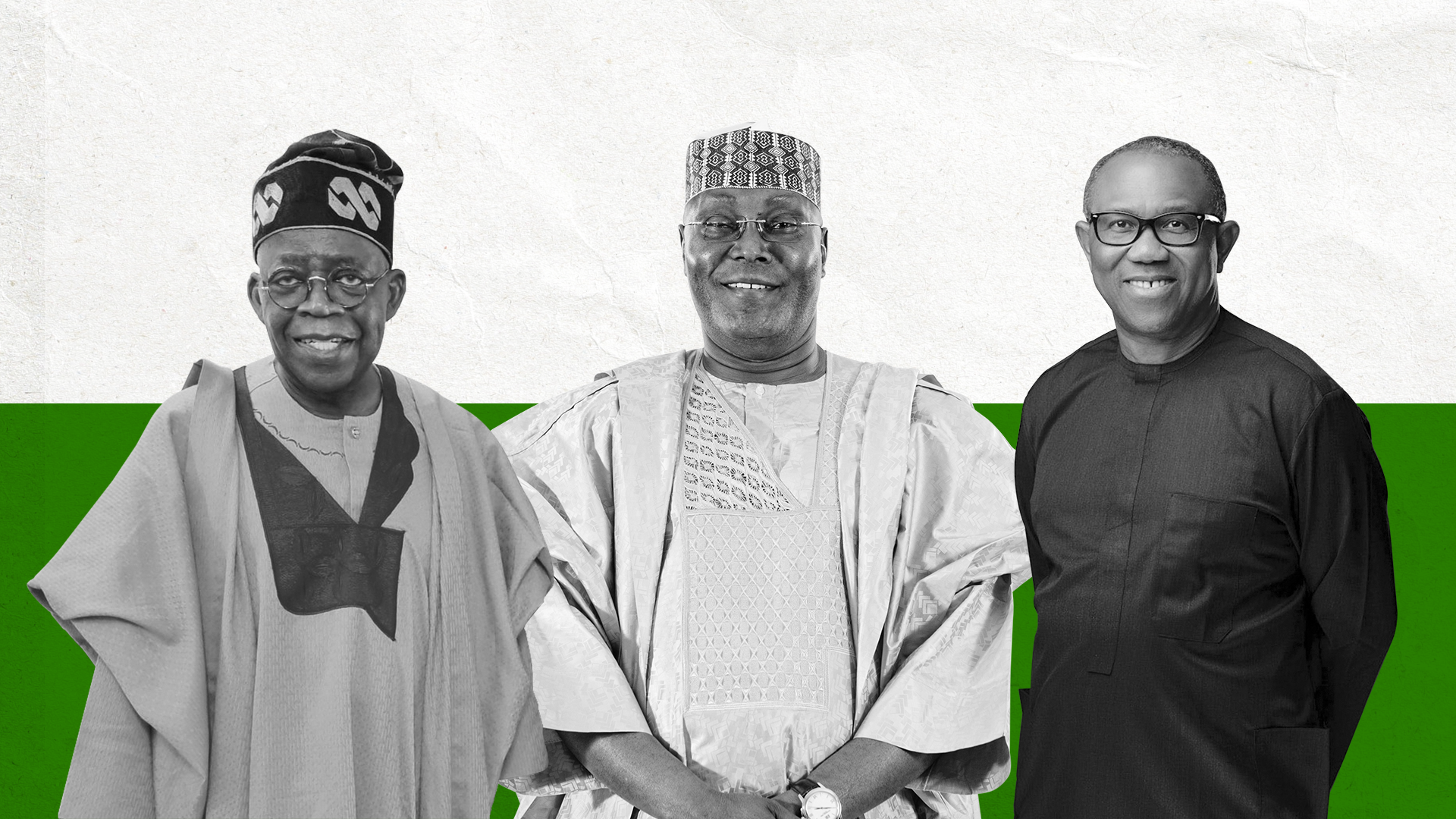

As Nigeria’s presidential election approaches, Labour Party candidate Peter Obi, 61, is widely expected by polls to win. He is Igbo, from the south-east – two characteristics that have rarely produced Nigerian presidents. He was the governor of Anambra state from 2006 to 2014, and is running as an outsider alternative to the two major parties.

