French and African leaders have wrapped up a two-day visit to Paris to address Africa’s post-Covid economic recovery amid sovereign debt and security challenges.

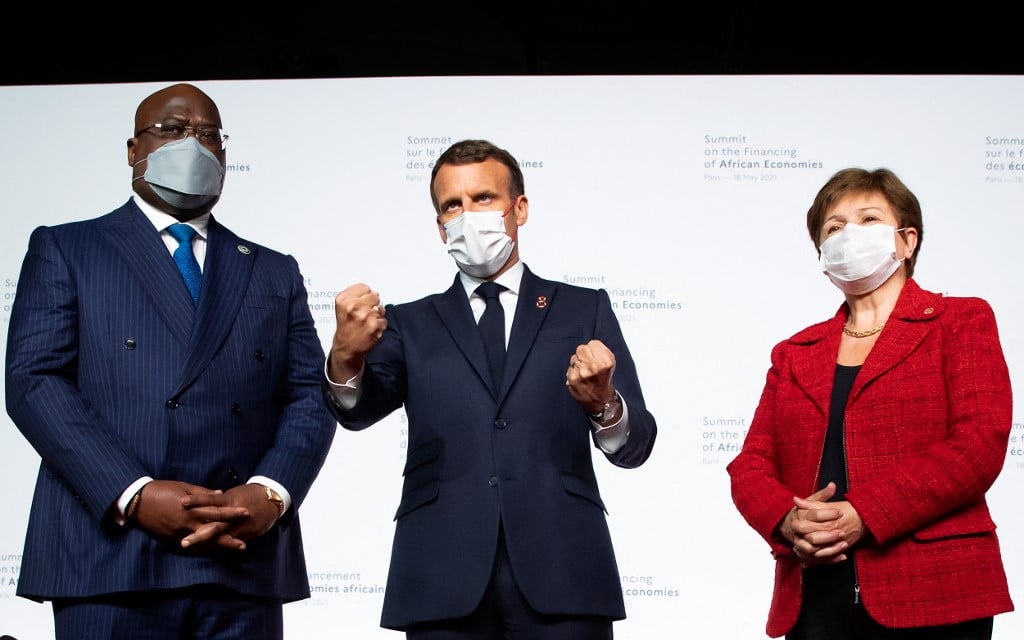

Hosted by French president Emmanuel Macron, the Summit for the Financing of African Economies in Paris was an opportunity for leaders from the Sahel and Francophone regions to meet lenders to discuss security and debt relief.

Talks with Total

Following a meeting between oil giant Total and Mozambican president Filipe Nyusi, the oil major’s chairman and CEO Patrick Pouyanné promised his company would return to the country after declaring force majeure at its $20bn liquefied natural gas (LNG) project in Cabo Delgado following insurgent attacks last month.

“We are going to return, and we have full confidence that the Government of Mozambique is working towards, and will be able to restore security,” Pouyanné told journalists after a meeting with government representatives.

“Total remains committed to its project in Mozambique. Natural gas is in great demand. For the planet, it is important energy; it is a priority, that is why we remain committed,” he said.

Support for Sudan

On Monday, the Paris Club of Africa’s major creditors met with African leaders to rally support for a debt restructuring for Sudan, which owes $60bn in external debt amid an ongoing democratic transition.

Sudan is reintegrating into the global economy after decades of economic isolation under former dictator Omar al-Bashir.

Setting the tone for the summit, French President Emmanuel Macron said he was “in favour” of cancelling debts of $5bn owed to France by Khartoum.

Macron also confirmed a $1.5bn bridge loan to clear Sudan’s arrears to the IMF that will be financed by pledges from member states.

Sudan was among the oil producers on the continent hit hard by a dampened demand for oil brought on by the pandemic, said Kwadwo Sarkodie, a partner at law firm Mayer Brown, which advises governments and international companies in Africa.

“It reached a point where Sudan simply wasn’t going to be able to make the repayments of its existing debts, and it was going to have to have some form of restructuring in order to be viable going forward.”

Macron’s efforts to spearhead financing for African countries are testament to Paris’ security concerns in the Sahel region, and the domino effect that financial instability in neighbouring Sudan could have on the broader region, Sarkodie says.

“France has been active in the Sahel and francophone region for decades, with security as its primary concern, and underpinning its military involvement in Mali,” he says.

“What we see in these countries is that borders are extremely porous so to ensure and generate stability in one country it’s important that the neighbours are similarly stable. Given Sudan’s geographic position, these security concerns, and France’s interests in the broader region, it’s important for France to promote stability. A debt default and financial crisis in Sudan would be detrimental for that country, but would also have a knock-on for countries around the region.”

Want to continue reading? Subscribe today.

You've read all your free articles for this month! Subscribe now to enjoy full access to our content.

Digital Monthly

£8.00 / month

Receive full unlimited access to our articles, opinions, podcasts and more.

Digital Yearly

£70.00 / year

Our best value offer - save £26 and gain access to all of our digital content for an entire year!

Sign in with Google

Sign in with Google