The beautiful and voluminous blue annual report of Ecobank, summarising the bank’s activity in 2022, consists of nearly 300 pages filled with abundant and well-presented useful information. The excellent layout showcases numerous tables, graphs, figures, images, photos, portraits, making the reading experience very enjoyable despite the austerity of some texts.

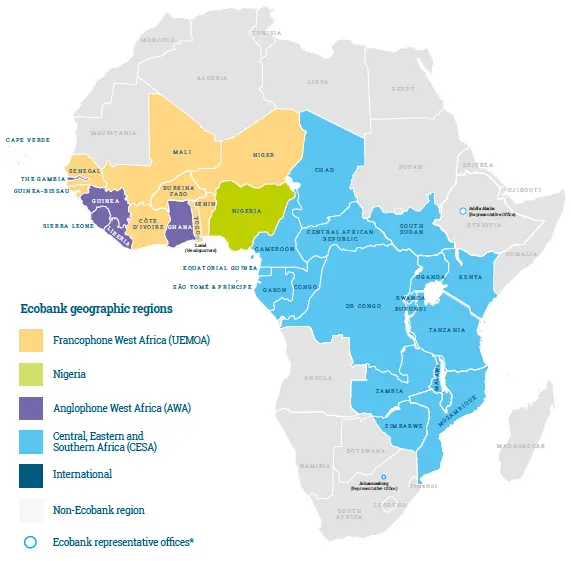

The notable fact is the bank’s presence in 35 countries in Africa and four countries in international markets, including Paris, London, Dubai, and Beijing. Its mission is to contribute to the economic development and financial integration of Africa.

This pan-African banking group was founded in 1985 in Lomé, the capital of Togo.

Therefore, it will celebrate its 40th anniversary in two years. The group employs over 13,000 employees from 43 different nationalities. It has more than 32 million customers and nearly 14 million mobile users. The total balance sheet stands at $29 billion, with equity capital of $2 billion. The gross amount of loans and advances amounted to $11.521 billion, of which a provision charge of $652 million was made. Ecobank led the execution of the largest initial public offering in the history of the UEMOA capital markets, Orange Côte d’Ivoire, with a market capitalization of $2.3 billion.

The group consists of three business segments: corporate and investment banking, commercial banking for SMEs, and retail banking for individuals. The highly diverse digital offering has accelerated growth across digital channels. For instance, the RapidCollect solution enables companies to collect payments throughout Africa.

Alain Nkontchou, the Chairman of the Board, highlights that despite a challenging environment, the group’s return on equity has increased to 21.1%, the highest in ten years. He pays tribute to Ade Ayeyemi, the retired CEO as of February 2023, for his contribution in stabilising an institution that faced difficulties in the past and enabling it to achieve sustainable profitability.

A new chapter

The bank has increased its market share in several regions and is the preferred partner of governments and international institutions. The pre-tax profit amounts to $540 million, and the cost-to-income ratio has dropped to 56.4%, the lowest since 2000. The new CEO, Jeremy Awory, will build upon this strong foundation to achieve the bank’s ambitions and overcome its upcoming challenges.

During the Annual General Meeting of shareholders, Ade Ayeyemi expressed his honour to have had the privilege of leading this great pan-African institution. “I am proud of what Ecobank represents, the vision of its founding fathers, and the work of all Ecobankers. We have inherited a unique heritage. It is now up to my successor, Jeremy Awori, to move the company forward, building upon what has been accomplished.”

Jeremy must write a new chapter in the group’s history. He recognizes the immense opportunities that exist in Africa. He will not hesitate to embrace audacity in embodying the bank’s pan-African vision.”

The CEO is supported by 15 members of the Executive Committee, which meets monthly and oversees the day-to-day management of the group and its subsidiaries. This Executive Committee comprises individuals from nine different African nationalities. It consists of the CEO, four regional directors, three Group Executives , the Secretary General, the CFO, and six officers and Executives responsible for compliance, risk management, audit and general services, operations and technology, and human resources.

The Ecobank Foundation, led by former Ecobank’s president Emmanuel Ikazoboh, was established in 1997. Its ambition is to improve the quality of life for people in Africa. The founding fathers emphasised from the beginning that Ecobank should not only be a commercial institution but also an institution committed to acting in the best interest of the communities in which it operates and contributing to their social and economic development. Thus, the Foundation plays an essential role in enhancing the group’s image.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google