In September Fidelity Bank, one of Nigeria’s largest banks in terms of deposits, announced record half-year results despite a challenging operating environment. Fidelity is not as boisterous as some of the bigger Nigerian banks but has gained a solid reputation for its work in serving the real economy and the unserved by growing its SME lending and also its digital services. The bank is known for its prudent philosophy and governance.

Its current CEO Nnamdi Okonkwo, who has occupied his role since 2014, will be handing over the reins to Nneka Onyeali-Ikpe, who will join a short but illustrious list of women at the top of African banks. During his tenure profits have increased over 200% and deposits by 100%. Arguably the bank’s greatest achievement has been in digital banking, where penetration has gone from 1% in 2014 to 50.1% today and now accounts for 28.4% of total fee income.

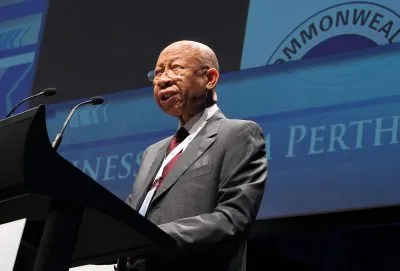

We caught up with Okonkwo to find out about how serious the current downturn is and what it means for banks in Nigeria.

The bank showed strong first half year indicators, with a rise not only in profits, but also in deposits and other metrics. What do you put this down to?

Our sustained growth is the result of many years of work. Our strong corporate governance and risk management have undoubtedly enabled us to grow our business in a sustainable manner. We have been agile and proactive in our decision-making and able to respond to changes in the macroeconomic environment.

Do you expect this to continue throughout the year or would you be more cautious?

Our strategic aspiration is to be a tier 1 bank in the next few years. We have laid a solid foundation for growth and we will continue to strive for a larger share of the market across key indices. I am optimistic that we will maintain our growth trajectory in the foreseeable future.

Are there any sectors that you are particularly worried about?

The sectors that require a high level of monitoring are those that were most impacted by the pandemic. According to data published by Nigeria’s National Bureau of Statistics, the economy contracted by 6% in Q2/2020. The largest contractions occurred in transport, hospitality, education, real estate and construction. Those are the sectors we need to focus on.

What’s the debt profile of the bank from a sectorial perspective?

As at 30 June 2020, our total exposure was N1.27 trillion [$3.3bn], with the manufacturing sector, oil & gas upstream, transport, public sector and power representing 60% of our total loans. The manufacturing sector alone contributes over 16% of our loan book. Other sectors where we are active include construction, education, agriculture, real estate and retail. But we have a rule whereby our risk acceptance level requires that no sector will contribute more than 20.0% of our loan book.

Was the oil and gas sector, with substantial balance sheets, sufficiently hedged?

Yes. Most of our exposures are hedged although we have had cause to restructure a few transactions in the past. The reason for the restructuring is to allow for better cash flow management. Actually, despite what you read in the press about the price of oil, we, as a bank, are comfortable at current price levels, that is prices above $40 per barrel. We will be worried if oil prices drop below $30 per barrel for a sustained period of time.

Has the Nigerian government, with the regulator, gone far enough to assist banks, with looser liquidity measures for example? Are there any lessons learned from this crisis in terms of quick and important measures that have been taken that have had a positive impact?

I think across Africa our regulators have been proactive and quick to act. In Nigeria, the CBN [Central Bank of Nigeria] response helped preserve the stability of the banking sector. The decision to grant forbearance on exposures to the most vulnerable sectors, reduction of interest rates on intervention funds as well as the provision of stabilisation funds to specific economic segments have helped stabilise the industry. So yes, the impact has been positive.

You are known as a solidly run institution. You have stated that you have proactively increased cost of risk due to the pandemic. Can you tell us a little about how you’re managing the crisis and your outlook for the next 6-18 months?

At the start of the crisis we set up two committees. The business strategy committee was responsible for proposing strategies for mitigating against the identified risks while the advisory committee focused on the business continuity processes of the bank.

We had three scenarios, based on the speed of economic recovery: mild case – a recovery within 3-6 months – moderate case, between 6-12 months and a worst-case scenario. We are evaluating risk and don’t think we will ever get to scenario 3.

On the risk management side, we have ensured our exposures are constantly evaluated and in some cases we have asked for additional collateral including increasing limits on customers’ debt service reserve accounts. This ensures customers do not have access to more than the cash they need thereby safeguarding the bank in a period of lower cash flow.

Most sectors affected by the pandemic are already on the path of full recovery. So our business environment will be in better state in 6-18 months.

You have seen a phenomenal uptake in terms of digital banking. Do you see this trend continuing and is the agency model the future of banking in the country?

As can be expected, the lockdown protocols adopted in response to the pandemic translated into the expedited adoption of digital solutions for financial services. Customers previously averse to these non-terrestrial transaction platforms quickly became students of the various applications to sustain financial access during these times.

Consequently, the increase in clientele adoption translated to an increase in digital transactions and provided the ideal environment for Fidelity Bank to shine. To be clear, prior to the events of the pandemic, we had completed our digital transformation project and a Technology Refresh covering networks, securities, cloud services, co-location and server optimisation.

As they say, luck is what happens when preparation meets opportunity. These technology upgrade projects not only allowed us to sustain our high service standards even as transaction volumes spiked, but also provided a robust infrastructure for business continuity during these times.

We expect digital banking, with all its advantages over terrestrial systems, will see improved adoption. Agency banking would be the key link between the new digital standard and the financial inclusion programmes we are currently running. Agents would help connect the unbanked and utilise digital solutions to provide the required services.

Despite uncertainty you said that this new phase of normalcy will unveil growth opportunities. Can you elaborate?

Digital solutions will be the lynchpin of business growth in the coming months. They will create new connections between expanding segments and consumer markets. I remain optimistic that such changes in market dynamics will present opportunities for financial intermediation.

Covid-19 is without doubt the most impactful event of the year if not the decade. The pandemic has far-reaching effects on the entire business landscape. The market has changed, and businesses must adapt to this new expectations or they will die.

The businesses that will stand out and survive are those that are able to innovate at the speed of thought. Flexibility and scalability are essential survival tools.

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google