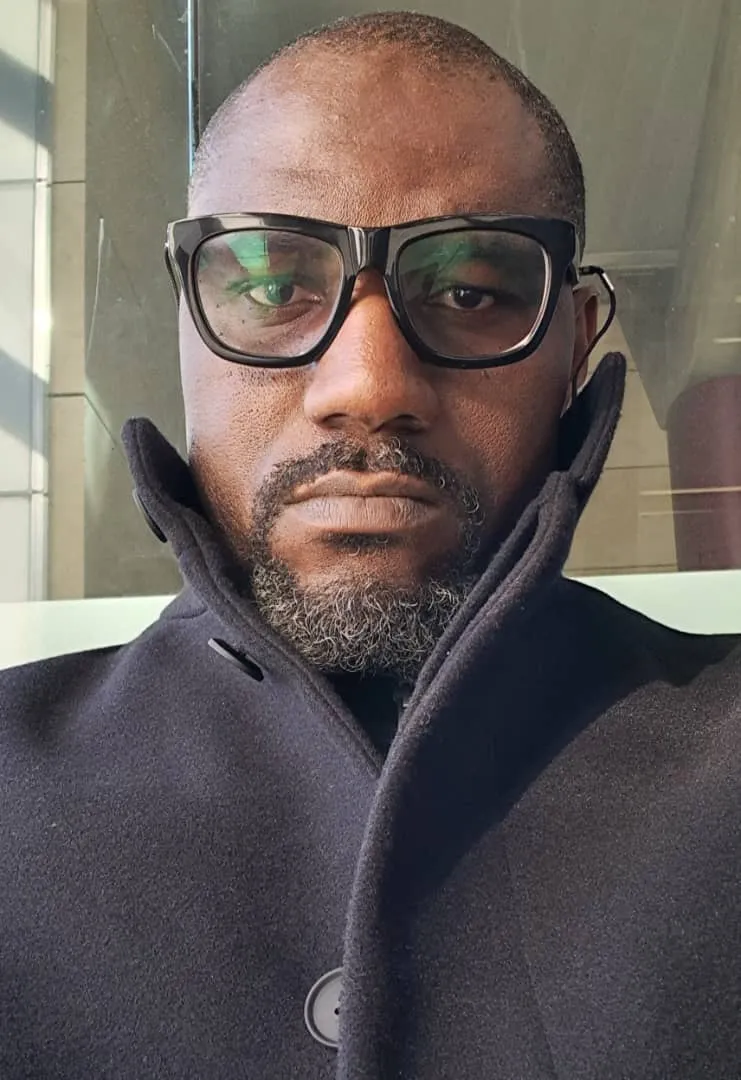

Patricia Ojangole exudes calm as she sits down for our impromptu interview on the sidelines of the Trade and Development Bank Group’s (TDB Group) Annual General Meetings in Kigali, Rwanda where Uganda and the Arab Bank for Economic Development in Africa (BADEA) have just signed loan agreements totalling $150m.

Ojangole, who was appointed as managing director of the Bank in 2013, has helped to lead the institution through a period of considerable expansion. UDB’s balance sheet has grown from UGX 109bn ($31m) in 2013 to UGX 1.78tn ($500m) in 2024, while its loan book has expanded from UGX 92bn ($26m) to UGX 1.53tn ($430m) over the same period.

This growth gives the bank more firepower to pursue sustainable development across key sectors of the Ugandan economy from agriculture to industry and green finance.

Ojangole’s professional journey has earned her recognition in Uganda and beyond, including the Banker of the Year 2025 at the African Banker Awards. She is also the newly appointed chairperson of the Association of African Development Finance Institutions (AADFI) – the first woman to hold the role since the association’s inception in 1975.

Forging strategic partnerships

According to Ojangole, strategic partnerships are crucial to unlocking alternative sources of capital. She believes that Africa must forge these partnerships to overcome the funding constraints currently facing many countries on the continent. She points to Uganda’s expanding cooperation with the Arab Bank for Economic Development in Africa (BADEA) as a compelling case study.

Hours before our interview, Uganda and BADEA signed their loan agreements totalling $150m. $100m will be issued under BADEA’s private sector window and channeled through UDB to support priority sectors like agro-processing, infrastructure, manufacturing, health, and education. The remaining $50m, secured under BADEA’s public sector window, is earmarked for financing micro, small, and medium-sized enterprises (MSMEs) operating in key sectors of Uganda’s economy.

“There are different areas of collaboration and partnerships. Coming from a national development bank, one of the areas we have always looked at in collaborating with MDBs (multilateral development banks) is financing,” she notes, citing the financing agreement signed with BADEA.

