The state-owned Ethio Telecom started offering 10% of its shares to the public from 17 October in the first of a planned wave of privatisation in the transforming economy. The shares are being offered only to Ethiopian citizens who buy them using the telco’s TeleBirr mobile payment service.

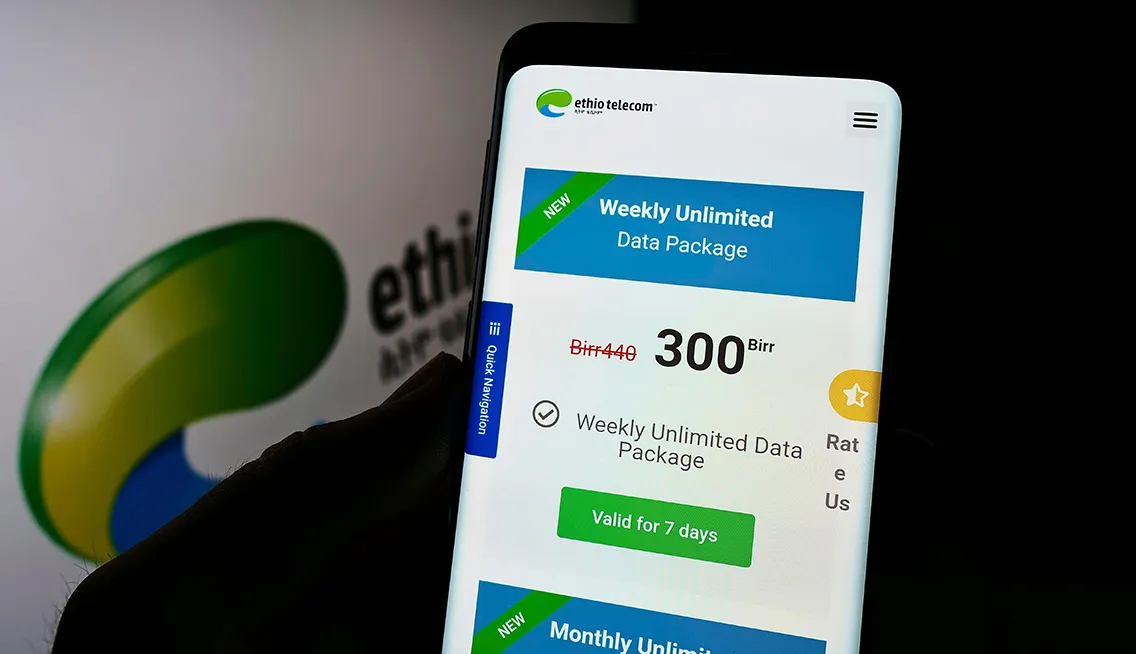

The offer is 100m ordinary shares at 300 birr each, for a total of 30bn birr ($250m) and is open until 3 January. The telco plans to list on the Ethiopian Securities Exchange after the shares are allotted.

The eagerly-awaited launch of the Ethiopian Securities Exchange will be in mid-November, according to Hana Tehelku, Director General of the Ethiopian Capital Markets Authority (ECMA). The ESX has a pipeline of potential listings.

The telco has 78.3m customers, of which 44.5m use its TeleBirr app, and reported profit of 21.8bn birr ($184m) for the fiscal year to 7 July.

Brook Taye (pictured right), CEO of Ethiopian Investment Holdings (EIH), says the offering is partly for learning. EIH is the state-owned sovereign wealth fund that acts as the government’s strategic investment arm and controls 27 portfolio companies. It values their total gross assets at $45bn and says annual revenue is some $18.5bn. EIH is working with 10 state-owned companies in preparation for more listings.

Brook Taye moved to head EIH after spear-heading capital market development as Director General of ECMA.Hana Tehelku, who succeeded him in August, said in October at the AFSIC Investing in Africa Conference in London that the regulator is working with the World Bank to create an IPO clinic to help state-owned enterprises and private businesses to prepare for listing. The pipeline could include Ethiopian Insurance Corporation and Ethiopian Shipping and Logistics Services.

Brook Taye told reporters that the government will eventually sell another 45% of Ethio Telecom to foreign and local investors and will retain 45% of the shares.

At the London conference, State Minister of Fiscal Policy and Public Finance, Eyob Tekalign Tolina said that six years of dramatic economic reforms was leading to “a major shift to a private-sector-driven growth model”.

