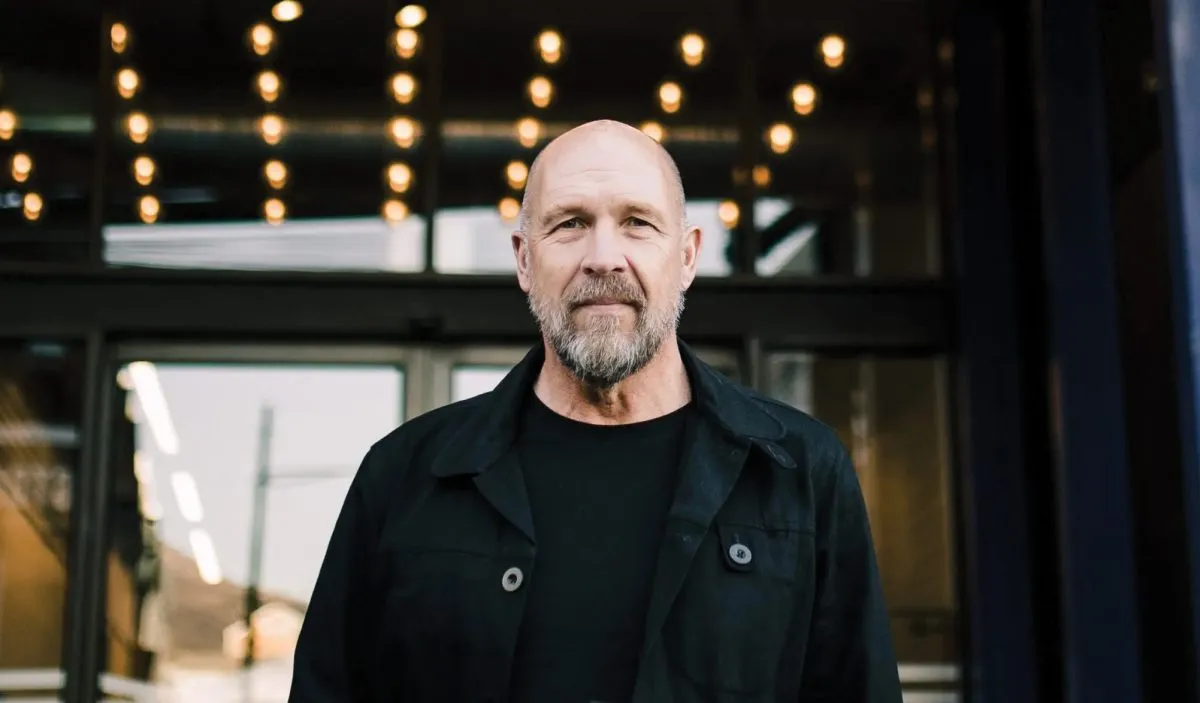

It has been long, tough, but rarely dull. Over the last half a century, millionaire tech entrepreneur Gour Lentell has navigated a huge circle around the world, in a business that began and ended in Africa.

Like Elon Musk, Lentell left Africa as a teenager with a rucksack, a handful of cash, ideas and a pocketful of ambition. It was the road less travelled for Lentell, with plenty of bumps. Along the way, he pulled pints, pushed paintbrushes, shovelled cow dung on a Swiss farm, built a pioneering tech company from scratch, sold it in New York for a cool $65m, 95% in stock; then, head-in-hands, watched its value vanish overnight.

A rich journey that began in Harare, Zimbabwe, in the last century has paused in Cape Town, South Africa, where he is disrupting WhatsApp or – in his own words – “f*****ng with Facebook.

“It’s a throwaway line, a good line, but we don’t spend our days worrying about Facebook, to be honest,” he laughs. “We have got plenty of other things to worry about!”

Indeed, as a disruptor in tech he has chosen the huge task of changing the way millions of Africans use their mobile phones and transact in these lean times.

About six years ago, Lentell sat with a shell of a company, Binu, in Cape Town. He raised around $11m in seed capital, largely from UK investors – which he ploughed into the breadwinner of the business: MoyaApp.

In the last three years, MoyaApp has claimed 6m users – more than twice the population of Botswana.

Read more about African tech

- Senegal: New hub set to boost gaming industry

- Africa’s fintech market to reach $65bn in revenue by 2030, says new study

- African startups stage funding comeback

Among hard-up South Africans the next biggest shortage, after electricity, is of data – specifically, mobile phone data. MoyaApp gets data to customers for free. Lentell likens it to an online shopping mall. Vendors such as supermarket chain Shoprite pay for the data that their potential customers use when they browse on the app.