“Where they (BADEA) sit they are better positioned to mobilise capital. National development banks on their part understand national priorities and can be a vehicle that MDBs can use to extend their mandate across some of the areas that are cross-cutting like private sector interventions and SMEs,” she says.

“If you look at BADEA, their focus is Africa’s economic development. That is why you find that, when you engage with BADEA, you have the same objectives – so it’s easy to find areas of collaboration. When they look at what we intend to do and it is aligned to their own priorities, they grant funding. By doing so they are achieving their very purpose, but through UDB,” she adds.

Affordable, long-term financing

The Uganda Development Bank will host the Uganda Development Finance Summit from September 1-2, 2025 in Kampala, Uganda. Looking ahead to the summit, Ojangole speaks to the role of national development banks, the imperative of low cost and patient capital and effective management in helping to fulfil their mandates.

National development banks, she emphasises, exist primarily to fill market gaps and address market failures. They must be strengthened and they must share best practices with their counterparts across the continent, she argues.

“In the case of Uganda, one of the main policy priorities that the government is using UDB for is driving down the cost of capital for private businesses,” she says.

While noting that the high cost of capital is one of the most frequently cited challenges facing businesses in Uganda, she says that for UDB to ensure that it can offer capital to the private sector at more competitive rates, the bank takes great care to mobilise capital only from affordable sources. Strong and consistent support from the government has proved highly instrumental in ensuring the success of these efforts.

“In our case, we are able to mobilise affordable capital because the government of Uganda will guarantee our borrowing… sometimes we have direct allocations from the budget,” she notes. This year, UDB received a fresh capital injection of UGX 1tn ($280m) in the FY 2025/26 national budget.

“The government is pursuing a private sector-led approach to development. That is why it is strengthening UDB by capitalising it to enable it to offer private businesses affordable capital so they can be competitive,” she says.

The IMF expects the Ugandan economy to grow by 6.1% this year, highlighting a strengthening recovery “with low inflation, favourable agricultural production, and strong industrial and services activity.”

Uganda has “navigated the post-pandemic recovery well due to sound macroeconomic policies”, the IMF said, while noting that the start of oil production is expected to further boost growth.

Besides lending at competitive rates, another major priority for UDB is offering borrowers longer repayment periods. This, Ojangole contends, is aimed at addressing the shortage of long-term financing in the Ugandan economy.

“We aim to provide long-term, affordable capital. If you look at our banking industry, it is quite liquid. However, commercial banks tend to have shorter term liquidity, while to grow the stock of investments in an economy you need long term capital. There is often a mismatch,” she says. “We are able to lend for long tenures because the funding that we get is long-term, usually 10 to 25 years,” she adds.

Building SME capacity

De-risking small and medium-sized enterprises (SMEs) through training and capacity building is another critical pillar in UDB’s strategy, Ojangole says. She notes that, for UDB, supporting SMEs is vitally important in view of the outsized role that they play in the Ugandan economy.

“SMEs are very important. We are pursuing a private sector-led development approach and close to 75% of our private sector is SMEs. We have tried to understand the issues they face and developed a tailored capacity building programme called the Business Accelerator for Successful Entrepreneurship (BASE).”

The initiative combines masterclasses, incubator sessions, and hands-on mentorship to empower entrepreneurs to run their SMEs professionally. This, she argues, enables them to access credit from formal sources. Entrepreneurs who go through the programme are also less likely to default on their loans, she adds.

“Once entrepreneurs complete the programme, they’re able to walk into any financial institution and apply for financing with confidence. They manage their facilities better, grow their businesses in size and profitability, and take pride in their work.

“We’ve had these testimonies. People initially come and then when you are taking them through these programmes they are like ‘you are requiring a lot, you want us to do so much’ but at the end of the day they come and say ‘I understand my business better, I can now say I am a proud business person.’”

Leveraging domestic resources

With global sources of funding constrained, Ojangole believes that African countries must turn to their domestic capital markets to fund development in key sectors like infrastructure. One effective way of doing this, she contends, is dedicating more efforts to building a robust pipeline of viable projects.

“Domestic resources are there but we need more viable projects for money to flow. If there are ready projects, then I think any investor, including local pension funds, would be able to invest,” she says.

She notes that UDB is focused on “scaling up project preparation” to help mobilise more domestic resources.

“We identify projects and prepare them. If we have structured the project properly and can demonstrate where the returns are, we believe that we can be able to go and raise domestic resources in the capital markets,” she says.

The goal of this initiative, she emphasises, is to “enhance the role of our capital markets to get our domestic resources to finance sustainable development projects in the country.”

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google