This article was produced with the support of African Guarantee Fund

Nairobi, 17th February, 2021 – African Guarantee Fund has issued a loan portfolio guarantee amounting to USD 10 million to Afriland First Bank to support SMEs, women entrepreneurs and green economy in Cameroon. The signing ceremony took place at African Guarantee Fund’s head office in Nairobi.

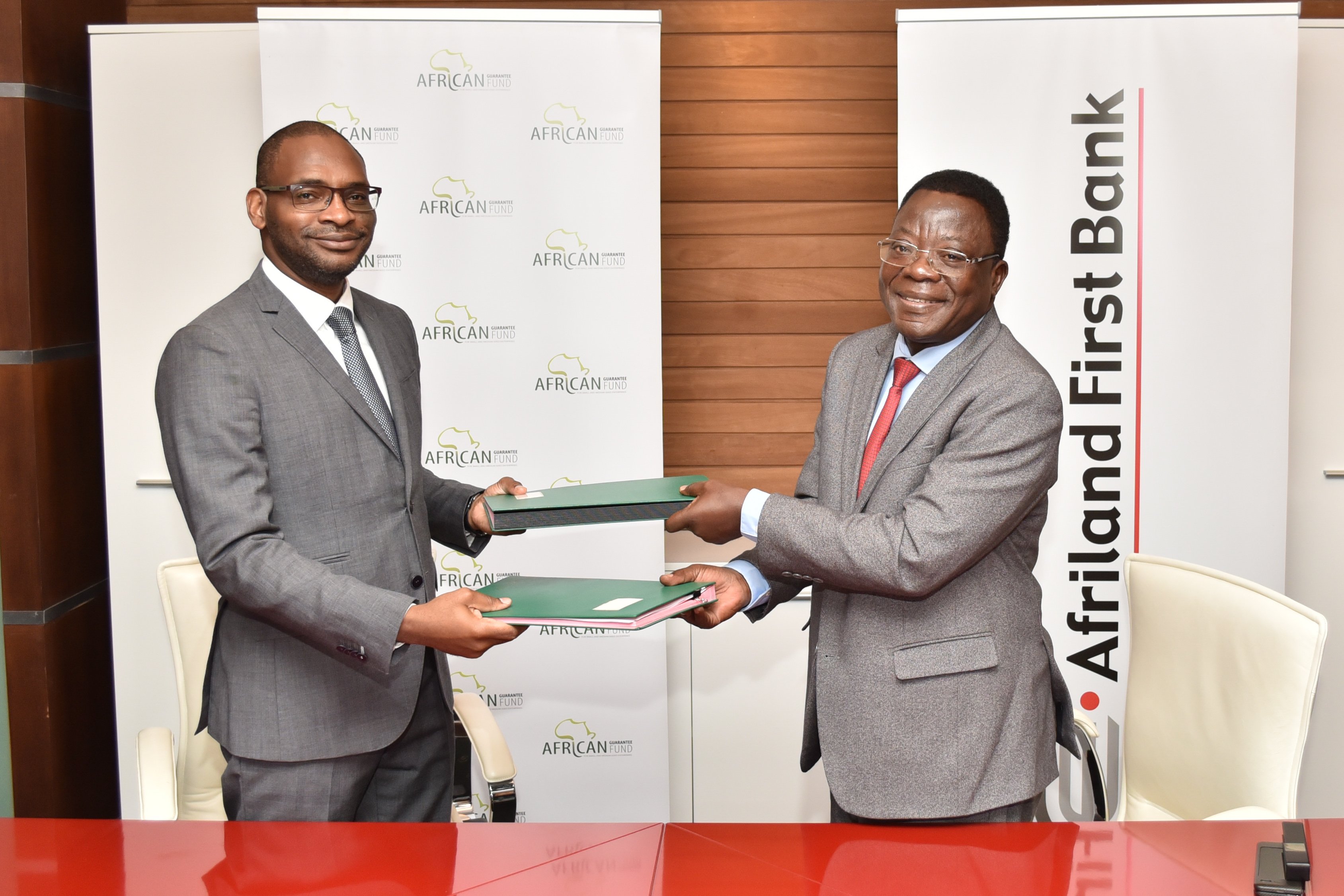

Signed by Alphonse Nafack, Managing Director of Afriland First Bank and Jules Ngankam, Group Chief Executive Officer of African Guarantee Fund, this agreement will enable Afriland First Bank, on the one hand, to strengthen its commitment to the SME/SMI sector and, on the other hand, to promote the development of green entrepreneurship and women’s leadership in the business community.

Commenting on the signing ceremony, Mr. Jules Ngankam, Chief Executive Officer of AGF Group, said: “Banks across the continent are in urgent need of risk hedging instruments to support their

lending activities to SMEs. This agreement affirms our commitment to Cameroonian SMEs alongside Afriland First Bank, a leading institution in the Cameroonian banking sector.”

Mr. Alphonse Nafack, Managing Director of Afriland First Bank stated, “This partnership is part of the DNA of Afriland First Bank and enshrines the strong commitment that has guided our daily activities since our inception, namely to support entrepreneurs, promote SMEs and support companies in their development programs.”

As major players in the Cameroonian economic fabric, drivers of growth and job creators, SMEs face enormous challenges in accessing financing from banks to expand their activities. Active in investment financing and winner of “Best financing of local investments” award at the CIF (Cameroon Investment Forum 2019), Afriland First Bank through this agreement, strengthens its objective of participating in the emergence of local economic champions. As of December 31, 2020, it claimed a volume of financing of over FCFA 150 billion to VSEs / SMEs / SMIs.

In the strategy of promoting entrepreneurship, women occupy a major place with regard to the role that they play in society. It is in view of this that Afriland First Bank supports women entrepreneurs through their support to the MUFFA (Financial Mutuality for African Women).

Sign in with Google

Sign in with Google