Luiz Inácio Lula da Silva, the veteran left winger and former president of Brazil, has dramatically returned to power after a bitterly-fought run-off victory over rival Jair Bolsonaro.

Lula, the fifth-time left-wing candidate, and founder of the Worker’s Party, has secured 50.9% of the vote to Bolsonaro’s 49.1% after 99.97% of votes have been counted. He has been congratulated by world leaders including US President Joe Biden and South African President Cyril Ramaphosa.

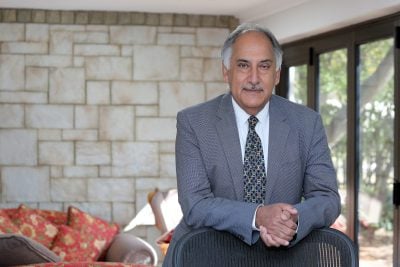

Lula’s return to power signals a new era in African-Latin American relations, says Carlos Lopes, professor at the University of Cape Town, former executive secretary of the UN Economic Commission for Africa (UNECA) and expert on African economies, policy and geopolitics.

“Brazil’s Lula and Colombia’s first ever black VP Francia Marquez will contribute to change the relations between Latin America and Africa. Both have made clear their commitment towards that. Africa in turn has to engage them more than symbolically.”

His presidency could also be transformative for Brazil-Africa trade integration after a period of stagnation.

During his two terms in office, from 2003 until 2010, Africa experienced a revamped Brazilian presence, with exports from Brazil to sub-Saharan Africa increasing by 25% per year.

Trade relations with Lusophone countries, such as Angola and Mozambique, and Anglophone Nigeria and South Africa, were deepened as Lula spoke of “Brazil’s historic debt to Africa”, referring to the million African slaves brought to Brazil between the 16th and 19th centuries.

However, since then, Brazil-Africa trade has lost much of its lustre. In 2019, Brazilian trade with sub-Saharan Africa reached its lowest value in 15 years, accounting for $3.67bn in exports and $2.35bn in imports.

Although the decline happened before Bolsonaro took office – mostly under the relatively short presidencies of Dilma Rousseff and Michel Temer – the existing trend has been exacerbated under the incumbent, limiting Brazil-Africa commercial and diplomatic relations.

Assessing the Bolsonaro years

“The African continent was not a foreign policy priority of the Bolsonaro government at any time,” says Kamilla Raquel Rizzi, associate professor at the Federal University of Pampa in Brazil.

“This, naturally, has distanced the two shores of the South Atlantic in recent years, and Brazil has been losing space with important African partners, such as Nigeria and Angola.”

During Bolsonaro’s term, major Brazilian companies with a historical presence on the continent have abandoned their activities. In 2020, the state-owned oil company Petrobras sold its Nigeria-focused subsidiary Petrobras Oil & Gas BV for around $1.5bn, ending its presence in Africa.

Last April, the mining company Vale withdrew from the Moatize coal mine in Mozambique – the biggest investment by a Brazil-based firm in Africa – after 15 years of operations.

Analysts say the lack of commercial interest has reflected the decline in political and diplomatic ties under Bolsonaro.

“Foreign policy is a public policy: if an external agenda becomes a priority at various levels of government, naturally, the policy can positively interfere in trade between Brazil and the African continent – if it is not a priority, the trade will be depleted,” says Raquel Rizzi.

There have also been unfortunate diplomatic hiccups.

Last year, Bolsonaro named Bishop Marcelo Crivella, a political ally and member of the Universal Church of the Kingdom of God (UCKG), as ambassador to South Africa.

But it was reported that Pretoria had refused to grant Crivella official approval, with sources saying that South Africa feared he was coming to advance the interests of the church, which was founded in Brazil but has a large presence in Southern Africa. In August, it was reported that the role would instead be filled by Benedicto Fonseca Filho, a seasoned career diplomat.

Critics also contend that Bolsonaro has failed to engage with the continent or further South-South cooperation in a meaningful way.

“Bolsanaro did not even visit Africa,” says João Bosco Monte, president of the Brazil Africa Institute.

“It gives a symbolic idea that he did not consider the continent as part of his political and economic agenda.”