A key move came on 29 July when the National Bank of Ethiopia (NBE, the central bank) issued a foreign exchange directive which allows exporters and commercial banks to keep foreign exchange instead of surrendering it to itself. The aim is to increase the supply of foreign exchange for the private sector.

The value of the birr fell from 57 birr = $1 before the NBE announcement, to about 75 birr on the morning of 29 July and drifted down to 120 birr as at mid-October, almost closing the gap with the unofficial parallel market rate. The black market and even crypto currencies had been used a lot before the announcement.

Minister Tolina said the market-based FX pricing replaces decades of distortion. He described how the team, including the national bank, carefully managed liquidity and credit in the months before the announcement in order to minimise disruption. The government also plans subsidies for fuel and the cost of living for low earners.

The move comes as Ethiopia seeks to secure a loan of $10.7bn from the International Monetary Fund (IMF) and the World Bank, and restructuring of external debt reported at $28bn.

Economist Charlie Robertson of FIM Partners told the Financial Times the move was unlikely to create an inflation surge because much of the economy had been effectively operating at the parallel exchange rate of 110-120 birr to the US dollar.

He said: “This is going to open up Ethiopia to portfolio investment and bring back exporters’ money hoarded offshore. I don’t think it will attract FDI overnight, but it makes Ethiopia more attractive in the medium term.”

ESX new trading system

Michael Habte, COO of the Ethiopia Stock Exchange (ESX), confirmed at the AFSIC conference that everything would be ready by November. He described Ethiopia as one of the largest economies without a stock exchange.

He said: “There are advantages in being late in building the capital market for Ethiopia. We are not just an equity-focused frontier market, we are a solutions provider. We offer solutions for banks that want to trade money-market instruments.”

The ESX would support the government and the NBE plans to issue more fixed income bonds and have active trading between buyers and sellers after the issue. Both are part of structural changes that should let the market participants have a bigger role alongside the NBE in determining interest

rates.

He added that the exchange would provide different avenues for different businesses to raise capital, including crowdfunding and other mechanisms suited for smaller businesses in future.

In July the ESX signed agreements with Infotech Private Limited which cover the design, supply, and installation of an electronic trading platform system and a broker back office and order management system. The flagship platforms are Capizar® and Marlin®, both targeting the needs of exchanges, regulators and brokers.

InfoTech was established in 1995 and is modernising stock exchanges and post-trade infrastructure in over 17 markets across Africa, the Middle East and South Asia.

The broker systems will automate and streamline the operations of brokerage firms, including adding clients, managing orders, reporting and processing transactions.

The trading of money market instruments (largely debt-related securities with a duration of 12 months or less, including treasury bills) is also set to launch in the coming weeks.

Pick n Pay to list Boxer chain on JSE

South African retailer Pick n Pay, which operates supermarkets, clothing and liquor stores in eight African countries, is aiming to raise as much as R8bn ($454m) by listing its Boxer supermarkets chain on the Johannesburg Stock Exchange (JSE) before the end of 2024.

The next steps are to seek shareholder and final board approval for a share issue and listing.

The company is still to reveal details of the share offer, pricing and target amount, as well as whether it will be an IPO and open to South Africa’s estimated 1m retail investors, including many of Pick n Pay’s loyal customers, or restricted only to a few large institutional investors.

Pick n Pay, which is listed on the JSE, already raised R4bn in August through a rights offer of its own shares in order to reduce debt. It operates 2,227 shops and has an online groceries e-commerce arm.

Pick n Pay Chief Executive Sean Summers is seeking to recapitalise the business as part of a turnaround strategy, including paying down debt and raising funds to close unprofitable shops and fund long-term growth.

According to news reports, it has been losing market share to the Shoprite chain for over 10 years. For the year to February 2024 it recorded an overall trading loss in the Pick n Pay supermarket business of R1.5bn, and across the group of R3.2bn, pushing overall debt up to R6.1bn.

A Pick n Pay circular on Boxer, released in October, says it is one of the fastest growing grocery retailers in the world, with annualised turnover growth of over 19% a year. It has 477 shops, total sales income of R37.4bn ($2bn) and made a trading profit of R2.1bn ($113m) in the year to February.

Altvest lists on JSE’s AltX market

Altvest Capital Limited listed on the AltX market of the Johannesburg Stock Exchange (JSE) on 14 October after offering four different classes of shares in an IPO which closed on 1 October.

