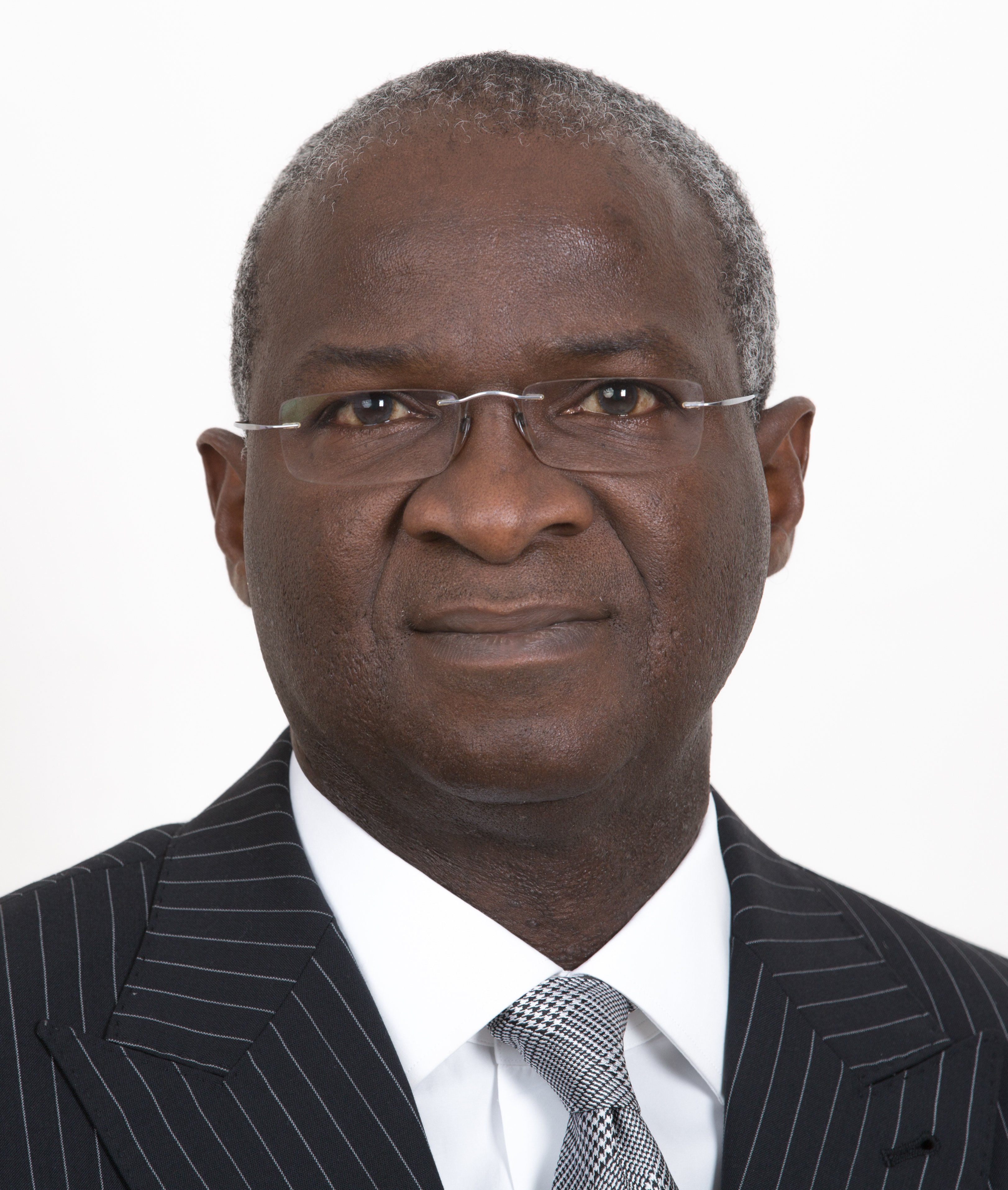

In his two four-year terms as governor of Lagos State from 2007 to 2015, Babatunde Fashola became a key player in the ruling All Progressives’ Congress and a household name in Nigerian politics. As governor of a state that generates a third of Nigeria’s economic output and hosts the nation’s commercial capital, he increased tax revenues and overhauled security and law and order.

Now in the key portfolio of Minister for Works and Housing, the 57-year old is flexing his muscles on the national stage as a crucial player in the country’s infrastructure drive.

