Just over two years ago in Dakar, Senegal, I and a few of my team organised a dinner for a few of the African ambassadors to China, who had been deployed to Dakar to join delegations for the eighth Forum of China Africa Cooperation (FOCAC). While the mood was celebratory – the diplomatic corps and their heads of state and government had secured many hard-won new commitments from China to the Africa partnership – in many areas from trade to foreign direct investment and lending, there was also an undercurrent of significant uncertainty. We were still in the midst of the pandemic and none of us could, for instance, have predicted that China’s quarantine measures for inbound travel would last until the end of 2022.

But it was this hard-to-predict shift, as well as the existence of the 2021 commitments, that set the stage for 2023 being a very interesting and extremely busy year in Africa-China relations. 2024 is likely to be even more so.

My team maintains a database on public Africa-China announcements made in Chinese, English and other languages – and we categorise them by sector or issue, type of activity, financier, and other variables.

During 2023, the predominant coverage of China in African and international news sources was of course about China as a lender, due to prevailing narratives that China has “turned the tap off” on global lending. There was also significant reporting of the ongoing debt relief negotiations with Zambia and a few other low and middle-income countries. Certainly, China’s opening up after Covid-19 made a difference to these negotiations, enabling delegations from those countries and China to travel back and forth to come closer to clear understandings.

There are many things besides debt

But the fact is, even when Zambia’s president visited China in 2023, debt hardly featured in his itinerary. The visit, and visits by over 20 other African heads of state and foreign ministers this year – well above average from 2010, when our records begin – were focused on re-engaging China on economic growth on the continent – from pitching for more concessional lending in energy and transport to pitching for investments in value addition and manufacturing, and finalising new export agreements for African products to China.

Around these visits of African leaders to China, which we have previously found are correlated with positive trade and investment flows, were numerous other forums – from the biennial China-Africa Economic and Trade Expo to the China-Africa agricultural forum, which had been committed to at FOCAC 2021 but which Africans were unable to travel to China to attend until this year. That said, it was activity on the continent with Chinese stakeholders that we found featured the most in our database in 2023, and certainly more so than in 2022. We saw agreements for investments in road upgrades in Zambia, a new industrial park in Mozambique, a digitally networked cement factory in Uganda, and much more.

We saw trade and tourism promotion conferences, Chinese medical teams, agreements on broadcasting and new agricultural ventures. And we saw financial transactions inked that we knew would be coming due to commitments at FOCAC 2021 – investments into Afreximbank and Africa Finance Corporation, and Egypt’s issuance of a “panda bond”, to name a few, while African governments continued to use Chinese contractors on their new construction projects.

Each month over the past year we have recorded at least 50 Africa-China activities, in some cases over 100. This might seem like an overly positive picture of 2023. The questions are: what was missing from 2023? And what might be rectified in 2024? While 2023 was certainly very busy, there were some notable gaps, which may set the tone for 2024.

A gap in connectivity

Commitments to financing ten regional connectivity projects have not yet been met, and while lending from China Development Bank and China Exim Bank is increasing once again after the pandemic hiatus, it is not yet at the level in ticket size, volume, or even concessionality terms that would really make a significant difference to African governments’ need to plug infrastructure gaps on the continent.

And, while exports from the continent to China are growing and diversifying, especially into agricultural products, investment in the opposite direction into manufacturing of value-added goods in all sectors – from textiles to solar panels to batteries for export to China as well as globally – is still lagging behind its potential. In my view, there is also significantly more potential for exposure of African entrepreneurs to Chinese venture capital and equity investment, which has yet to really be seen.

Can these gaps be plugged?

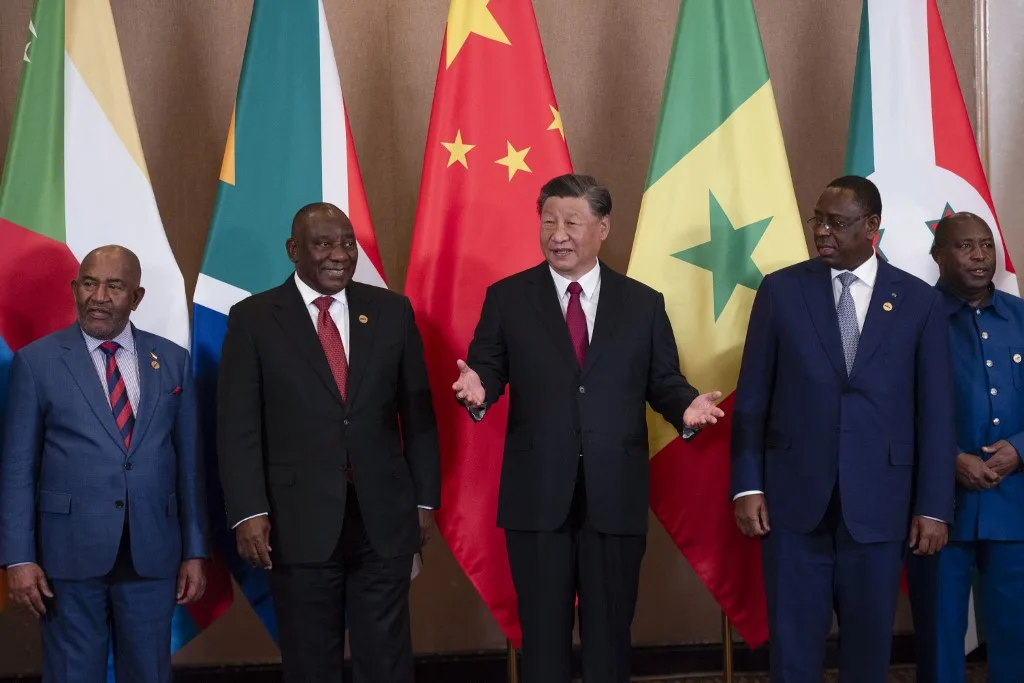

In 2024, the ninth FOCAC will be held – this time returning to Beijing, after the eighth in Dakar. It’s too early to tell now what can be expected from the Beijing session, during or beyond the dinners we will have with African delegations there afterwards. However, based on the 2021 conference, plus three new initiatives on industrialisation, agricultural modernisation and talent that were announced at the China-Africa conference in South Africa on the sidelines of BRICS, plus our experience of a very busy “catching up” year in 2023, I and my team are poised for an extremely busy 2024 when it comes to Africa-China. I hope you will be too.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google