South African banks have posted strong revenue growth this year, as an improving macroeconomic climate and a stabilising political environment bolster the outlook for the country’s banking giants.

In the first half of 2024, Standard Bank reported headline earnings of 22bn rand ($1.22bn) – a 4% rise compared to the same period the year before – and a return on equity of 18.5%. In the same period, Old Mutual’s pretax profit rose by over 10% to 9.22bn rand ($510m), while Capitec saw headline earnings growth of 36% to 6.4bn rand ($354m).

FirstRand, Absa, and Nedbank also saw similarly strong revenue growth. Combined, South Africa’s major banks saw a total headline earnings growth of 2.5% in the first half of 2024 compared to 2023 – despite South Africa’s macroeconomic picture being complicated in the period owing to a fraught election campaign and considerable levels of political volatility.

What explains this strong performance across the board? Higher interest rates in South Africa and globally are part of the picture. With interest rates starting the year at 8.25% and still standing at 7.75% – compared to pandemic levels of around 3.5% – this has boosted the net interest income banks South African receive on their issues loans.

South African firms expand across continent

Part of the growth is also coming from the fact that many major South African financial institutions are increasingly investing abroad in other African markets.

Furthermore, international banks with their headquarters in the UK or Europe, such as HSBC, Standard Chartered, and BNP Paribas, are increasingly divesting from Africa in order to focus on their core operations and markets. This is opening the door for Africa’s most prominent financial institutions – many of which are South African – to fill the gap that has been left by their departure.

Of course, pan-African expansion is not without its risks. While many African markets are seeing high levels of revenue growth in local currency terms, the ongoing strength of the US dollar and massive depreciation of African currencies has posed difficulties for international banks operating on the continent.

However, the potential upside is also considerable. For Standard Bank, 41% of the group’s headline earnings now come from their franchises in its “Africa regions,” with particularly strong growth from countries such as Angola, Ghana, Kenya, Mozambique, and Nigeria. Partly because of their pan-African expansion, Standard Bank’s active client base grew by 5% in the first half of the year.

Other South African banks are now similarly seeking to enhance their presence across Africa. Nedbank is aiming to reduce its dependence on South Africa by expanding into new African markets. The bank recently set the target of increasing the profit share from other African countries from the current level of 9.2% to almost 40% within the next decade.

Making strides in fintech

Another reason for their strong performance is that South African banks have also been quick to embrace the potential offered by digitalisation. A recent report from PwC noted that “the migration of customers to digital banking platforms and channels […] has moved from theme to certainty.”

“South Africa’s major banks have consistently grown their number of digitally active clients every reporting period since the second half of 2019 to approximately 20 million,” the report outlined. The move to digital has allowed South African banks not only to expand its client base, but also to enhance and personalise the customer experience while making cost-cutting savings, boosting profitability.

These digitalisation trends have also contributed to the growth of South Africa’s fintech industry, which has become another important player in the country’s finance scene. In 2023, the country was home to 140 fintech start-ups – around 20% of the African total. South Africa’s traditional financial institutions have often moved to support the growth of the country’s new fintechs, recognising the growth potential of the fintech industry.

For example, in March this year, Standard Bank announced that it would be providing a 200m rand ($11m) “growth facility” to the Johannesburg-based fintech Float, which offers “buy now pay later” services – allowing consumers to make purchases on credit cards and split their payments over 24 interest-free and fee-free monthly payments. The facility will allow Float to facilitate the mass rollout of its platform and accelerate its growth plans over the next four years.

Announcing the move, Standard Bank said, “Float aligns with Standard Bank’s strategy of driving sustainable growth and supporting fintech businesses which promote financial inclusion and digital transformation across Africa […] assisting innovative, high-growth businesses is a key component in achieving sustainable growth across the African technology, media, and telecom landscape.”

The potential of South Africa’s fintechs is perhaps best evidenced by some major investments that have taken place this year. In December, the South African digital bank Tyme Group became Africa’s latest unicorn, securing a $250m investment from Brazilian firm Nubank in a Series D round valuing the company at $1.5bn.

TymeBank already has 10m users in South Africa and specialises in providing financial services to lower-income and financially excluded individuals. This approach has seen the digital bank secure strong growth even prior to the Nubank cash injection: its net operating income tripled year-on-year in 2024, despite its operational costs going up by 10%.

More growth is likely to be in store for TymeBank and other South African fintechs: it is predicted that the number of South Africans using neobanks will total 19.5mn by 2027, driven by continued and rising demand for mobile banking, and a focus on reaching underserved communities through digital solutions.

Coalition government stability a boon

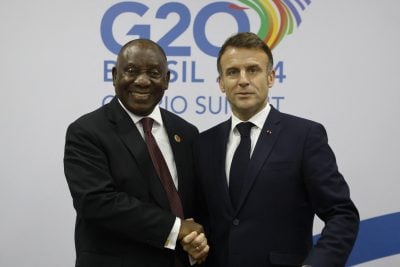

The outlook appears to be positive for South Africa and its banking sector. The establishment of a stable coalition government after a historic election in May has reassured investors and business, particularly given the government has embarked on an ambitious programme of structural reform in key areas such as energy and logistics.

Lingering challenges in, for example, the country’s ports and railway network has hindered growth but the new coalition government has made resolving these challenges a defining priority. South Africa’s government of national unity (GNU) has also committed to boosting job creation, slashing public debt, and investing in infrastructure.

The Bureau for Economic Research has predicted that these reforms will see South Africa achieve a stronger growth rate of 2.2% in 2025. With inflation on the way down, the South African rand stabilising and strengthening against the US dollar, and interest rates predicted to come down further, South Africa’s growth prospects are looking bright. Similar trends are expected across the region in the key markets in which South African banks operate.

The global credit ratings agency S&P recently lifted the outlook for South African debt from “stable” to “positive,” saying that the upgrade “reflects our view that increased political stability following the May general elections and impetus for reform could boost private investment and GDP growth.” While South Africa’s rating remains at BB-, below investment grade, a possible credit ratings upgrade would make it cheaper for the government to borrow from capital markets to fund its infrastructure plans.

South Africa’s banks have proved their resilience in challenging macroeconomic circumstances, with ambitious expansion and digitisation plans driving up their revenues and profitability. As economic pressures ease and, it is hoped, higher levels of growth return, South African banks are well poised to continue on this promising trajectory.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google