The government, hampered by Covid-19 and an oil price decline, has been accused by some of moving too slowly. But since the start of the year, it has unveiled a raft of ambitious projects, and Fashola remains positive about the country’s prospects.

There have recently been major infrastructure announcements, including multibillion dollar projects. How are you funding them?

I think the place to start is to recognise that the world is not in a very strong place financially at the moment. Many economies are struggling. That is the common thread. What differs is the compelling and object need of each economy. One of ours is to upgrade and expand the infrastructure of the country in terms of its quality and quantity. Since the 1970s we’ve spent relatively less on infrastructure while the population has grown. Businesses have grown from where they were in the 70s and the infrastructure hasn’t grown correspondingly.

So where is the money coming from? Debt of course. We are also using strategic interventions from able private sector operators using tax credits. The minister of finance and budget is making strides to increase the stock of revenues without necessarily increasing the rate of taxation or levies, through gains in efficiencies. Currently, 12 highways are being concessioned to attract private investment under the Highway Development Management Initiative.

Nigerian companies and institutional investors who build infrastructure that the public can access will be able to apply for a tax credit. In effect, you are advancing your tax to government ahead of when it is due by making that investment. Companies that are eligible identify the infrastructure works, submit a design with estimates to the Ministry of Works in consultation with a management committee set up by the president, and then we will decide an agreement. They need to adhere to our minimum design standards and we agree costs in consultation with the government statutory cost advisor and the process of approvals moves on.

This administration has often been accused of going a bit slowly with infrastructure projects – how would you respond?

On the contrary, sometimes we forget also that there is now a swath of legislation around global best practice principles, the environment, citizens’ rights, compensatory rights, and settlement legislation. If you look at the average length of time now that it takes to build any public infrastructure in any part of the world that subscribes to these global best practices, you are looking at sometimes a decade to get all of these permits, because you are not likely to get funding if you don’t comply with all of these things.

Was it easier to get things done as Lagos state governor?

I often get asked this question. I think my analogy is probably comparing raspberries with watermelons. They don’t compare. Lagos is 3,000 sq km, Nigeria is almost one million sq km. Then there is the size of the government at municipal level, the level of consultation that is necessary. The challenges and principle are the same, but the scales are clearly not comparable.

Are governments sometimes too wary about privatising assets?

I have constantly made a distinction between commercial and social assets and I think that if we bear that in mind, we will understand what is more amenable and likely to succeed as a concession. Where we take a concession for airports, there is the runway, the airport building and the shopping opportunity, the control tower – which asset are you looking to privatise or commercialise? When we are talking about our concessional highways, we are talking about the right of way, not just the road, because it is the commercial opportunities of both sides of the way, advertising, fuel services, storage for delivery trucks, all of that. That makes the route an enterprise as against just a social asset.

What is Nigeria’s position on borrowing?

You’re damned if you do and you’re damned if you don’t. The global fiscal space is constrained and everybody has borrowed, is borrowing and wants to borrow more. You want to be very clear in the messages you are sending to your lenders because that defines how they assess your risk and how they price your debt.

Security is an increasing threat to Nigeria’s growth and has been highlighted by the president as a priority. How are you finding the current developments?

I first accept that this is a number one responsibility of any administration anywhere in the world. The number one responsibility for every head of the family is to protect your family. Crime is a business, so governments must outlaw crime, out-fight it, and there is very little scope for implementing any developmental agenda if you don’t deal with crime. That said, my view is that this is momentary, it is situated in the global reality. We have conflict driven by different reasons: water shortages for example. How do we remove the source of conflict? By making sure there is water supplied. This will be a momentary experience and we will put it behind us.

Is your outlook positive for the years ahead?

The point to make here is that the outline of the infrastructure commitments of this government are very clear now. The wheels are also turning and what people should expect to see is more developments on the ease of doing business. Infrastructure is very important too for enabling and achieving that. We have 10,000+ km of road network, we are refurbishing 37 bridges, we’re refurbishing public infrastructure highways, and we are beginning to build our maintenance economy because it is a very important economy that really has not taken off.

This is where we will be, this will be a decade of infrastructure renewal and expansion. It will be an exciting space to play. You bet against Nigeria at your own risk. This is the best country in terms of return on investment. You have a market that has a very high youth population, you see very active demand power. If you look in all the shops, all the malls, all the airports across the world you will see that Nigerians have the capacity to not only spend, but also to demand. That’s a market for any smart investor.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google