This article was produced with the support of Central Bank of Nigeria

Well-managed external reserves provide resilience for any economy, as they enable it to absorb the adverse effects of a crisis in the event of one. That is why an oil producing and exporting country like Nigeria, which depends heavily on imports for its foreign exchange, absolutely needs to effectively and efficiently manage its reserves.

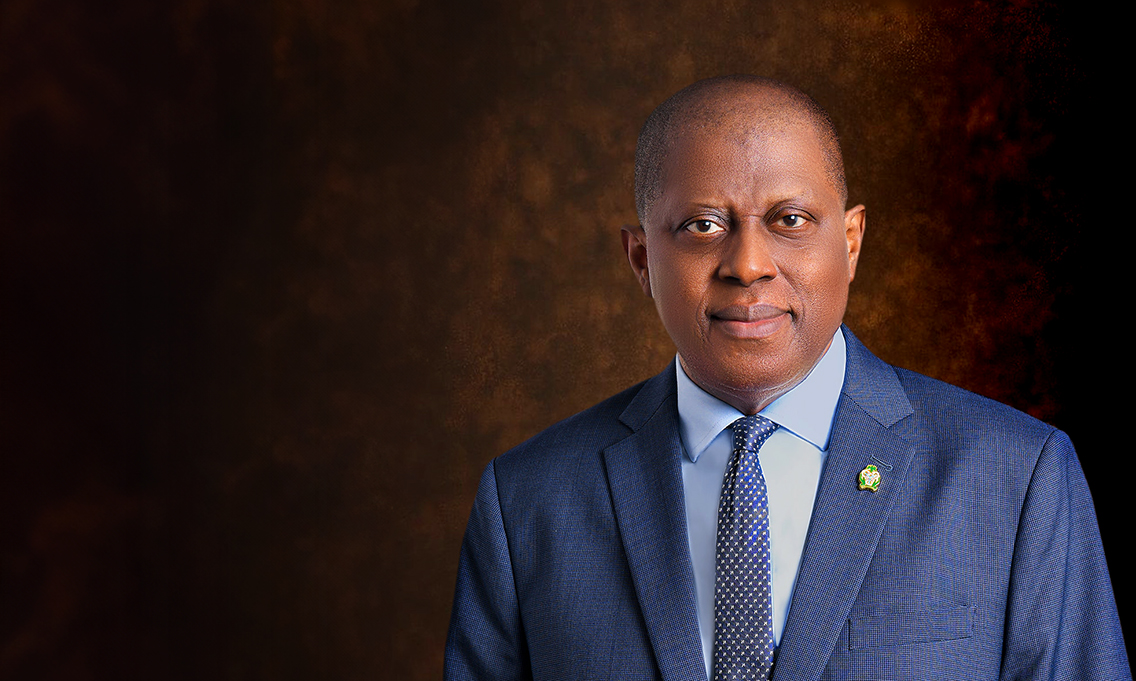

Hence, understanding the management of external reserves becomes very critical, especially in relation to its effect on the country’s sovereign risk as well as credit ratings. That is apparently why, since the Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, assumed office on 15 September 2023, he has continued to take deliberate steps to ensure accretion in the country’s reserves.

Two years into his five-year tenure, Nigeria’s gross reserves have improved sharply from $33bn in September 2023 to over $42bn presently, which is an increase of about $8bn. The increase in the West African country’s gross external reserves was due to of the trade surplus it has continued to enjoy given the exchange rate and price stability achieved by the country under Cardoso.

For instance, Nigeria recorded a trade surplus of N7.5 trillion in the second quarter of 2025 (Q2) as its total exports were valued at N22.751 trillion, reflecting a 28.43% rise when compared to the N17.714 trillion recorded by the country in the corresponding quarter of 2024, and 10.45% increase when compared to N20.598 trillion in Q1, 2025.

Also, in the period under review, the value of the country’s total imports stood at N15.287 trillion in Q2 2025, representing a 9.43% increase from the value recorded in the corresponding quarter of 2024 (N13,969.34bn) and a 0.90% decrease compared to the value recorded in Q1 2025 (N15,426.17bn).

The current accretion in reserves represents the highest level recorded since 3 December 2021 and has continued to maintain the upward trajectory in recent weeks.

The importance of reserves

Why is this important? FX reserve movements are particularly crucial for economic stability, currency strength, import capacity, debt management and overall investor confidence. Changes in the reserves could signal economic stress or ill health.

