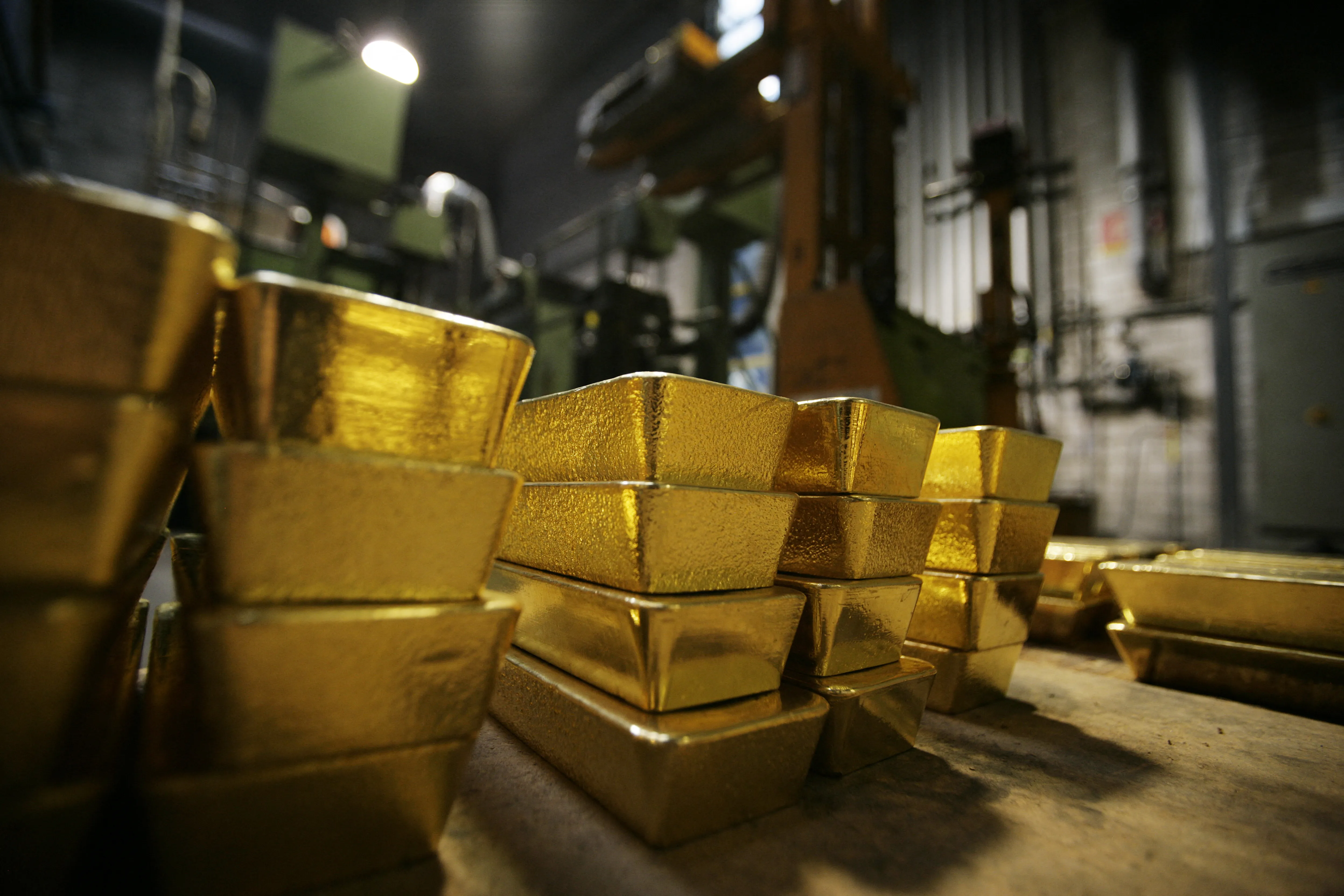

“The current environment,” says the Zurich-based World Gold Council (WGC), “has made gold increasingly relevant as a strategic asset.

“Not only could investors benefit from gold’s role as a diversifier amid ballooning budget deficits, inflationary pressures, and potential market corrections,” it says, “but they may see additional support, as gold consumption will likely benefit from the nascent economic recovery, especially in emerging markets.”

During times of crisis, gold has been the traditional safe haven for both governments and investors. The indications are that gold will sustain its glitter as an investment asset class in 2021. Usually, a sound investment portfolio would comprise a basket of asset classes to spread the risks – treasury bills (gilts), corporate bonds, equities, real estate, commodities (including gold) and cash, and recently they have also included derivatives such as ETFs (exchange traded funds).

