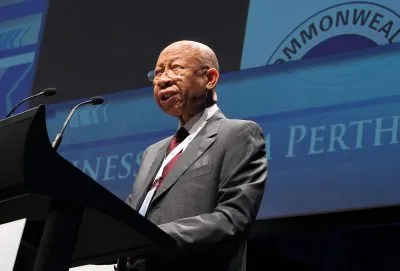

Gabon’s BGFI, which dwarfs most banks throughout Central Africa, is celebrating its golden jubilee this year. It has operations in West and Central Africa, with over $5bn in assets and nearly $1bn in equity. We caught up with Henri-Claude Oyima, the mastermind behind the bank’s rapid growth to find out what lies behind its success.

What does the 50th anniversary of the founding of the bank mean to you?

It is a proud moment when an individual celebrates a 50th birthday and even more so for a company to reach that milestone. We take pride in seeing how the vision and ambition we have worked on is being realised. We take pride in the work that has been done by the entire group – employees, managers and all the partners who have supported us over these past 50 years.

It’s been a journey and the endeavour of many people. This milestone allows us to look back and to thank all the wonderful people who have brought us here and of course, all those that continue to trust us.

Growth is never linear. Your bank has had some challenges in the past. Can you talk us through how strengthening your governance structures has helped overcome past weaknesses?

Mistakes, failures and dysfunctions are part of our process of continuous learning. Today, we use this past experience to strengthen the skills within our group and the quality of our service. We have guided the progress of our group on the basis of a five-year business plan. Governance is now part of the first pillar of our business plan and our goal is to strengthen it. Our institutions and our businesses are governed according to the best practices, ensuring that we learn from our past mistakes and do better in the future.

You are present in 11 countries; multiple jurisdictions and regulatory regimes, currencies… How do you run this structure and what makes your proposition unique?

We have committed to a high degree of decentralisation and that is very much a deliberate group policy. Decision-making is very much decentralised. Each institution has its board of directors and its credit committee, who are responsible for making decisions. We have strong control procedures at a country level and as a result it allows us to make decisions quickly. No one is better placed to make decisions than the people on the ground, who know the operating environment and the general business climate and context.

We design a five-year group strategy from the headquarters, and ensure that we adhere to a certain standard, especially in terms of respecting the regulatory, economic and legal environment. But otherwise, decision-making is very much decentralised.

How are you conducting your growth and expansion strategy today?

You can look at it in concentric circles. The inner circle is Gabon, where the bank was founded and where we have a 50% market share. The second circle covers our operations in Central Africa; the third is West Africa; and the fourth represents our international operations outside of Africa.

Our expansion is very much thought-through. We never go to another country just to be another bank. Our aim, and thus our competitive advantage, is to innovate and enhance the banking industry through the quality of our products, and also, how we operate, our processes, our methodology.

You place such a strong emphasis on training and moulding your executives that you have a training academy. Can you tell us the rationale and the techniques that you use?

With 3,000 employees in different countries, you have to give them a structure and make them adhere to your culture and principles. It can’t be a free-for-all.

To do this, we have created a training centre, a banking academy that we call BBS (BGFI Business School). It allows us to also build team spirit and allows us to set out the company’s methods. This creates a cohesion and company culture, as well as helping our staff to learn and progress as bankers. I think it enables us to develop our people and also develop the uniqueness which allows us to be distinct.

Every single employee, from the highest ranked to the most junior ones, attends our academy. Many will do so twice a year to update themselves on the latest practices, and this also helps us to standardise working methods. I think this is very particular of the BGFI group. While we set up this school for ourselves, we also know that some of the students we train will go on to work across the African banking and financial sector and not only for BGFI. We see it as a contribution to the whole banking sector of Africa.

The pandemic has accelerated the move to digital. How is this working out at BGFI?

The group embarked on digitalisation several years ago. Unlike others, we did not set out to create a digital bank but to digitise our processes, our products and our methods, to increase efficiency and as a result, also improve our bottom line. We have streamlined the whole process, allowing you to open an account remotely from your home. The rest will be done by a dedicated account manager who finalises the process.

We are very proud of these new products we have developed. They help differentiate us from others. Our motto is ‘BGFI is not just another bank, but a truly different bank’.

Banks are often criticised for not doing enough for the real, productive parts of the economy. What are you doing in this respect?