Amid huge debt service obligations and revenue challenges, the stability in external reserves movement, coupled with a marked deceleration in the inflation rate as well as the naira’s relative stability, offer renewed hope for the country about better days ahead.

Commenting on what the growing external reserves position means for Nigeria, Bismarck Rewane, chief executive officer of Financial Derivatives Limited, said “our gross reserves guarantee almost 8 to 10 months of import cover. The IMF says that a country that has less than 6 months of cover is the one that you watch,” Continuing the economist explained what this means for the country. “Nigeria is in what they call the ‘comfort zone’ and therefore investors, our traders and those who buy our instruments are not going to be worried.”

Tackling inflation

Aside from Nigeria’s healthy external reserves position, the Cardoso-led CBN has continued to tackle inflationary pressure in the country by deploying all the monetary policy tools at its disposal. By adopting aggressive monetary tightening, the CBN has been able to steadily moderate inflationary pressure. Today, the country’s Consumer Price Index (CPI), which measures the rate of change in prices of goods and commodities, has declined for the fourth consecutive month as it stood at 21.88% in July, compared to 33.4% in July 2024, based on rebased figures.

Cardoso made tackling inflation his paramount mission, holding onto orthodox monetary policy with his belief that it is an essential path to achieving sustainable economic growth in the mid-to-long term, as well as improving the standard of living of ordinary Nigerians.

Olufemi Oladehin, CEO of Argentil Capital Partners, hailed Cardoso’s aggressive approach to inflation targeting. “You will recall that inflation in his first year went as high as over 33%, and Cardoso was focused on using monetary policy tools to ensure its moderation. There has been improved corporate governance at the CBN and improved policy around the naira.

“If you then extend it to the banking industry, you can talk of improved stability for the banking sector and improved corporate governance for the systemically important banks and of course, recapitalisation of the banking sector,” he said in his assessment of the CBN two years under Cardoso.

Cardoso’s introduction of initiatives such as the Nigerian Foreign Exchange Code (FX Code) have helped entrench accountability, compliance and transparency in the country’s foreign exchange market while the Electronic Foreign Exchange Matching System (EFEMS), has set clear and enforceable standards for ethical conduct and governance in the forex market.

Today, Nigerian banks are undergoing recapitalisation, an exercise initiated by Cardoso, to increase their capital base with a deadline of 31 March 2026. The banks are all working towards beating the deadline. The capital-raising options include equity issuance, mergers, or license adjustments. The new minimum capital base for commercial banks with international licences is N500bn, while that for commercial banks with national licences is N200bn. A N50bn minimum is required for commercial banks with regional licences; for merchant banks with national licences N50bn; and for national and regional non-interest banks, the base is N20bn and N10bn, respectively. At the beginning of the exercise, the estimated required capital gap was about $4.1 trillion, and so far the banks have raised $2.8 trillion.

Bank succession

In addition, to strengthen the level of corporate governance in the industry, the Cardoso-led central bank has also directed all Domestic Systemically Important Banks to secure its approval for the appointment of successor managing directors six months before the exit of incumbents. The central bank also ordered that such appointments must be made public at least three months before the outgoing chief executive formally leaves office.

Bismarck Rewane also scored Cardoso highly in terms of monetary policy and overall macroeconomic health. “Nigeria is in a good position in the sense that for every dollar of net reserves, we have $2 of debt. So, compared to its peers like South Africa, Nigeria is less leveraged…Nigeria’s outlook, as Moody’s and Standard and Poor’s have stated, is positive.

He pointed out, however, that “there are still signs of fragility,” and so the CBN leadership must remain vigilant.

Over the past two years, the central bank under Cardoso’s leadership has worked to restore confidence in monetary policy through consistency, transparency and targeted reforms. His administration has pursued stability in the foreign exchange market, strengthened regulatory oversight and prioritised inflation management in a way that reflects both prudence and vision. These measures, though not without challenges, have signalled to investors, businesses and households that the CBN is committed to rebuilding credibility and laying the foundation for sustainable growth.

Looking ahead, Cardoso’s legacy will depend on sustaining these gains and deepening reforms that align Nigeria’s financial system with global standards while addressing local realities. By combining fiscal discipline with innovative monetary tools, the CBN can continue to drive stability, foster investor confidence and create a more resilient economic environment. Cardoso’s tenure, so far, offers a reminder that effective leadership at the apex bank can be both a stabilising force and a catalyst for broader economic transformation.

Sign in with Google

Sign in with Google