According to the JSE, there are now 279 listed companies on the main and AltX markets, with the total value of the shares listed (market capitalisation) at more than R19.7trn ($1.1trn).

Altvest is a financial platform which aims to bring alternative assets such as private equity, agriculture, property, fintech, blockchain and renewable energy within the reach of retail investors. It is working closely with the Easy Equities trading platform.

The share offer and listing are part of Altvest’s broader strategy to give retail investors access to alternative investments. The listing on the JSE marks the next phase of growth for the company.

Warren Wheatley, founder and CEO of Altvest, said: “At the heart of Altvest Capital’s mission is the goal of bridging the financial accessibility gap by funding South African small and medium enterprises (SMEs) through debt and equity instruments.”

Altvest listed four classes of shares, each linked to different assets within the company’s portfolio. It moves from its existing listing on the Cape Town Stock Exchange (CTSE).

Rwanda miller issues bond on RSE

Mahwi Grain Millers Plc, an industrial company, issued its first corporate bond on the Rwanda Stock Exchange (RSE) in September.

The first tranche has a five-year tenor (duration to maturity) and offers a coupon of 15% per annum, payable semi-annually. The programme aims to raise RWF5bn ($3.75m) over two tranches. The second tranche will be worth RWF 2bn and the tenor will be determined at a later stage.

Chantal Habiyakare, Chairperson of Mahwi

Grain Millers Plc (pictured below), said: “The capital raised through the bond issuance will enable the company to expand and contribute to the country’s vision of self-reliance in the agriculture sector.”

Proceeds from the second tranche will mainly cover acquiring equipment and related construction, including animal feed machinery equipment, the purchase of silos for storing maize grains, and a building for the animal feed factory.

Mahwi Grain Millers was incorporated in 2018 and produces and distributes 150 tonnes of refined maize flour every day. It also produces fortified maize flour for school feeding programmes and maize flour for high-end consumers and for export. Its processing lines have a production capacity of 250 tonnes daily.

Bond issue raises hope of revival of Sierra Leone exchange

The issue of a small corporate bond heralds a step towards the revival of Sierra Leone’s capital market. Local microfinance institution LAPO (Lift Above Poverty Organisation) SL raised SLE32m ($1.4m) to expand its loan portfolio. The bond issue was approved by the central bank of Sierra Leone in December 2023 and the transaction closed in June 2024.

LAPO SL serves 33,000 customers, 99% of whom are women, across 37 branches. The loans support micro, small, and medium enterprises, with a focus on affordable loans to women from low-income households.

The anchor investor is the Africa Local Currency Bond (ALCB), Fund which invested some SLE27m ($1.18m) to back Sierra Leone’s economic growth.

The advisors were United Capital Group, a pan-African investment banking and financial services institution, and local corporate advisory firm Pennarth Greene.

The bond launch was supported by Invest Salone, a private sector development programme funded by the UK Government’s Foreign Commonwealth & Development Office (FCDO) and managed by Cadmus, via the PROSPER Salone grant scheme.

Invest Salone provided a grant to the ALCB Fund to support the transaction hedging cost. It also provided local investors with a limited partial guarantee.

Gabriel Eshiague, Managing Director of LAPO SL, said: “We recognise and value the anchor role played by the ALCB Fund for the success of our debut bond. Besides being the largest investor, the ALCB Fund also supported the improvement of the bond documentation.”

Claudius Bart-Williams, CEO of Pennarth Greene, said: “As Sierra Leone’s first officially approved local currency corporate bond, the central bank’s regulatory and approvals process is a key milestone for the country.

“The transaction puts Sierra Leone in the spotlight, attracting new international investors who have never invested in the country before, as well as providing a new avenue for existing investors who are looking to diversify their portfolios. Furthermore, it gives a strong signal to the investment community that the authorities are open to attracting additional sources of funding into the economy.”

Christina Clark-Lowes, Invest Salone’s Investment Lead, said: “This transaction was an innovative way for us to achieve our goal of facilitating inclusive economic growth in Sierra Leone. We believe that this transaction will channel funding from institutional investors to local Sierra Leonean businesses, giving them access to an alternative source of financing and hence leading to improved private sector business activities in the country.”

