This article was produced with the support of Stone X

Around the world, there is a distinct lack of female representation in the technology and finance spaces. In 2023, the percentage of women in tech leadership roles fell to 28%. Women hold only around 20% of board seats globally within financial services institutions. Africa is no exception, with fewer than 15% of Africa’s tech start-ups having at least one female co-founder, with fewer than 10% having a woman CEO. The figures are not much better in finance, an industry in which only 18% of C-suite positions are held by women.

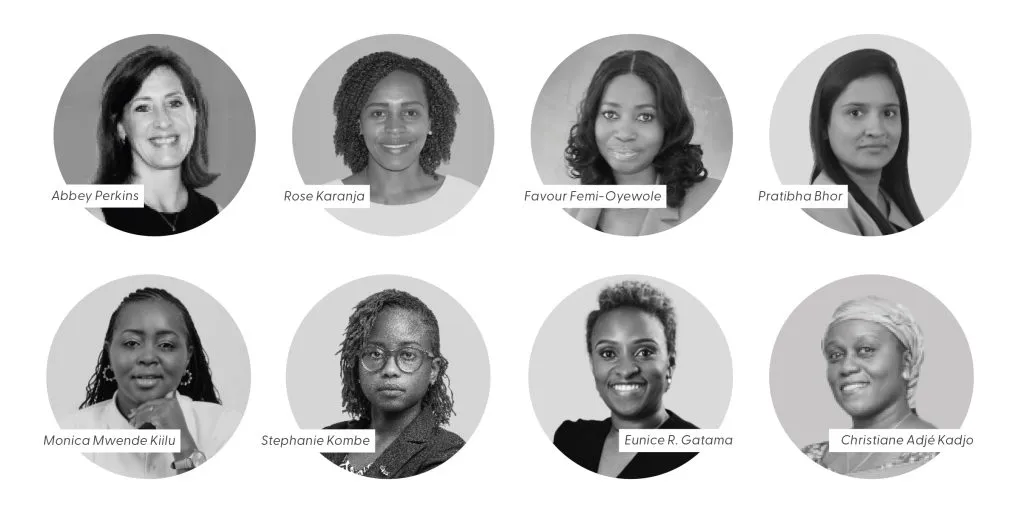

Abbey Perkins, Chief Information Officer (CIO) at StoneX, an international firm that connects clients to markets, has grappled with this issue throughout her career. However, she is now determined to make sure that other women feel better equipped to thrive in corporate environments.

“There will often be times when you are the sole woman in the room. It is important not to be discouraged or allow it to imbalance you in any way. Recognising your uniqueness grants you a distinct perspective. Lean in, and assertively participate,” she suggests.

The rewards for finance and tech firms could be significant should they commit themselves to greater gender diversity, Perkins argues. She is especially confident of the leadership skills women employees can offer.

“A leading business publication published an article on women’s leadership effectiveness during the pandemic, citing that women leaders have consistently shown their exceptional attitude in times of uncertainty or chaos,” Perkins says. “They are attuned to the stress and anxiety people might feel and excel at inspiring and motivating teams.”

Motivated to Succeed

Rose Karanja, Assistant General Manager of Treasury Operations and SWIFT Payments Project Lead at I&M Bank in Kenya, tells African Banker that women are no less motivated to work in tech and finance than their male counterparts. Growing up, she was “always intrigued by the dynamic nature of financial markets and how they impact the global economy.”

Karanja also found “the space exciting because it is rapidly evolving. The marriage of technology and finance is a powerful driver of meaningful change; it provides a platform for innovation, personal growth, and the opportunity to contribute solutions that have positive social impact.”

Favour Femi-Oyewole, Chief Information Security Officer at Access Bank in Lagos, likewise said that she is “passionate about value creation”.

Pratibha Bhor, Development Lead with StoneX, was similarly attracted to “the intellectual challenge and the sheer complexity of financial systems and the intricate problems that need solving […] finance presents some of the most challenging and intellectually stimulating puzzles in the tech world.”

Monica Mwende Kiilu, Senior Manager in Transactional Banking at I&M Bank in Kenya, was also determined to pursue a career in finance. “My career journey was mapped from as early as I can remember,” she says. “I always wanted to work in financial services and everything I did was towards actualising this goal. My first job was as a Teller, and in a serendipitous way, all my choices, interests, and achievements led me to joining I&M Bank in 2021, where I established myself as an expert in the digital and transactional banking space.”

Unique challenges

Why do not enough women follow the kind of path taken by Karanja, Bhor, and Kiilu? Stephanie Kombe, Manager of Integrations and Strategic Partnerships within the Transactional Banking Department at I&M Kenya, tells African Banker that women have unique hurdles to overcome. “Many women in finance and technology cite a lack of role models or mentors as a major deterrent to pursuing their careers,” she notes. “This often makes women underestimate their own capabilities and refrain from applying for or accepting positions in finance or technology.”

Kiilu also suggests that the demonstrable lack of female representation becomes a self-fulfilling prophecy – women are not represented in the workplace, so other women do not feel like they belong in such environments, which only makes the problem worse.

