For over 16 years African Business has been running an annual ranking of Africa’s 250 Top Companies, taking the top listed companies from national and regional stock exchanges across Africa. In this article we focus on the top 20 companies from East Africa in 2021.

East Africa is seen as as a trailblazer for regional integration of capital markets, labour, trade and investment. Kenya and its neighbours offer good climates for business and educated, hard-working and entrepreneurial labour forces and management.

But although Kenya, Rwanda, Tanzania and Uganda all feature strongly for economic growth prospects, the regional impact on the Top 250 Companies survey is little changed compared to last year. East Africa is the smallest of the four regions, contributing 19 companies (as last year) and accounting for 3.5% of the total market capitalisation.

Nairobi Securities Exchange falls

Most of the biggest companies are listed on the Nairobi Securities Exchange (NSE), where the shilling slipped back against the US dollar and the NSE All Share Index bucked the positive trend of all the other exchanges by falling 6% over the year to 31 March 2022.

An analysis by investment bank EFG Hermes released in March showed that investors on the NSE had the lowest returns above government securities of 15 comparable frontier and emerging markets, which it attributed in part to the market’s long bear run.

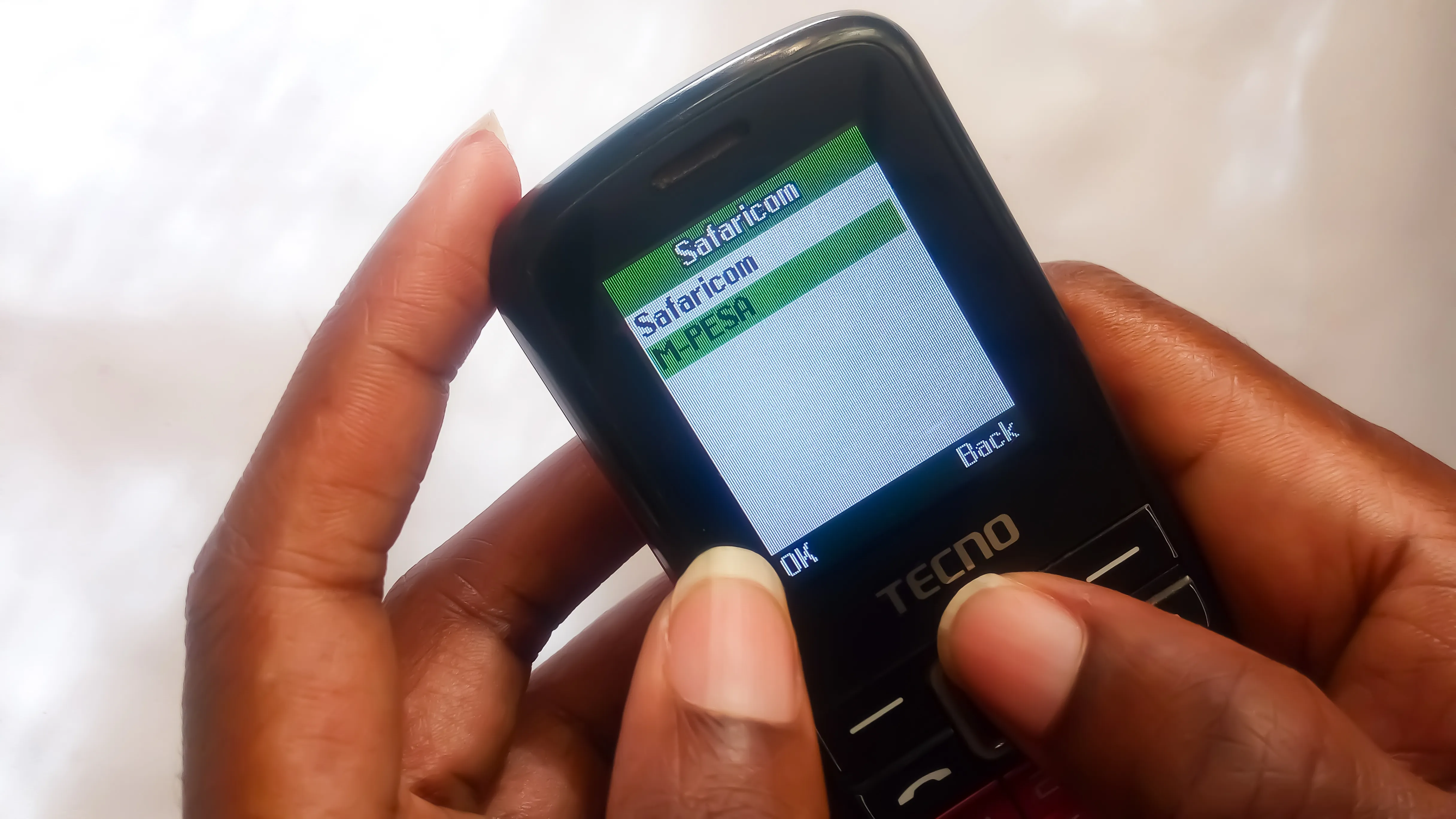

Kenya’s Safaricom is the region’s highest ranking company, but falls from last year’s #9 to #12, with market capitalisation down from $13.3bn to $11.9bn. Its huge opportunities in neighbouring Ethiopia will take some time to realise, given the continuation of that country’s disastrous civil conflict. The conflict is likely to continue weighing on the prospects of Ethiopia’s companies, which until recently were seen as the gatekeepers of a hugely exciting domestic market.

Dynamic bank Equity Group Holdings continues to expand, announcing a move into life assurance in January and taking advantage of big opportunities in Congo and elsewhere. In December the merger of Equity Bank Congo and Banque Commerciale du Congo was approved. Equity Group is up from #92 to #84 in this year’s rankings, with a 26% boost in market capitalisation to $1.7bn.

MTN Uganda listing doubles size of Uganda Securities Exchange

Dar es Salaam Stock Exchange contributes Tanzania Breweries, which is down from #90 to #98 but ahead of Kenya-based East African Breweries (#110). Vodacom Tanzania and Tanzania Cigarette Co are among its largest listings.

The Uganda Securities Exchange (USE) more than doubled in size in December with the listing of MTN Uganda, which raised $150m for its South African parent. MTN Uganda is an impressive new addition to the Top 250 Companies at #105, with market capitalisation of $1.1bn (the figure covers all the shares listed on the USE, including those owned by the parent). The initial public offer was undersubscribed, meaning that MTN Group is still looking for further share sales.

Most of the region’s large companies are banks, including Tanzania’s CRDB Bank, which entered the ranking last year at #250 and has seen a 67% increase in market capitalisation to $433m to rank at #197.

© Data provided by Emerging Markets Investment Management Limited and also in-house research. Data as at 31/03/2022. Data relates to listed companies only. Listed companies with less than 50% of their revenues in Africa and companies that are not listed or dual-listed on an African exchange were excluded.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google