International migration to rich countries is growing at the fastest pace recorded in more than 15 years, according to the Organisation for Economic Co-operation and Development (OECD). The 2023 edition of the OECD’s International Migration Outlook report, which was released in October last year, shows that permanent migration to OECD countries reached 6.1m in 2022. This is the highest level since at least 2005 and represents a 26% increase compared with 2021.

Overall, 15 out of the 38 OECD countries registered in 2022 their highest levels of permanent migration over the past 15 years. The report reveals that labour migration through routes that could lead to permanent settlement doubled in the UK in the past year. There was a rise of 59% in Germany, 39% in the US and 26% in France.

“Most OECD countries are experiencing labour shortages,” said José Luis Escrivá, Spain’s minister responsible for migration, at the launch of the OECD’s report. “The situation can only get worse in future.”

Escrivá pointed out that significant demographic trends in Europe such as an ageing population and a low birth rate are creating a need for continued migration. The EU will need at least 50m people to come from abroad in the next 25 years, he says.

A big boost for African remittances

Africa is a major beneficiary of the sustained increase in the flow of migrant workers to rich countries in Europe and North America. African migrants who leave their country of origin in search of opportunities and work in richer countries like the UK, France, Germany, Canada and the US regularly send money back home to loved ones.

These cross-border transfers –referred to as remittances – have been growing in leaps and bounds over the past decade, underscoring the contribution of African migrants in the diaspora to their countries of origin. The UN estimates that remittances to Africa rose from $67bn in 2016 to $87bn in 2019. In 2020, they decreased modestly by 4% due to the Covid-19 pandemic, before growing again by 9% to reach $91bn in 2021.

Shem Ochuodho, global chair of the Kenya Diaspora Alliance and the co-president of the African Diaspora Alliance, told African Business that remittances from the African diaspora have become the major foreign exchange earner in several countries on the continent, including Kenya.

According to Ochuodho, the amount of money that Africans living abroad send to their families and communities has increased steadily in recent years, despite the difficulties caused by the pandemic and the economic crisis due to high inflation and global interest rate hikes. He is hopeful that the value of remittances to Africa will keep growing, as the African diaspora is gradually catching up with India, which has the biggest diaspora population in the world with about 18m people, as per the UN.

Could pushback impact African remittances?

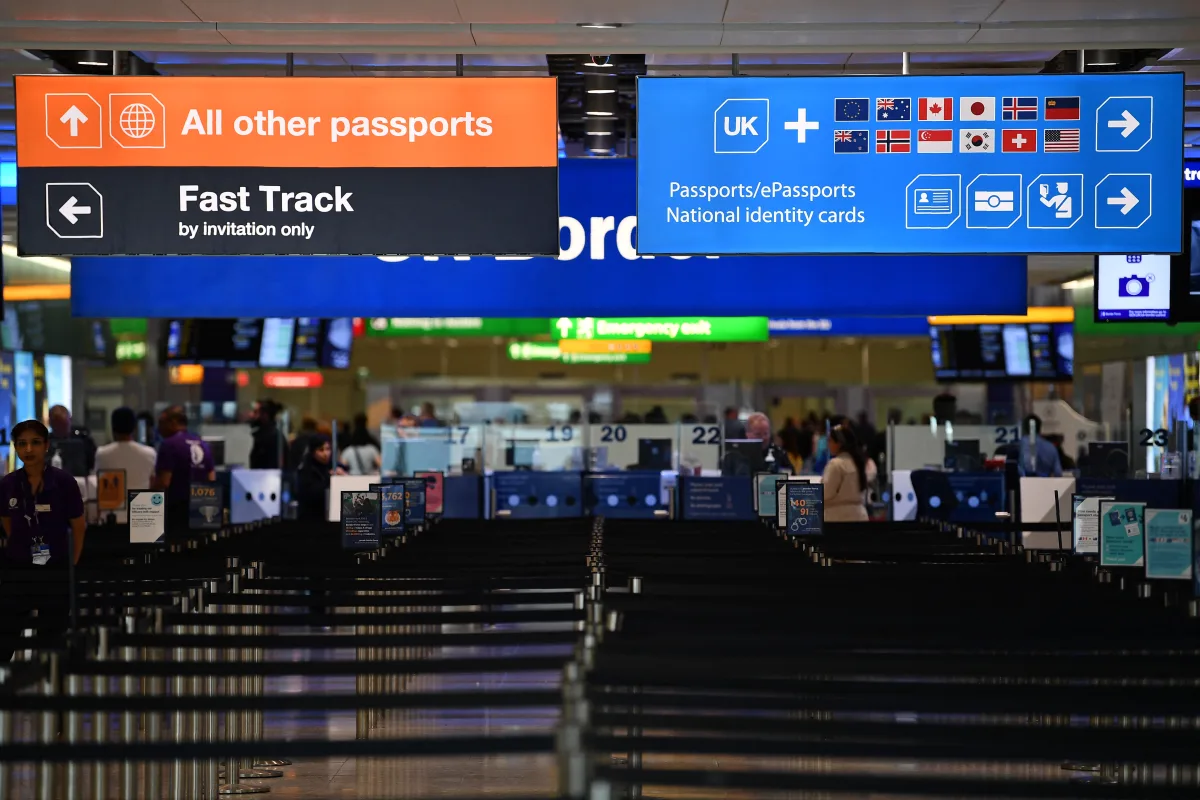

Although diaspora remittances to Africa have grown robustly in recent years, the introduction of stricter immigration policies in many OECD countries is designed to limit the ability of immigrants to work and earn in host countries. This could in turn affect the amount of money they are able to send back home.