This has undoubtedly helped to bring in customers, but, I venture, if people can’t afford data, how can they be expected to spend freely online? Lentell bridles at this.

“That is such a patronising, lofty view. People sit somewhere and say ‘all of you people have no money – that is why you use data for free!’ That is such bullshit! In South Africa, the vast majority of people are cost-conscious, just as people in Brazil or Argentina or wherever are; they have limited disposable income and they count their pennies,” he says.

“People want to be entertained. They want to find jobs. They are all consumers of food and clothes and transport or whatever – but don’t have a lot of money. What they are saying is that they are not spending money on data, so that they can afford to buy a coffee or a coke or whatever.”

Selling to customers is merely one way in which MoyaApp makes its money. There is advertising; a messaging service; and games where people pay to play with the promise of prizes. There is even a new dating site. In July a government agency is spending R800,000 (about $42,000) with MoyaApp to carry out a survey.

“They can reach our audience and get a really, really high response rate,” Lentell says.

The lean years

What a contrast to the hungry years after Lentell left Zimbabwe in the late 1970s: “I arrived in London with a new rucksack, a new sleeping bag, all my possessions and £300 – that’s all my parents could afford, and foreign currency restrictions made it difficult anyway. I made my way in life,” he says.

“I had an uncle and his wife and I stayed with them for two months. I tried to get into university and got offered a place, but that was at the time when Maggie Thatcher got into power and foreign student fees went through the roof – and we had no capacity to pay anything. Although I was a British citizen I was not classified as a home student – to get that status I had to live in the UK for three years and pay taxes.”

In London Lentell trained as an accountant, but realised after a year that was not what he wanted. He pulled pints in a pub in Portobello Road, in London’s Notting Hill. He painted and decorated and went into debt. In these lean times, he heard there was work on a farm in Switzerland.

“I was a farm labourer cleaning up cow shit and chicken shit, throwing things around and feeding cows and working on the land. I was on the bottom rung; I was a labourer. I was working without a visa so the farm people hid me away and didn’t want me to go many places. I was paying off debts that I had so I was happy to work, earn money, be fed and pay off my credit card. None of them spoke English so I had to learn Swiss-German,” he says.

“I had a good three years of labouring work and forever appreciate the lessons and life wisdoms I got from that. When I said to the people in Switzerland that I wanted to leave and travel and was thinking about going to university they were astonished… They saw me as a farm labourer!”

Lentell flew back to England and to Lancaster University, where he earned an honours degree in operational research; a management science degree with mathematics, statistics and computer science.

“It was computers that really got me interested,” he recalls.

Following graduation, he went back to farm labouring. This time it was bringing in the harvest in Hertfordshire, to pay off more debt.

As the 1980s built up steam in London, with all the decade’s swagger, materialism and wide suit lapels, Lentell got a job in the thick of it at the consulting arm of Price Waterhouse (now PwC). “It was growing and everybody was doing MBAs and it was all happy days for the big consulting firms.”

Price Waterhouse helped Lentell emigrate to Sydney, Australia, where he jumped ship to consult for Oracle for four years.

“Then along came the internet in the mid 90s – and I decided that was really what I wanted to do – Oracle were talking about it, but not doing anything about it. So, in 1996, I went to OzEmail, the first Australian tech stock ever to list on the NASDAQ.”

The chairman was Malcolm Turnbull – the future prime minister of Australia, an accomplished lawyer, who had defended former MI5 operative Peter Wright in his efforts to publish the controversial book Spycatcher, in 1987. Australia had banned it.

Lentell says he learned a lot from Turnbull at the heart of what was then Australia’s largest internet company.

Read our review of Chris Bishop’s latest book

Dotcom boom and bust

Even though the internet crawled along on painfully slow dial-up connections, it was gathering power faster than a Sydney summer storm.

“In June 1998 we were riding into the peak of the dotcom boom. It was a wonderful time to be around – it was amazing actually. We started this ad serving technology company leveraging the experience we had at OzEmail,” he says.

The company was called Sabela Media. “We were two men and a dog with $100,000 each invested in the business.”

By January 2000, just a year-and-a-half from its founding, the company was thriving with 50 staff in Australia, Canada, the US, London and Paris.

“We grew, we got a third co-founder in, put some money in, we raised $2m from a private family office in Japan, and we expanded to the US and UK.”