“Most women feel intimidated by men, particularly given the stereotypes that are associated with industries like technology,” she says. “This, coupled with the industry being male-dominated and the limited access to opportunities for women to pursue this career in Africa and worldwide, has led to few women in the industry.”

Christiane Adjé Kadjo, Senior Project Manager at BGFI Bank in Côte d’Ivoire, also notes that women face additional hurdles to a successful career in finance. “Balancing work and family life can be difficult to maintain, as one often has to leave the office late at night to ensure the bank is open the next day,” she tells African Banker. “However, these are challenges that can be met with determination and good organisation.”

Favour Femi-Oyewole, Group Chief Information Security Officer (GCISO) at Access Bank Plc points out that there are “two major impediments that [she] would love to see removed: gender stereotypes and inadequate mentorship and networking.”

“Social standards and ingrained myths frequently influence perceptions of what kind of employment is appropriate for men and women. Finance and technology have historically been considered male-dominated fields, which may discourage women from pursuing them,” she notes. “Additionally, it may be difficult for women to picture themselves in leadership roles in these industries due to the insufficient number of female role models in those positions.”

Valuable contributions

All are convinced, however, that there could be lucrative results for firms which embrace the challenge of boosting gender diversity. They say that female-led or more inclusive projects they have worked on have had considerable success.

Eunice R. Gatama, Group Head – Digital Lending, Ecosystems and Partnerships at I&M Bank, says that when she worked at Safaricom they had an internal initiative dubbed “Woman” that aimed to drive more engagement with impact from and with women through various initiatives. This was led by the executive woman leader in the organization and saw multiple gains.

She adds that at a Vodacom group level, another initiative dubbed Connected Woman in partnership with GSMA had a key objective of having more women connected with GSM products, i.e. mobile data and mobile money, through initiative/propositions designed for women. This saw an increase in the women to men active users on both products grow to 50:50.

Karanja recalls a recent example. “As I&M’s representative to the Central Bank of Kenya and Kenya Bankers’ Association National Payment Systems workgroups, I have been impressed by the collaborative problem-solving, diverse perspectives, efficiency, and diligence demonstrated by my female peers,” she says.

Bhor notes an issue she faced in a previous role, in which her team was struggling with user-experience (UX) design challenges. The team was looking to ensure that the product was both functional and accessible to a wide audience.

“At that point, a female colleague with expertise in UX design joined the project. She brought a fresh perspective and a deep understanding of user-centred design principles,” Bhor says. “What was particularly significant in this context was her emphasis on inclusive design, ensuring that the product would be accessible and usable by a diverse group of users.

“Ultimately, her presence on the project not only improved the product’s quality but also broadened our perspectives and enriched our understanding of how technology and finance intersect with the user’s needs and expectations. It underscored the importance of diverse teams in fostering innovation and ensuring that financial products are designed with the end-users in mind.”

Femi-Oyewole recalls the experience of “the cybersecurity certification project in which we as women made a positive impact.

“In the project, we were resource-constrained, and an additional workload was already on the way. To meet the deliverables, additional resources were requested, however, only one resource was approved, and the top candidate was a woman. Working together, we were able to meet and surpass expectations by multitasking, marshalling resources, and gaining collaborative commitments from stakeholders across the genders,” she tells African Banker. “Looking back critically at our success, our ability to balance multiple priorities in a multi-threaded manner made the difference and it continues to stand out in women.”

Action needed

There is clearly an incentive for technology and finance firms to take stronger steps towards boosting gender diversity. But what does that look like in practice? Karanja believes that the task will not be easy. “Closing the gender gap in finance and technology is a long-term undertaking and requires a concerted effort from governments, educational institutions, businesses, and society as a whole,” she notes.

Kombe suggests some practical measures that firms could adopt to help them get closer to this goal. “To increase the number of women, organisations must create a welcoming, friendly, and supportive environment for them,” she argues. “They must also develop programmes that assist women in advancing their careers, such as providing training and development opportunities for female employees, as well as providing mentorship and networking opportunities for them too.”

Femi-Oyewole agrees that investment is crucial. “We can get more women into the finance and technology sector in Africa and around the world by developing and investing in programmes that encourage women to pursue education in technology,” she believes. “Successful women in both sectors also need to be showcased more, to inspire and encourage other women to pursue a career in finance and technology.”

Bhor is optimistic that “progress has been made in recent years, with many organisations and governments taking steps to address gender diversity.” However, like Karanja and Kombe, she believes that “sustained efforts and a commitment to change are required to create a more inclusive and equitable finance and technology sector that welcomes and values the contributions of women.”

The financial rewards for firms which manage to do this could be great. McKinsey has previously argued that “if Africa steps up its efforts to close gender gaps, it can secure a substantial growth dividend in the process.” This is particularly true of the finance and tech spaces.

In Kombe’s words, “female talent in finance and technology remains one of the most untapped business resources.”

Next, we will hear an inspiring story of what women-led teams can achieve in some of the most hostile conditions in the world. Read on to find out how a women-led initiative at one of Sudan’s largest banks overcame the challenges presented by a warring country.

Sign in with Google

Sign in with Google