The reasons for investing in gold as a strategic investment asset, especially during times of upheaval, are manifold: Gold started the year on a positive note, breaking above $1,900/oz. Last year, says the WGC, it was one of the best- performing assets, returning investors an impressive 25%.

Historically, gold has generated long-term positive returns during both good and bad economic times. “Looking back almost half a century, the price of gold in US dollars has increased by an average of nearly 11% per year since 1971 – when the gold standard collapsed. Over this period, gold’s long-term return is comparable to equities and higher than bonds,” confirms the WGC.

Research by the IMF and WGC shows that adding between 2% and 10% in gold to a hypothetical US pension fund average portfolio over the past two decades, can make “a tangible improvement to performance and boost risk-adjusted returns on a sustainable long-term basis.”

Over the last two decades, gold, together with real estate investment trusts, outperformed most broad-based portfolio components, giving an average annual return of around 11%. These include US equities, US treasuries, global bonds, cash and commodities. Only emerging market equities have performed better, at 14%.

Strong production outlook

There are currently 201,296 tonnes of gold above ground, worth $12.2trn, says the WGC. Mine production has contributed a steady 1.8% per year increment to above-ground gold stocks from more diversified sources.

Total global gold production at end 2019 amounted to 3,533.7 tonnes. The contributions of the four largest gold producers in the world were: China 383.2 tonnes, Russia 329.5 tonnes, Australia 325.1 tonnes, and the US, 200.2 tonnes. But as a region, Africa remained the single largest producer at 853.7 tonnes, indicating that gold production continues to be an important activity.

Ghana, with 142.4 tonnes at end 2019, is the largest African gold producer, overtaking South Africa. The latter’s previous dominance in gold production has slipped markedly. In 2010, according to the WGC, South Africa, with 210 tonnes, was the fourth-largest producer of gold; this declined to 118.2 tonnes at end 2019 and its ranking slipped to eighth.

Sustained demand dynamics

The demand for gold comes from four important sources – from investors as a safe haven asset class (42%); from central banks as a reserve asset (17%); from consumers for jewellery (34%); and from industry as a technology component (7%).

The demand for gold is linked to investment and consumption, and its performance is driven by economic expansion and periods of growth which support jewellery, technology and long-term savings. Increased risk and uncertainty often boost investment demand for gold as a safe haven. Also, interest rates and relative currency strengths influence investor attitudes towards gold, as do capital flows.

The outlook for gold in 2021 is further buoyed by: increased demand from China (28% of global demand) and India (22%), the two largest consumers of gold; steady demand from central banks, which is expected to persist in 2021; and increased demand from gold derivatives such as gold-backed ETFs (exchange traded funds) – a $228bn portfolio at end 2020.

Central banks also maintain gold holdings as a percentage of their reserves. According to the IMF, the US had by far the largest gold holdings in the world in January 2021 – 8,133.5 tonnes, comprising a staggering 78% of its reserves; followed by Germany with 3,362.4 tonnes, comprising 75.2% of its reserves.

In Africa, Algeria had the highest holdings at 73.6 tonnes (16.3% of reserves), followed by South Africa with 125.3 tonnes (13.4% of reserves).

An improving global economic outlook

Global GDP growth in 2021 is projected by the IMF to recover to 5.2%. This is based on expectations that social distancing and other measures to contain the pandemic will be successful, and that fiscal, monetary and structural policy intervention will continue. Widespread vaccine availability will boost the outlook, but a delay would be a drag on growth.

For emerging markets, a collective growth of 5% in 2021 is projected. The rebound will not be sufficient to regain 2019 levels of activity by the end of 2021. China’s recovery is important. The IMF projects growth of about 10% over 2020-2021 (1.9% in 2020, and 8.2% in 2021). China was the first economy to face a shutdown, and it rebounded faster than expected thanks to strong policy support and resilient exports. By contrast, India’s GDP contracted by 10.3% in 2020, but is expected to rebound by 8.8% in 2021.

A proven hedge against inflation

Gold is considered a useful hedge against inflation. In times of low interest rates – in the US, UK and EU they are currently almost zero – with reduced consumption, investment and increased financial stress, demand for gold increases. The pandemic encapsulates the above trends and has created the perfect conditions for gold prices to increase.

The market dynamics and perceptions of gold within an institutional investment portfolio have changed over the past two decades, reflecting increased wealth in China, India and Brazil, and a growing middle class in many emerging markets, including in Africa.

Its role as a safe-haven asset means it comes into its own during times of high risk. This dynamic, as the WGC contends, is likely to continue, given ongoing political and economic uncertainty, persistently low interest rates and economic concerns surrounding equity and bond markets.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google