Instead, Bolsonaro prioritised ties with big commercial partners, such as China, Argentina, the European Union, and the US, where he enjoyed a close relationship with President Donald Trump prior to his 2020 election defeat.

“Bolsonaro is interested in leaders close to him ideologically and forgets about other regions of the world,” says Bosco Monte.

Bolsonaro’s scepticism during the Covid-19 crisis – during which Brazil suffered some of the highest death rates in the world – and his ambivalent attitude towards the deforestation of the Amazon basin have also made him a controversial figure on the global stage and ensured a rigid focus on domestic affairs.

Lula: The “Brazil Rising” president

Lula’s African legacy appears more substantial – Brazil’s trade with the continent increased more than sixfold from 2000 to 2008, from $4.2bn to $25.9bn, while 60% of Brazil’s Cooperation Agency’s spending was allocated to African countries. From 2009 to 2012, Brazil was even Mozambique’s largest source of foreign direct investment – a position that China has occupied since 2014.

For eight years, Lula intentionally pushed Brazilian investors across the Atlantic. During his first visit to South Africa in 2003, he was surrounded by 160 Brazilian entrepreneurs to build stronger connections between the two BRICS nations.

Diplomatically, the number of Brazilian embassies rose from 17 in 2005 to 37 in 2010. Lula visited more than 27 African countries, including visits to countries where no Brazilian president had set foot before.

However, Adriana Schor, associate professor at the University of São Paulo, argues that the increase in the value of Brazil-Africa trade was mainly driven by high prices for Brazilian imports of African oil.

“Not only is fuel the main imported good, but it also accounts for more than 70% of total imports since 2000,” she says.

“As oil prices increased, fuel imports peaked at more than 90% of the total value of Brazilian imports from sub-Saharan Africa. It seems that higher imports were just due to higher prices.”

Despite a more diversified basket of Brazilian exports to Africa including food, machinery, and plastic – and Lula’s efforts to build ties beyond Lusophone Africa, Shor argues that most of the increase can be accounted for as “just part of another story of a traditional commodity cycle of boom and bust”.

Furthermore, under Lula and his successors, Brazil’s corporate image took a battering. Operation Car Wash, the largest corruption investigation in the country’s history, launched in 2014, investigated allegations of government bribery and embezzlement at state-owned companies.

Lula, who was initially jailed for 12 years, was the most senior politician to be convicted on corruption charges. His conviction, which he maintained was a politically motivated witch-hunt, has since been annulled by the Supreme Court. However, the long saga has undermined confidence in the probity of Brazil’s corporate sector.

Can Lula drive Brazilian investment back to Africa?

Still, despite the challenges, analysts expect a Lula presidency to boost Brazil’s global multilateral engagement.

“Under Lula, the Brazilian foreign agenda will reconsider the African continent as a priority,” says Rizzi.

“Naturally, this will stimulate foreign trade between Brazil and Africa, using public policies, a concession of credit, and more appetite within the private sector.”

But if ties are to truly enter a new era, Brazil’s reluctant private sector will again have to be lured back, says Bosco Monte.

“There is a good expectation on the African side that if Lula comes to power the ties between Brazil and Africa will be strong again… the main question here is to see if these companies, which recently left the continent, want to reverse the trend,” says Pedro Esteves, partner at the Lisbon-based intelligence firm África Monitor.

In an analysis, Schor shows that there is potential for Brazil to boost exports of transportation, machinery and electronics to the continent.

“These are the kind of exports that drive productivity increase and economic growth. From the African side, these are imports that induce interdependence and the common business cycle.”

Another example of technology transfer can be found in Brazil’s successful fuel ethanol industry. Brazil’s agriculture research agency, Embrapa, opened an office in Accra in 2008, in a bid to improve Ghana’s agricultural production.

Brazil could also share knowledge with the continent on its transformational agricultural policies, says Bosco Monte. If the will to build ties is there, the opportunities will follow, he argues.

“Brazil came from a position of large importer of food to one of the biggest producers in the world. Is our model replicable in the African context? My answer is yes. Hence why Brazil can be a significant partner for Africa, more than any country.”

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google