In late 1999, Sabela Media was about to carry out a venture capital (VC) round for $14m. “It was mad dotcom days. You could put ‘dotcom’ on anything. You could put ‘dotcom’ on a tea cup and you could get funding. It was a mad time, but it was a wonderful time. We were two men and a dog in a little serviced office in Sydney and a year later, or so, I was meeting bankers on Wall Street who were competing to raise money for us.

“I had never been to New York or Wall Street and it was bizarre in a way. It was wonderful – it was such a huge experience in a short space of time; it opened my eyes to the world of business, banking, venture capital, growing businesses, travelling the world doing this crazy dotcom stuff.”

Success had drawn the corporate vultures. At the turn of the century digital giant DoubleClick – a company that would be bought by Google for $3.1bn in 2008 – was about to overshadow the fortunes of Sabela Media by plotting a takeover in the thick of the VC round.

Wooed with a writ

DoubleClick’s opening gambit was to sue Sabela Media for patent infringement “They sued us on Friday and then met us in New York on Monday and offered to acquire us. The patent lawsuit was to stop the VC [funding] round because then they wouldn’t be able to get their hands on us.

“It taught us a lesson about how business works in America, which I have always remembered. The DoubleClick guys were nice guys. We learned what it takes when you play on the football field in America, everyone plays within the rules but people will run into you and smash you!” says Lentell

“There were no hard feelings or emotional resentment or whatever – it was just a tactic to achieve their objective to acquire us.”

“At the eleventh hour this other company came in and we had to run two negotiations in parallel; and over the weekend we closed the deal. DoubleClick was offering us $38m, trying to squeeze us… we closed the deal over the weekend and told DoubleClick on Monday: ‘Sorry, we have sold the company’!”

“The other company came along and offered us $65m – 95% of it in their stock and the rest in cash. Of course, in the middle of the dotcom boom we were all sheep and we were all convinced the price of that stock was going to increase because that was what was happening in the dotcom world.”

The other company was 24/7 Media. The deal made headlines in the New York Times.

“I flew back to Sydney after that deal in New York, prior to the dotcom crash starting. I got up one morning and the value of my shares had increased by a million dollars. You kind of get up in the morning, look at the computer, you are worth a million more dollars, and make a cup of tea and carry on with life,” he laughed.

And then, the bust

“We took all of the shares – and of course the dotcom crash started happening in March and April 2000. During 2001, those shares declined 99%. Of course, we held on because everyone assumed it was going to go up two or three times in value. Then the tech wreck happened and the shares we were paid declined by 99%.”

So, was Lentell left empty-handed? “Pretty much. We managed to get something out before that happened. The hardest thing is to sell shares that you once thought were worth this much and were going to double – then they are worth half, and a third, and 25%. There is a human psychology that says ‘hang on to them, they are going to come back’ – but they just went down the toilet. I got a cheque for a few hundred thousand dollars, as part of the 5% cash part of the purchase.”

A multi-million-dollar fortune slipped through Lentell’s fingers. It could have been the end for many a sturdy entrepreneur.

Back in Southern Africa

Instead of that Lentell continues to battle the slings and arrows of outrageous fortune. He is in search of another fortune, 30 years on.

This time around, the harbinger of doom is the crumbling South African economy – which grew a mere 0.4% in the first quarter of 2023, according to Statistics SA, compared to 1.9% in the quarter to the end of March 2022. Bear in mind that most economists believe that South Africa needs to grow by at least 5% to keep ticking over and offering work to school leavers.

On top of that there are crippling power cuts– “load shedding”. “We are all impacted by it and it impacts businesses at large and it is disastrous for the economy. The people who have, by far, the biggest problem are the mobile networks. I know from conversations with insiders that they are all in crisis mode – because their cell towers are going down; their batteries get stolen; they constantly have to repair, protect, replace and secure. It is a living nightmare for the mobile networks,” says Lentell.

How will it all hold together with this uncertainty and what promises to be a turbulent election next year? “It is very controversial and very sensitive, but it is a worry and the economy can’t sustain itself and function well when your basic energy supply is compromised.

“It can carry on like this for years, but there are so many costs being sustained by everybody in the economy. There is so much potential in this economy – people, resources – but everything is constrained by this inability to keep a constant electricity supply. South Africa and Africa in general has this amazing ability to work around things and make a plan.”

You could say that Lentell – like the continent of his birth – has been doing just that for nearly half a century.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google