Our group is a financial portal that takes into account the concerns of all of our customers, from the very smallest to the largest conglomerates. Being a full-service financial services group means we have many specialisations and dedicated departments catering for the needs of the whole value chain. No single group is excluded from this. Our clients range from businesses and individuals seeking microfinance loans to the largest businesses. Our intention is to strengthen our penetration in all the markets in which we are present.

SMEs need greater support. Do you pay particular attention to this group?

Each year, we allocate a package for the financing of MSMEs. In Gabon, we devote CFA10bn [$18.5m] to the financing of small businesses… a lot of very small loans. We try as much as possible to tailor products and credit lines to all the clients that come our way.

Do you work with development finance institutions?

They are our loyal long-term partners. Development finance institutions can help share the risk burden and can come in so that we can offer blended rates of finance. Also, they can play a part in supporting projects that have a longer life-cycle, and as such, require more patient capital. We work with both European DFIs but also those in Africa, with whom we have a strong relationship. As for our international partners, through our investment banking and correspondent banking networks, we have developed a trusting relationship, and as a result it allows us to offer truly international services, with trusted partners.

What is your approach to supporting African national champions?

We’re a full-service bank. Which means that in our group, we have an investment bank that allows us to support clients by helping them develop projects and, of course, helping them finance these projects. We have a stock market intermediation company that supports companies to raise capital through equity markets. We want to develop and help grow national champions. It’s in our interest to have large, strong African groups. We can then support them across their different needs, structuring transactions, engineering new models of financing and supporting them with their growth, and as a result, hopefully help them to make a positive impact on the continent.

How do you view the rise of pan-African finance groups? Are you are facing more competition, both in Gabon and the other markets where you operate?

It may sound counterintuitive but we are delighted to see the emergence of large African groups – in financial services and other fields – that are helping build a new Africa. We see our work as complementary. Actually, we need each other because one group, or one bank, cannot meet all of Africa’s needs. Having large banking institutions can help, because we can pool our resources together to finance large, transformative projects and support the needs of our clients. If anything there is more demand than supply. And as far as our group is concerned, we are not afraid of competition, quite the contrary, we embrace it because it helps us improve.

From where do you get the financing to support your growth plans?

We grow with our own funds, which are, right now, sufficient to finance our activities. We have abundant liquidity, which allows us to finance our projects. We only call on international partners for longer-term needs. Generally speaking, the financing needs are short-term. To finance long-term investments is when we make recourse to other partners. In terms of solvency, we have the necessary resources to hand.

We are actually quite conservative by global standards and we have prudent thresholds that we respect rigidly. Our capital adequacy ratio, for example, is in the region of 20%. We have a fairly low cost of risk amounting to around 2% of commitments. This is a good ratio which allows us to guarantee the efficiency of our operations.

Even if the word ‘resilience’ is overused, how are we going to move from survival to a more creative dynamism?

The pandemic has only reinforced our basic conviction: you can only develop on your own. The pandemic has allowed everyone, with the closure of borders, to defend their home turf without waiting for outside help to develop. Africa cannot develop with the help of others and must do so with its own means and with its own people. Covid is there but does not change anything in our strategy of defending our interests and being there to finance our economies and our own development. We can’t expect others to develop our continent; it’s not going to happen.

Do you think that with the AfCFTA, Africa will be able to industrialise and make the necessary gains in productivity?

Africa is industrialising in pockets. It must maintain its industrialisation plan and we must step out of this false paradigm that the best comes from elsewhere. We already have our industries, but Africa’s big problem is not industrialisation per se. African governance needs to be improved on top of that. Once governance improves, and we make significant improvements in some areas such as the delivery of infrastructure, then industrialisation will come and the rest with it. We must continue to transform Africa, so that we are no longer just commodity sellers but producers, made by us, for us.

You’ve been at the bank an extraordinary 36 years. Looking ahead, what more do you want to achieve?

My project after 36 years at the bank is that of governance. To make sure that the future generations who will take over are well trained, better organised and better prepared to face increasingly complex challenges. This is what will guarantee the sustainability of our group. It is only normal for the new generation to prepare, train and be ready to take on these challenges. They have a big responsibility if they are to fulfil the BGFI Group mission, which is to support the social and economic development of Africa, no more, no less.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google