Rich countries historically focused on policies aimed at curbing illegal immigration, but in recent years, the concern has become immigration more generally, including legal immigration for work or study purposes.

The UK government, for example, recently enforced new rules that aim to slash the number of people coming to the UK by around 300,000 a year after official figures released last year showed net migration had increased to a record 745,000 in 2022.

“The new rules will be rolled out at different stages throughout 2024 and will impact migrants on a variety of routes, including family visa applicants, skilled worker visa applicants and overseas care workers coming to the UK under the health and care worker route,” notes Smith Stone Walters, an immigration legal practice, in a note on the sweeping changes.

Ismail Ahmed, the founder and chairman of WorldRemit, a global money transfer service mostly used by migrants to send remittances, believes that the African diaspora will keep growing despite the West’s tough immigration policies. He told African Business that stricter immigration laws have not stopped migrants from going to Europe and other wealthy countries in the past, and that he does not expect a different outcome this time round.

“In 2007 and 2008, just before we started WorldRemit, there were similar concerns that migration would slow down on account of stricter laws. However, in 2018, there were estimates that the number of African migrants to rich countries had doubled in a decade. Four or five years from now when we look back, we will likely see that the number of African migrants will continue increasing despite the renewed push against migration.”

Ahmed notes that there’s a greater need to focus on managing the flow of informal migrants, as this is what is largely responsible for the migrant crisis in many Western countries, including the US, which is grappling with a huge influx of informal migrants on its southern border with Mexico.

“Total migration is increasing because of informal migration, which is really accelerating. We’ve seen what’s happening in the US recently. Africans make up a sizable percentage of those who have recently moved to the US in terms of the Mexican border,” he says.

Citing official government data, The New York Times reports that the number of Africans apprehended at the US’s southern border jumped to 58,462 in the fiscal year 2023 from 13,406 in 2022. Most of these Africans travel first to South America and then make their way to Mexico until they arrive at the southern US border.

African diaspora eager to invest back home

Remittances are not only a source of income for many African households, but also a way of improving their living standards. By receiving money from their relatives abroad, they can afford better health care and education, and reduce their vulnerability to hunger and poverty. However, Ochuodho argues that the African diaspora can do more than just send money to their families. They can also invest directly in their countries of origin, creating jobs and boosting development. He says that an increasing number of Africans in the diaspora are willing to invest in their home countries, and that some governments are offering incentives to attract them.

“In Kenya the State Department of Investment Promotion is keen to increase the percentage of remittances that is channeled towards investment from 25% to 50%. Some of the economic sectors where the Kenyan diaspora have expressed strong investment interest are the securities markets, food security, tech and the mining sector,” he says.

According to Ochuodho, the Kenyan government has increased its attention and support for the diaspora in recent years, compared to previous periods. He says that more resources have been allocated to foster the growth and development of Kenyans living abroad.

“We are excited by the government’s creation of a Diaspora State Department. We had requested for a full ministry with three state departments and are still exploring this. However, this is a good start.”

According to Ahmed, Africans in the diaspora are valuable sources of both funding and knowledge for their home countries, as they have acquired skills, education and international experience while living and working abroad. He admits that brain drain – the loss of highly qualified Africans to other regions – is a real challenge but not a decisive one and that Africa can actually gain from having its best talents exposed to international opportunities.

“We may lose some professionals. Nigeria, for example, has lost many nurses and doctors, so there is that concern. On the flipside, however, there are a lot of African diaspora who are trained in the West, gain international exposure and experience, and then return to their home countries both with capital and knowledge. This is in addition to the remittances.”

Research needed on diaspora impact

Ahmed says that for Africa to harness the full potential of the diaspora, governments will need to invest more resources in gathering accurate and timely data on migration and remittances.

“We should not be relying on rough estimates on remittances produced by aid agencies. The UN and World Bank tend to underestimate the size of Africa’s diaspora.”

“Governments should conduct detailed surveys and finance research to gather this important data. Some countries have done a fantastic job. Look at Kenya. The monthly remittances data published by the Central Bank of Kenya shows the true size of the country’s diaspora remittances.”

Ahmed is optimistic about the future of the African diaspora, despite the recent introduction of stricter immigration laws in Western countries. He further notes that, while rich Western countries have historically been popular with African migrants, the Gulf has emerged as an increasingly important destination for Africans. “The Gulf is becoming a major source of remittances because of the increasing legal migration. That will continue,” he concludes.

“Africans have been on the move since gaining independence and this is not about to change. We will still continue to see people moving across borders to seek better opportunities, jobs and so on.”

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google