Formerly a member of the People’s Democratic Party (PDP), he defected to the Labour Party to run in 2023. Labour currently holds no seats in the Senate or Parliament, meaning an Obi victory would break the PDP/APC duopoly that has historically dominated Nigerian politics.

The PDP candidate, Atiku Abubakar, 76, is from the north-east. He is considered a legacy candidate, having been vice-president of Nigeria from 1999 to 2007 and has had a long career at the zenith of Nigerian business and politics. This is his sixth tilt at the presidency.

Bola Ahmed Tinubu, 70, the candidate of the incumbent All Progressives Congress (APC), is likely to be runner-up. He was governor of Lagos State in the south-west of the country from 1999 to 2007. Unusually for Nigerian politics, he and his running mate are both Muslims – the first same-faith presidential ticket in three decades.

The economy: Oil to GDP, debt and startups

The Nigerian economy is traditionally dominated by oil and gas, but this dominance appears to be weakening. As the chart above highlights, the contribution of this sector to Nigerian GDP is gradually declining, even as crude oil prices skyrocket.

This is largely due to production troubles, with Nigeria experiencing widespread oil theft and other supply-side disruptions, which will make it difficult to service the large debts run up during the last years of Muhammadu Buhari’s presidency.

High oil prices have the additional impact of raising the cost of the government’s generous fuel subsidy, placing further pressure on public finances. Accordingly, Moody’s recently downgraded Nigeria’s ratings, and expect difficulties to endure given a deteriorating fiscal and external position over the medium-term.

Even as the oil and gas sector fails to capitalise on high prices, it is not clear what will fill this void. While Nigeria produced the most startups of any African country in 2022, the charts below suggest this is largely a function of population.

Per capita, Nigeria is on the lower end of African startup ecosystems; the tech and financial hub of Mauritius was by far the best performer. Resurrecting Nigeria’s flagging economy, consolidating external and fiscal positions, diversifying away from oil and gas and finding new sectors to drive increases in living standards are high on the agenda for the 2023 election.

Civil society

Nigerian civil society is losing confidence in institutions. As the chart below highlights, on the eve of the 2023 election, confidence in key institutions – the judiciary, the government and elections themselves – is declining. After “high points” in 2011 and 2017, which coincided with the election of Goodluck Jonathan and the mid-term performance of his successor, Buhari, respectively, the trend is profoundly negative.

If a distrustful public in 2023 produces an anti-system “protest vote”, as was the case in Kenya, Labour Party candidate Peter Obi is the most obvious beneficiary. Young Nigerians, particularly, are expected to back Obi in huge numbers.

Distrust seems to have morphed into apathy. The chart below demonstrates steep declines in voter turnout for Nigerian presidential elections, from over 70% in 2003 to less than 40 in 2019. This mirrors trends elsewhere on the continent.

Widespread apathy may play further into Obi’s hands, with his supporters being regarded as the most zealous and most likely to turn out for their leader. Buhari supporters, enticed by his cult of personality in 2015 and 2019 but disappointed by economic and security struggles toward the end of his reign, may simply stay home. Buhari’s APC, and its candidate, Tinubu, cannot count on their support.

Security

Security is set to dominate this election, with the chart below demonstrating just how serious the issue has become.

Having simmered down in the mid-2010s, social, political and economic-based violence has seen a resurgence since 2019. While Boko Haram have traditionally been the antagonists in this respect, violence has recently spilled out ethnic, religious and official lines.

According to many commentators, the speed, spread and scale of insecurity across this period is unprecedented. A January 2023 attack by unknown gunmen on the office of the Independent National Electoral Commission in Enugu State, as well as large-scale police protests in recent months shows just how real the threat is. Widespread worries about insecurity are at the top of the list for the 93.4 million Nigerians eligible to vote in 2023.

Dr Desné Masie is chief strategist and Angus Chapman is a research associate at IC Intelligence, the strategic advisory and business intelligence division of IC Publications, publishers of African Business magazine.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google