The Sierra Leone Stock Exchange (SLSE) was first established in July 2009 with support from the then Nigerian Stock Exchange. The Bank of Sierra Leone trained 21 people to be qualified stockbrokers.

The first listing was state-controlled Rokel Commercial Bank. Trading was illiquid and infrequent; trading hours were few. By 2017 there were reportedly three listings: Rokel Commercial Bank, First Discount House and HFC Mortgage (since renamed Commerce and Mortgage Bank (SL) PLC, a related entity of the National Social Security and Insurance Trust, NASSIT). Three more companies were reported to be interested to list their shares.

The SLSE later closed and work is in progress to relaunch the exchange and the capital market.

Ghana SE launches OTC market

The Ghana Stock Exchange (GSE) has launched an over the counter (OTC) market for trading in securities that are not listed on the official market. This aims to encourage capital raising and to enhance trading between sellers and buyers of unlisted securities.

The aim of the OTC option is to offer trading in a wide variety of securities including: ordinary shares, preferred shares, derivatives, depositary receipts, and securities from collective investment schemes such as unit trusts, mutual funds, hedge funds, and Real Estate Investment Trusts (REITs).

Abena Amoah, Managing Director of the Ghana Stock Exchange (right), said: “We are excited to launch the OTC market as part of our ongoing efforts to deepen and broaden the financial markets in Ghana. This platform will provide significant opportunities for companies to access capital and grow while offering investors new avenues for diversification and investment.”

Alex Kwasi Awuah, MD of ARB Apex Bank Plc said: “The GSE OTC Market will not only provide a regulated platform for the trading of unlisted securities to enhance transparency and liquidity, but also further strengthen the corporate governance of the participating rural and community banks to make them more attractive to investors.’’

The OTC market is a centralised marketplace which allows trading on approved market infrastructure, facilitated by a network of expert dealers and brokers. The aim is to boost liquidity in the unlisted shares as an alternative to buyers and sellers of securities having to contact each other in order to buy or sell, without transparent prices. It also gives investors access to a broader range of financial instruments.

Helios closes first $200m of climate fund

In July, fund manager Helios Investment Partners reached the first close of the Helios Climate, Energy Access, and Resilience (CLEAR) Fund by raising some $200m. The fund will invest in African businesses focused on climate mitigation and adaptation and eventually could increase the amount to $400m.

Several UK government initiatives helped the fund get to this launch stage and opened the way for other investors to join. Backing was provided by the Foreign, Commonwealth & Development Office (FCDO) through its MOBILIST programme and by InfraCo Africa, a company that is part of the Private Infrastructure Development Group (PIDG).

The investors that came on board to boost the CLEAR Fund are the UK’s development finance institution, British International Investment; the European Investment Bank; the Emerging Markets Climate Action Fund, managed by Allianz Global Investors; the Dutch development bank; and Swiss Investment Fund for Emerging Markets.

MOBILIST (Mobilising Institutional Capital Through Listed Product Structures), is an FCDO programme investing equity and supporting capital markets in Africa and globally, and seeks to mobilise private capital to help achieve the United Nations Sustainable Development Goals (SDGs).

In September MOBILIST announced a partnership with the Nairobi Securities Exchange Plc (NSE) to support more investment into sustainable development in Kenya via the listed market. It is asking for proposals from Kenyan brokers, investment banks and promoters.

Ross Ferguson, who leads the MOBILIST programme, said: “Public markets in Kenya and other African economies hold great untapped potential to mobilise the private capital the continent urgently needs to gain ground in addressing the SDGs and the severe impact of climate change.”

In May MOBILIST launched its partnership with the Nigerian Exchange at an event that also brought together regulators from the Securities and Exchange Commission and managers of pension funds to discuss how to solve barriers to increased investment in the SDGs via public markets.

NGX Chairman Ahonsi Unuigbe said: “An enhanced and efficient listing process will democratise access to capital, nurturing a vibrant entrepreneurial ecosystem, (so) particularly businesses dedicated to the achievement of Sustainable Development Goals (SDGs), can flourish.”

MOBILIST says that $193bn can be invested with sustainable returns into renewable energy in sub-Saharan Africa by 2031. The African Development Bank has called for at least $402bn more each year to be invested into education, energy, productivity and infrastructure in order to achieve the SDGs.

The Organisation for Economic Cooperation and Development (OECD) says Africa needs additional financing of about $194bn annually to achieve the SDGs by the target year of 2030.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google