There has been an increasing issuance of sustainable green bonds in East Africa.

In April Tanzania’s water utility, Tanga Urban Water Supply and Sanitation Authority (Tanga UWASA), issued a 10-year water infrastructure green bond, which attracted Tshs53bn ($20m) in investments and was listed on the Dar es Salaam Stock Exchange on 15 May. The bond offered a high 13.5% annual interest rate and was pitched at retail investors, with a minimum investment of Tshs0.5m ($187).

It will finance improving and extending the water supply and sanitation services infrastructure for the city of Tanga and nearby townships. Water production, treatment and distribution capacity will be boosted to 60,000 cubic metres per day from 45,000, which is projected to enhance access to safe and affordable clean water for 6,000 households (26,000 people).

It will also fund environmental conservation activities and protect the natural water sources of the Zigi river and surrounding villages.

Local investors flocked to give support, contributing 65% of the sum raised, while foreign investors made up the rest. It is the first issue of a green bond by a utility. It shows that the regulations and frameworks can be used by municipalities, cities, parastatals and others to raise significant capital to finance development from Tanzanian domestic investors in local currency and reduce pressure on the government’s budget.

The UN Capital Development Fund (UNCDF) was the lead technical and financial partner, NBC Bank was the lead transaction advisor, FSD Africa (funded by the UK government) supported the green financing framework, FIMCO and Global Sovereign Advisory provided financial and investment advisory, ALN Tanzania was the legal advisor, and Vertex International Securities was the stockbroker.

A pioneer in the green bonds field was CRDB Bank’s launch of Kijani (‘green’) bonds in a TShs780bn ($300m) multi-currency medium-term note (MTN) programme over five years. The first tranche offered 10.25% interest per year and the minimum subscription was Tshs0.5m. It raised the Tshs equivalent of $68.3m (an oversubscription of 429%) and listed on the Dhaka Stock Exchange (DSE) in October 2023.

The International Finance Corporation, part of the World Bank Group, invested in 29.3% of the bond, equivalent to $20m, with the funds coming from the International Development Association’s (IDA) Private Sector Window Local Currency Facility. FSD Africa provided technical assistance, Stanbic Bank was lead underwriter and book runner and Orbit Securities Tanzania was the sponsoring broker.

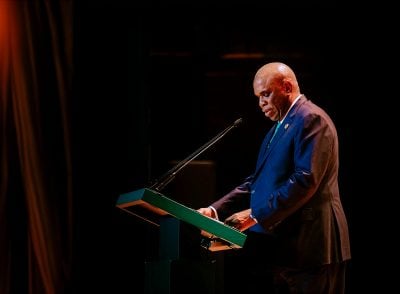

Launching the Tanga UWASA bond, Mwigulu L Nchemba, Tanzania’s Minister of Finance, highlighted that the bond issuances are linked to the Alternative Project Financing Strategy (APF) launched by the government in May 2021.

The Ministry of Finance, the Capital Market and Securities Authority, the DSE, stockbrokers, banks and others work together to develop the capital market.

In April, Bloomberg reported that the World Bank is helping Kenya to issue a $500m sovereign sustainability-linked bond, initially expected by November 2024. The proceeds will be used for general budget support. Isfandyar Zaman Khan, lead financial sector specialist at the World Bank Kenya, said: “Kenya has promised a very ambitious sustainability agenda, which includes not just climate, but also social and health and energy.” Khan said the Democratic Republic of Congo and Angola are also exploring bond issuances.

Acorn Holdings claimed the title for East Africa’s first green bond in 2019, with a Kshs4.3bn ($33m) bond to finance six purpose-built environmentally-friendly student accommodation properties in Nairobi, with a capacity of over 5,000 beds. Standard Bank Group, via Stanbic Bank Kenya Limited and SBG Securities Limited, acted as lead arranger and placing agent on the bond.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google